Are you still blindly keeping exactly $20,000 in your CPF Ordinary Account? Many Singaporeans follow this rule without a second thought. But does this one-size-fits-all number actually protect your family? With the latest Budget 2026 updates, the old rules are changing fast. You might be playing it too safe or taking risks you do not even realize. Let us dive into what the HardwareZone community is saying about your money.

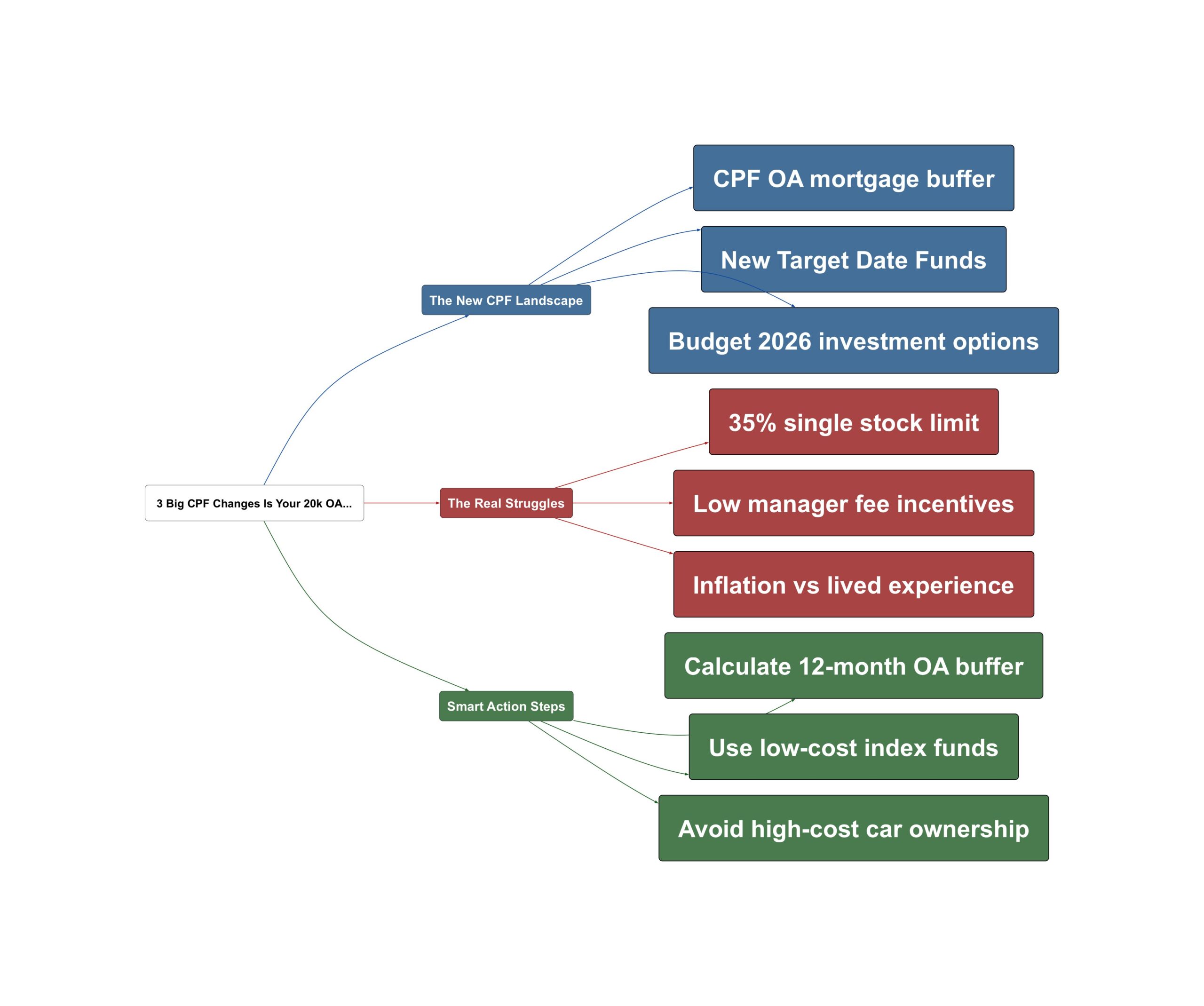

The New CPF Landscape

The recent Budget 2026 discussions have put CPF back in the spotlight. One major topic is the $20,000 buffer in the Ordinary Account. This is often called the prudent amount to keep. However, the community is questioning if this figure makes sense for everyone today. Your optimal OA balance depends heavily on your specific mortgage size. It also depends on how much cash you have outside of CPF. For some, $20,000 is a massive safety net. For others with large loans, it might be quite thin.

“$20,000 is quite a lot when your share of your monthly mortgage is $1,200. That is 16+ months!”

The government is also introducing new Target Date Funds (TDFs). These funds are designed to change their risk level as you age. They aim to help members get higher long-term returns without the stress of manual rebalancing. This is part of the Lifetime Retirement Investment Strategy (LRIS). While it sounds good, the community is divided on its effectiveness. Some see it as a needed option for passive investors. Others feel it has been a long 10-year wait for something quite simple. We are seeing a shift toward more automated investment choices for the masses.

The Real Struggles

Not everyone is convinced by these new government-backed investment options. A major concern is the incentive for fund managers. Since these CPF funds have very low fees, will top managers actually perform well? There is a fear that low fees lead to mediocre results. We have already seen big players like MoneyOwl exit the market. This makes members worry about the long-term survival of these new platforms. If a distributor closes, what happens to your retirement nest egg?

“With low fees, will the fund managers be incentivised to do a good job?”

Another sticking point is the strict 35% limit on single stocks in CPFIS. Many savvy investors feel restricted by this cap. One forum member shared how they could not invest a single cent more. This happened even with $710,000 in their account. They wanted to buy local bank stocks like UOB but were blocked. This frustration is real for those who want to take charge of their own portfolios. Additionally, there is the issue of inflation. The official CPI might show low numbers, but your lived experience might feel different. If you own a car or use private healthcare, your personal inflation rate is much higher.

“I only wish they would allow 100% instead of 35% stock limit on CPFIS. I would dump all of it into UOB.”

- The gap between official CPI and personal cost of living

- Strict investment limits preventing high-conviction stock plays

- Sustainability of low-fee investment platforms in Singapore

Smart Action Steps

So, how should you navigate these changes? First, stop following the $20,000 rule blindly. Calculate your own emergency buffer based on your mortgage. A good target is 6 to 12 months of installments. This gives you peace of mind if your job situation changes. If you are not a confident investor, look into the upcoming Target Date Funds. They are a simple way to get exposure to the markets. You do not have to worry about rebalancing your portfolio every year. It is a hands-off approach for the busy Singaporean.

“CPF members may wish to keep more than $20,000 in OA if they are paying a large mortgage and would not have 6 months of reserves.”

If you want to maximize your savings, “take the hints” from the market. Owning a car in Singapore is becoming fundamentally incompatible with FIRE principles. If you want to retire early, you must prioritize your CPF and investments over depreciating assets. For those over 55, remember that rules change again. Once you meet your Basic Retirement Sum, you have more freedom. You can even invest 100% of your OA in single stocks if you wish. Just be careful not to put all your eggs in one basket. Diversification is still the golden rule for retirement.

- Customize your OA buffer to cover 12 months of mortgage

- Evaluate Target Date Funds for a hands-off retirement strategy

- Avoid high-cost lifestyle assets to accelerate your FIRE journey

💡 Key Takeaway: Your CPF strategy should be personal; calculate a custom mortgage buffer instead of following the standard $20,000 rule.

Read the original discussions on HardwareZone: