Are you still paying 2.7% on your home loan while others pay 1.45%? That is a massive difference in your monthly installments. Many homeowners feel the pinch as interest rates fluctuate. Is it time to talk to your bank? Let us look at what the community is saying right now.

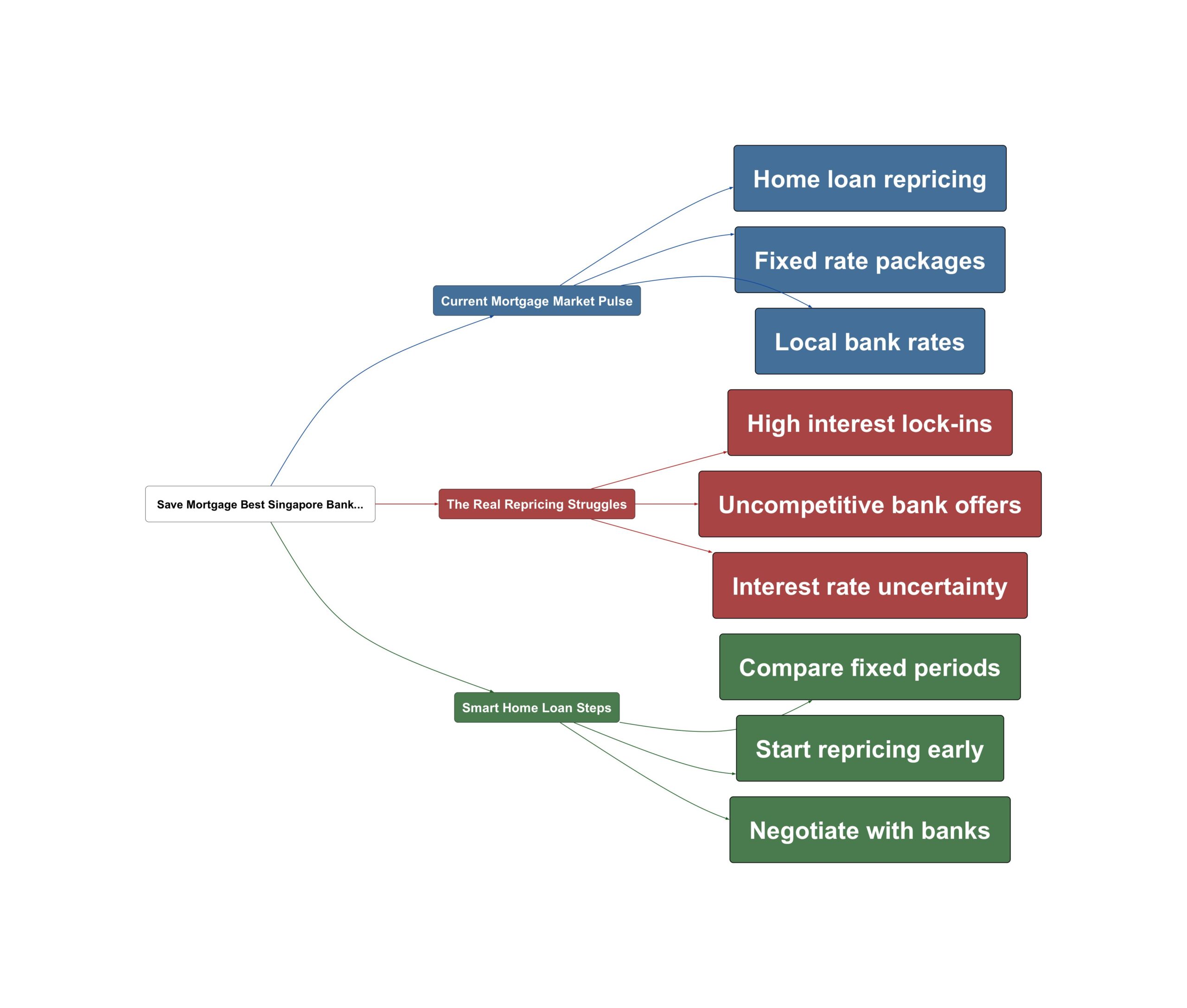

Current Mortgage Market Pulse

The market is seeing some very attractive fixed rate offers lately. Some local banks are dangling rates as low as 1.45% for a 2-year lock-in. This is a significant drop for those coming off higher interest periods. Private property owners are especially active in hunting for these deals. One popular insight from a forum member shared their recent success with UOB.

“Sharing my repricing offer from UOB: 1.45% fixed 2 years, lock in 2 years Pte property Outstanding loan 650k”

The community largely agrees that acting now is better than waiting. If you can save 1% immediately, why wait for a tiny further drop? Most members feel that a 1% saving is a clear win. Waiting for another 0.1% drop might cost you more in the long run.

“Saving more than 1% with immediate effect sounds like a better option than waiting for it to drop maybe another 0.1-0.2%.”

Local banks are also adjusting their longer-term fixed packages. We are seeing a shift in how banks price their 3-year and 5-year plans. It is a competitive landscape for savvy Singaporean borrowers right now.

The Real Repricing Struggles

Not all banks are offering the same level of value this month. Some major players have become less competitive with their fixed rates. This creates a headache for loyal customers looking to reprice. If your current bank is not budging, you might feel stuck. The community has noticed that DBS rates have been less attractive lately.

“DBS new-to-bank rate and repricing fixed rate package are not competitive since Jan.”

Lock-in periods remain the biggest hurdle for most homeowners. If you are still in your lock-in, your hands are mostly tied. Banks hold the upper hand during this period. Negotiating a waiver is possible but very difficult in the current climate. Many users wonder if they can even start the process early.

“Wondering if anyone has experience asking for repricing within lock-in period when there is no free conversion?”

Another complication is the rising cost of longer-term stability. While short-term rates are low, banks are pushing longer fixed rates higher. This forces homeowners to choose between immediate savings and long-term security. It is a stressful balancing act for any household budget.

Smart Home Loan Steps

Timing your application is the key to a successful repricing move. You should generally start looking 3 to 4 months before your lock-in ends. This gives you enough time to compare offers and submit paperwork. Do not wait until the last minute to contact your bank. Most banks allow you to initiate the process early to avoid higher floating rates.

“But usually repricing application can put in 3-4 months before lock in ends right?”

Decide between short-term gains and long-term peace of mind. A 2-year fixed rate offers the lowest interest now. However, a 5-year fixed rate protects you from future spikes. For a small difference in interest, the longer term might be safer. It depends on your personal risk appetite and financial goals.

“1.78% – 5 years for peace of mind for 5 years. For a difference of 0.28% only i will go for 5 years.”

- Compare offers across at least three different banks.

- Calculate the total savings versus the administrative fees.

- Always check if your current loan has a free conversion clause.

- Consider a longer lock-in if you prefer stable monthly payments.

The bigger picture is about taking control of your debt. Do not let inertia cost you thousands of dollars. Check your latest bank statements today. See if you can benefit from the current 1.45% to 1.5% rates. A simple phone call to your banker could save your family a lot of money.

💡 Key Takeaway: Start your mortgage repricing process 4 months before your lock-in ends to secure rates as low as 1.45%.

Read the original discussions on HardwareZone: