Is your hard-earned money just sleeping in a basic bank account? Inflation in Singapore is a silent killer of wealth. Your cash loses its purchasing power every single day. Many Singaporeans are now hunting for better ways to save safely. Are you confused by the many different financial options available? SSB, T-Bills, and high-interest accounts can feel very overwhelming. You want total safety but you also want decent growth. The local community is buzzing with new saving strategies right now. Let us look at what the local experts are saying. You can grow your wealth without taking any huge risks. It is time to make your money work much harder. Let us dive into the latest Singapore savings trends today.

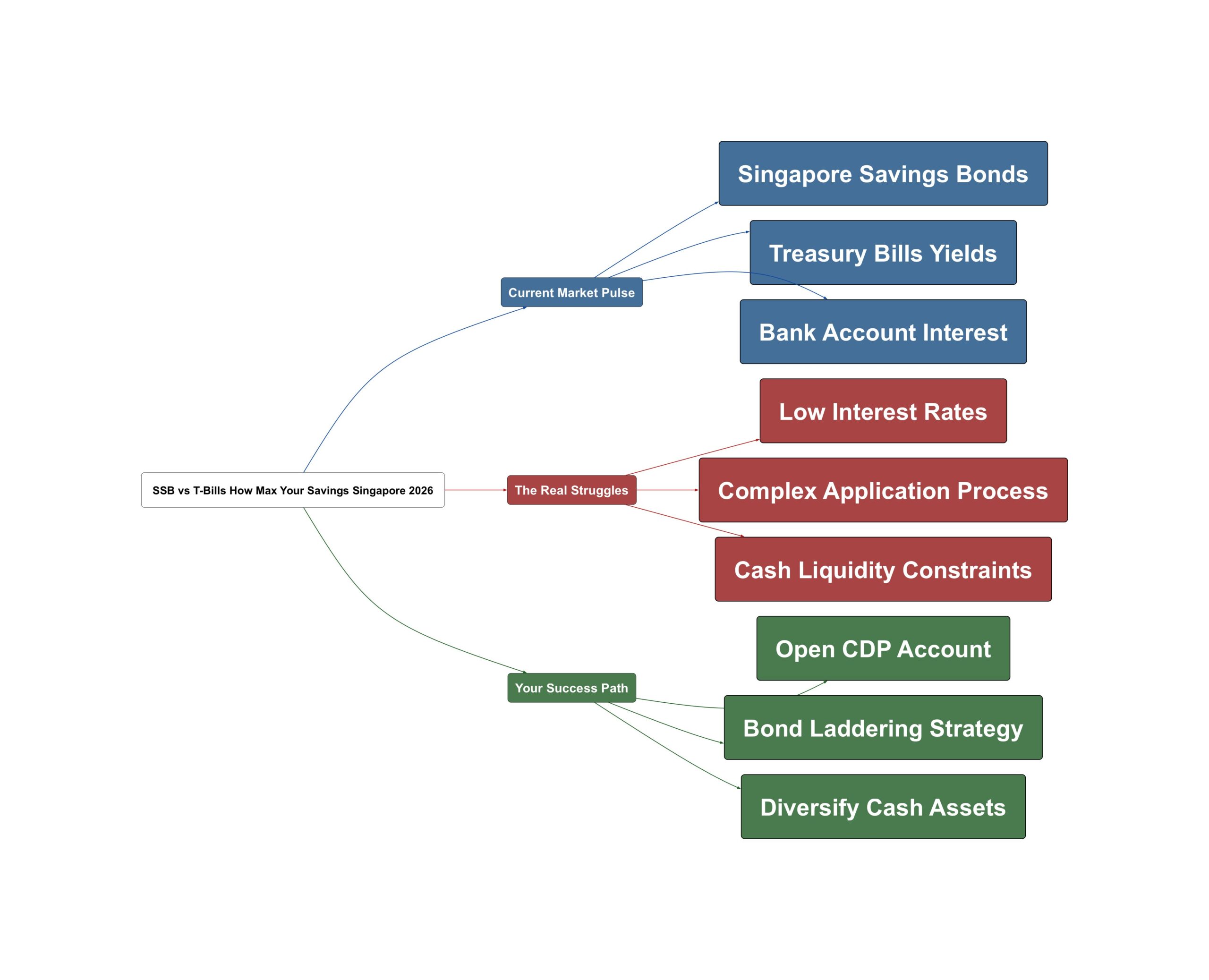

Current Market Pulse

The savings landscape in Singapore is changing very fast. Singapore Savings Bonds remain a very popular choice for many. The average return for ten years is now 2.25%. The first-year rate starts lower at around 1.35%. These rates generally increase the longer you hold the bond. You can invest up to 200k per person easily. Treasury Bills are another hot topic in the forums. These are short-term loans to the Singapore Government. You can choose between six-month or one-year durations. The six-month T-Bills are available every two weeks. The last T-Bill yield was around 1.6% recently. Many people are also maxing out their bank accounts. Accounts like UOB One and UOB Stash are very common. Investors are looking for stability in a volatile market. The community is actively sharing the latest interest rates online. They want to ensure every dollar earns its keep.

- Singapore Savings Bonds offer long term security with flexible redemption

“Do you have Singapore Savings Bond ? Go for this if you want longer term and less hassle. Upto 200k per person. This is for 10yrs but can be redeemed earlier.”

- T-Bills provide short term gains with government backing

“need to open cdp account and buy tbill through dbs/ocbc/uob, like how one would apply for ssb. every 2 weeks got tbill.”

- High interest bank accounts are reaching their maximum limits

“Alot of dragons here max out liao including their spouses acct leh? so bopian UOB 1 or even UOB stash also have.”

The Real Struggles

Saving money efficiently comes with its own set of hurdles. Many find the current interest rates to be quite low. Some investors feel these rates are just measly returns. Setting up the necessary accounts can be a major headache. You need a CDP account to buy T-Bills or SSB. Applying through local banks can feel like jumping through hoops. T-Bill rates are not known during the application phase. This uncertainty makes some Singaporeans feel very uneasy. If more people apply, the yield usually drops down. This creates a competitive environment for very small returns. Liquidity is another big concern for many local savers. T-Bills are not easy to sell before they mature. Most people end up holding them for the full term. This locks up your cash for six months. For those used to stocks, these returns feel slow. The effort required might not seem worth the reward.

- The application process involves multiple steps and account setups

“it might be troublesome to set up and read up from scratch, but if you’re risk-averse and have a lot of cash on hand, this will be worth your time”

- Returns can feel insignificant compared to the stock market

“interest rates so low…and got to go through many different methodology to get measly interest rates… for people in the stock market, definitely wont waste time doing all this.”

- Increased competition is driving down the available yields

“The yield will be lower than previous auction because more people are interested.”

Your Success Path

You can take control of your savings with simple steps. Start by opening a CDP account as soon as possible. Link it to your bank account for easy applications. Use the three local banks for a smoother process. Consider the laddering strategy for your Singapore Savings Bonds. This allows you to access cash while earning high rates. Redeem your old bonds if newer ones offer better yields. This keeps your portfolio updated with the latest market rates. Check the HardwareZone T-Bill thread for the latest updates. The community provides real-time data on auction results. For those near retirement, T-Bills offer a safe haven. It is a great way to get 2.5% returns easily. Diversify your cash across different low-risk assets. Do not put all your eggs in one basket. Keep some cash in high-interest accounts for daily needs. Move your excess funds into SSB or T-Bills. This balanced approach ensures both safety and growth.

- Active management of bonds allows for better yield capture

“If rates increase in future, you can even redeem and apply the higher rate.”

- Low risk options are ideal for those nearing retirement age

“for those who are near withdrawal age. this is one way to get 2.5% , instead of buying t bill with low yield”

- Leverage community knowledge to stay ahead of rate changes

Managing your savings in Singapore does not have to be hard. The key is to stay informed and stay active. Do not let your money sit idle in low-interest accounts. Take advantage of the tools provided by the government. Whether it is SSB or T-Bills, every bit counts. Your future self will thank you for being proactive today. Start small if you feel unsure about the process. The local community is always here to help you out. Happy saving and enjoy watching your wealth grow safely.

Read the original discussions on HardwareZone: