Are you tired of seeing your savings stay flat? Inflation is eating into our chicken rice money every day. Is your CPF just sitting there doing nothing? Many Singaporeans are now hunting for better ways to grow their wealth. Let’s look at what the community is saying this week.

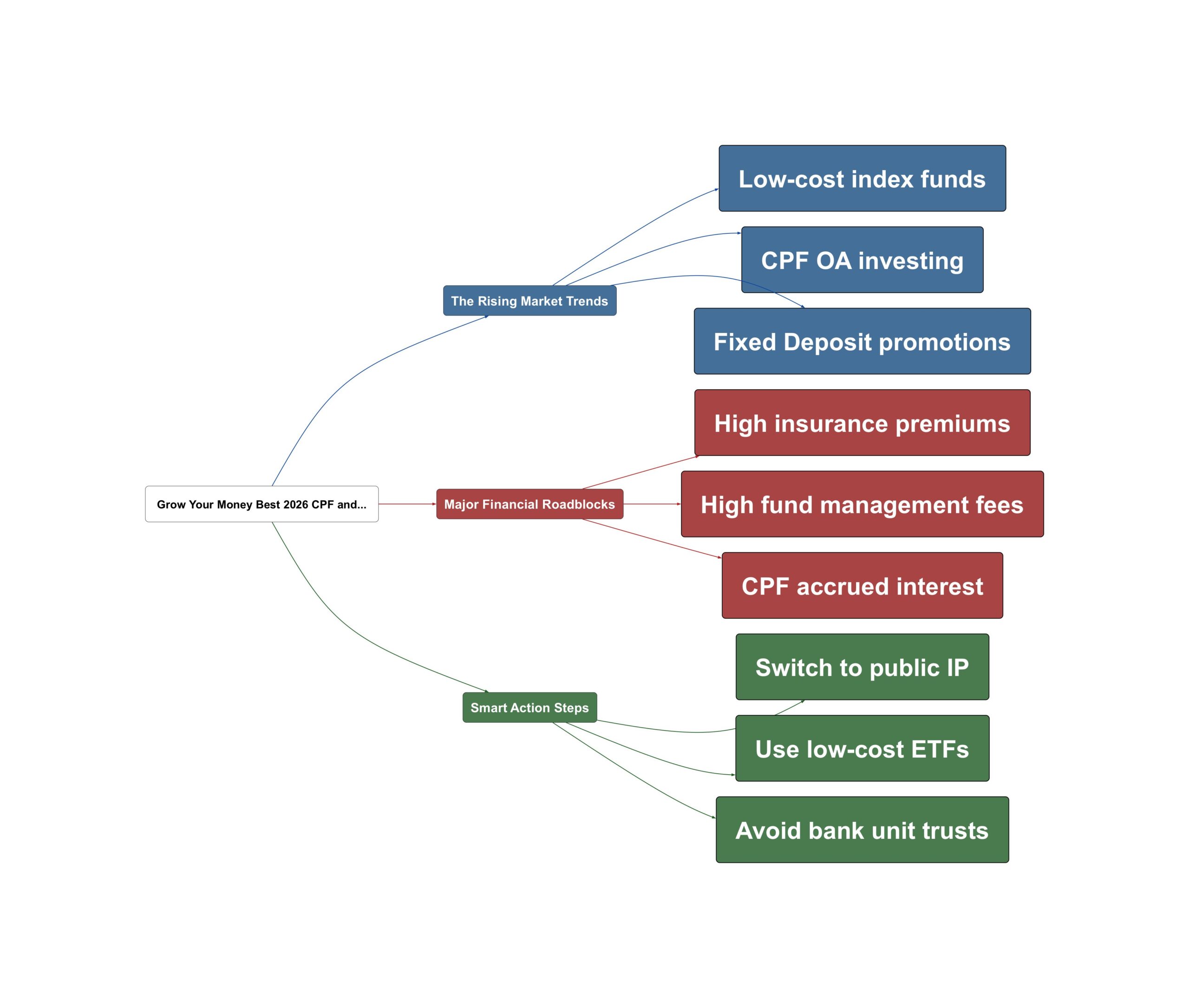

The Rising Market Trends

- Fixed Deposit rates are currently hovering around 1.6 percent for short terms.

HL Bank is offering 1.6% for 6-month deposits. This is a safe haven for risk-averse savers. However, long-term rates are lower at 1.3% for a year.

- Global stock index funds remain the top choice for savvy investors.

The community favors low-cost options like FWRA and VWRA for cash. For those using CPF OA, A12S via POEMS is a popular pick.

“For non-U.S. persons using CPF OA or SRS dollars: A12S via POEMS”

- Managed funds are facing scrutiny over high management fees.

Some funds charge up to 1.6% annually. Investors are questioning if these fees are worth the service provided. High fees can eat into your long-term returns significantly.

Major Financial Roadblocks

- Insurance premiums for private hospital plans are exploding.

Many are seeing massive hikes in their Integrated Shield Plan renewals. Switching to a public hospital plan can save over $1,300 a year. This gap only gets wider as you get older.

“The premium gap explodes with age and time, of course.”

- Some managed funds pay dividends using your own capital.

This happens when the fund performs poorly. It means you are just getting your own money back. This can deplete your initial investment over time.

“They have no choice but to indirectly pay out from the capital.”

- CPF accrued interest is described as a financial sinkhole.

Interest builds up if you use CPF for housing. You must pay this back to yourself later. This reduces the actual cash you get when selling property.

Smart Action Steps

- Downsize your insurance plan to save more cash.

Public hospitals still provide excellent care for Singaporeans. The cash saved can be used for other medical expenses. Shield plans do not cover everything, like chronic medications.

“Would you rather have more or less cash to pay for the medical expenses?”

- Avoid expensive Unit Trusts pushed by bank managers.

Relationship managers often prioritize high-commission products. Always compare their suggestions against low-cost index funds. Do your own due diligence before signing anything.

“The RM only interested to ask me to buy some UT.”

- Use low-cost ETFs for your long-term global exposure.

Stick to funds with low expense ratios. This keeps more profit in your pocket. Options like VWRA or ISAC are great for unrestricted cash. Simple strategies often beat complex ones over time.

Managing money in Singapore requires constant attention. Don’t let your hard-earned cash sit idle. Compare your options and choose low-cost paths. Your future self will thank you for being proactive today.

Read the original discussions on HardwareZone: