Is your hard-earned money just sitting idle in a basic account? Inflation in Singapore is rising every single day. Your savings might be losing value while you sleep. Are you tired of seeing measly interest credits every month? Many Singaporeans are now hunting for the best lobangs to grow their cash. HardwareZone users are sharing secret strategies to hit high yields. Some are even reaching returns of over 4.5% per year. Do you want to know how they do it? This guide breaks down the latest bank promos and bonds. Stop letting your savings stay stagnant. It is time to make your money work harder for you. Let us look at what the community is doing right now.

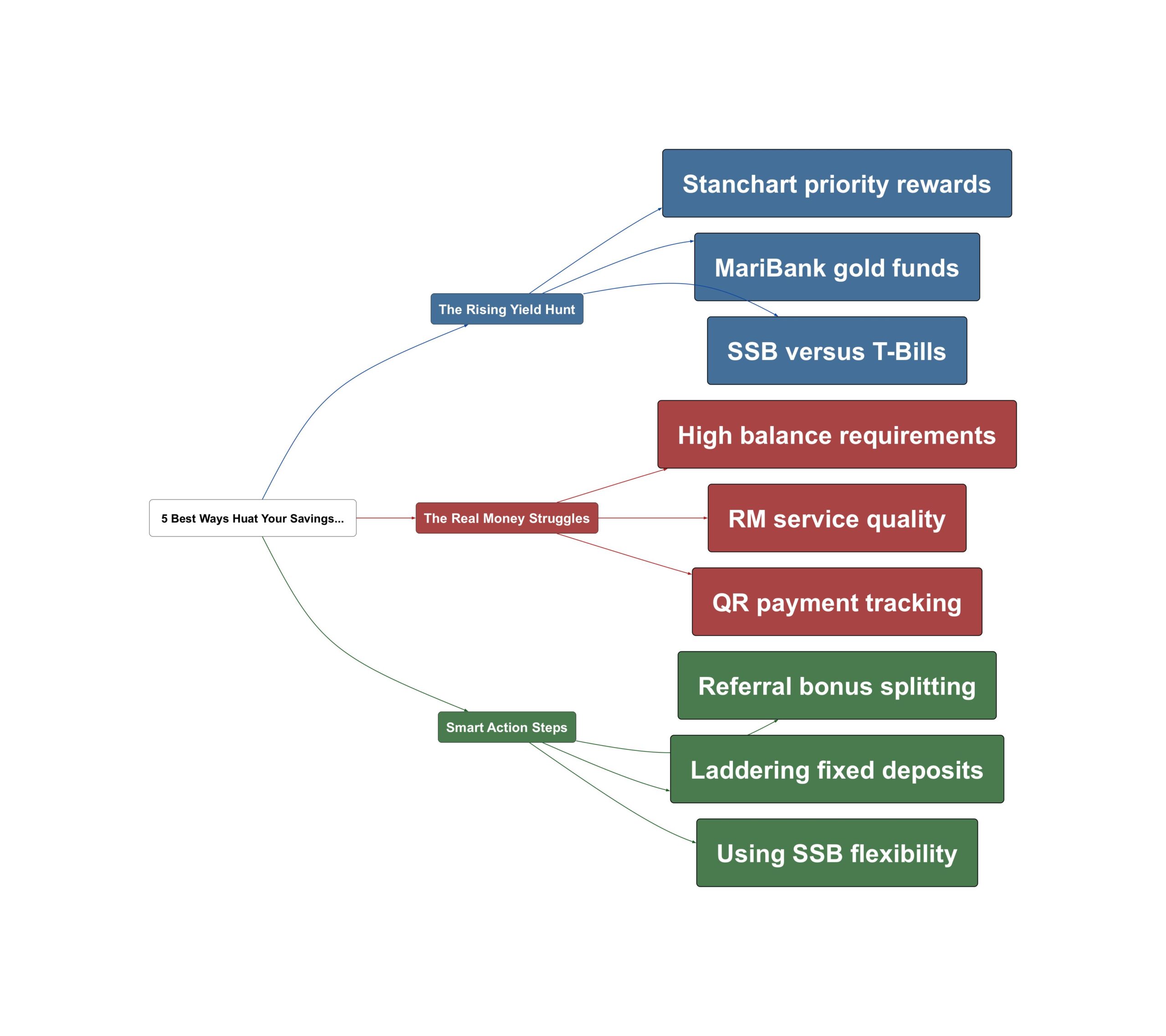

The Rising Yield Hunt

The search for high interest has reached a fever pitch. Many local banks are fighting for your fresh funds. Standard Chartered is currently leading the pack with a massive combo deal. You can achieve a yield of 4.65% if you play it right. This strategy involves priority banking and clever referral splitting. The community is buzzing about these high-tier rewards. One popular insight from HWZ user ericcsn explains the detailed math behind this. He suggests using a ladder strategy for larger sums like $500,000. For a basic $200,000 deposit, the rewards are still very impressive.

- Priority banking combos can reach 4.65% yield

“Total for items 1-3 is $2000+1250+88= $3338 over 6 months… yield is 3.347%. If 4+5 are included total now is $3338+$800+$500=$4638 yield… is 4.65%”

- MariBank users are moving into gold funds

“Mari Invest Gold has a different Class. It is LionGlobal Singapore Physical Gold Fund Class MariBank SGD H (Acc)”

- DBS continues with earmarking promos at 1.38%

DBS is offering a 1.38% promo for specific earmarking periods. This is a safe way to get a bit more from your spare cash. Many users are registering for the latest window ending in January. It is a simple way to park money for a few months. The community agrees that every bit of interest helps. Even small digital banks like MariBank are seeing a shift. Users are moving from basic savings to gold and income funds. They want to diversify their risk while seeking higher returns. The market pulse shows a strong preference for liquid but high-yield assets.

The Real Money Struggles

Getting these high rates is not always a smooth journey. There are many roadblocks that Singaporeans face daily. The biggest challenge is the high entry barrier for priority banking. Most top-tier promos require a $200,000 fresh fund deposit. This is a huge sum for the average worker. If your balance dips, the bank might change your service level. Some users reported losing their dedicated Relationship Manager. This happens when you fail to maintain the minimum wealth holdings. It can be frustrating to lose that premium touch.

- Maintaining high balances is a constant stress

“Some years back they assigned me to this pooled RM system because I fail to consistently maintain 200k”

- Tracking small promo requirements is very tedious

“Be careful, some QR code is actually PayNow which… will not get tracked.”

- T-Bills and Bonds have liquidity limitations

Another major pain point is the complexity of promo terms. Maybank iSavvy rewards require specific spending patterns. You might need to buy food at hawker centers eight times. But you must use the correct QR code format. If you use a PayNow QR instead of a merchant one, it fails. You could lose your $68 angbao reward over a small mistake. Also, T-Bills are not easy to sell before they mature. This locks your cash away when you might need it most. Many feel the effort to track these rules is exhausting. It feels like a full-time job just to save money.

Smart Action Steps

You can still win the savings game with smart moves. Start by looking at Singapore Savings Bonds (SSB). They are perfect for those who want a long-term safety net. You can invest up to $200,000 with full government backing. The current average 10-year yield is around 2.25%. The best part is the flexibility of redemption. You can take your money out any month without penalty. If interest rates rise in the future, just swap your bonds. This is a great way to hedge against market changes. It is much simpler than chasing monthly bank targets.

- Use SSB for flexible long term savings

“Upto 200k per person. This is for 10yrs but can be redeemed earlier. Application and redemption is easy.”

- Split referral bonuses with family members

“Extra $800 if you used a referral… u can share the $800 with him/ her.”

- Ladder your deposits to manage liquidity

Don’t forget to leverage your social circle for bank promos. Many banks offer huge referral bonuses for priority accounts. You can get up to $800 just by using a friend’s link. HardwareZone users often suggest splitting this bonus with the referrer. This creates a win-win situation for both parties. It effectively boosts your yield without extra risk. For those with larger sums, try the laddering method. Spread your money across different maturity dates. This ensures you always have some cash becoming available soon. It balances high returns with your daily cash flow needs. Always read the fine print before committing your funds. Small details in the T&Cs can make a big difference.

In conclusion, saving in Singapore requires a proactive mindset. You cannot just leave your money in a 0.05% account anymore. Whether it is SSB, T-Bills, or priority banking, options exist. Start small if you have to, but start today. Use the community’s collective wisdom to avoid common traps. Watch your spending categories carefully to hit those bank rewards. Every dollar of interest earned is a win against inflation. Your future self will thank you for being financially savvy now. Go check your bank balances and start planning your next move. Happy saving and huat ah!

Read the original discussions on HardwareZone: