Are you letting your hard-earned savings sit idle in a basic savings account? Many Singaporeans miss out on thousands in easy rewards every year. Do you want to earn over 4% yield on your cash safely? It is time to look beyond simple fixed deposits. Learn how to play the banking game like a pro. Your HDB upgrading fund could be working much harder for you today.

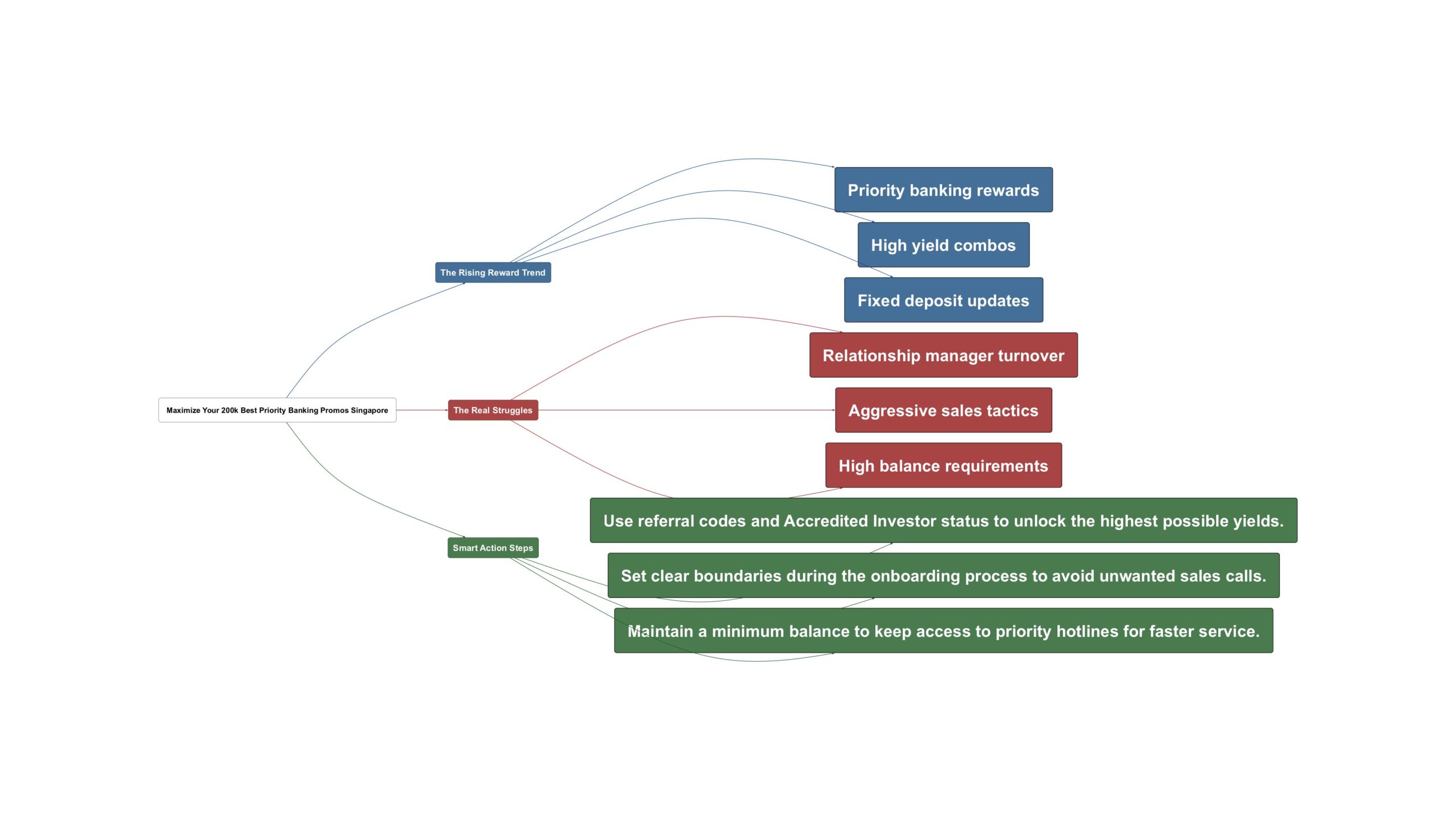

The Rising Reward Trend

Banks in Singapore are fighting hard for your deposits right now. They are offering massive sign-up bonuses for priority banking customers. Standard Chartered is currently leading the pack with impressive combined yields. You can get cash rewards and unit trust units. These rewards can push your total yield above 4.6% easily. This is much higher than standard fixed deposit rates. Many local investors are moving funds to capture these short-term gains.

- Standard Chartered offers a complex but lucrative reward combo for new priority customers.

“Total for items 1-3 is $3338 over 6 months… yield is 3.347%. If 4+5 are included total now is $4638 yield… is 4.65%”

- Other major banks like OCBC and Citigold are offering high cash incentives for three-month commitments.

“Ocbc – $800 put 350k for 3 months Citigold – 1.2k (singsaver) put 300k for 3 months”

- Banks are now differentiating interest rates based on total wealth holdings rather than just account type.

This means your total relationship balance matters more than ever. You should track your total assets across different bank products. This includes your insurance and investment holdings with the bank. High-net-worth individuals are getting better perks like airport lounge access. These lifestyle benefits add extra value to your banking relationship. Always check the fine print for total balance requirements. Missing the mark by even a dollar can void your rewards.

The Real Struggles

Managing priority banking relationships is not always a smooth experience. Many Singaporeans face constant changes in their assigned Relationship Managers. These RMs often stay in their roles for a very short time. This makes it hard to build a long-term financial plan. You might feel like just another number in their system. Some banks are even moving to pooled RM systems. This means you do not have a dedicated person to call. This can be very frustrating when you need urgent help.

- Relationship Managers often have high turnover rates and prioritize their own sales targets.

“I’ve lost count of the number of RMs over the years. They don’t stay long one. we all know… this is a job for them, not a career.”

- Banks may downgrade your service level if your balance falls below certain thresholds.

“Some years back they assigned me to this pooled RM system because I fail to consistently maintain 200k.”

- There is often pressure to buy high-risk investment products to satisfy bank KPIs.

RMs are often incentivized to sell products with higher commissions. These products may not suit your risk profile or age. Older investors need to be especially careful with their retirement funds. You must stay firm and say no to unwanted products. It is your money and your financial future at stake. Do not let a friendly RM talk you into bad deals. Always ask about the underlying risks of any recommended fund. If it sounds too good to be true, it probably is.

Smart Action Steps

You can maximize your returns by being strategic with your deposits. Use a laddering strategy if you have a larger sum of money. This involves splitting your funds across different banks and maturity dates. It keeps your cash liquid while capturing the best promotional rates. Always look for referral bonuses to boost your initial returns. You can share these bonuses with friends or family members. This turns banking into a social and profitable activity. Being a savvy consumer pays off in the long run.

- Use referral codes and Accredited Investor status to unlock the highest possible yields.

“extra $800 if you used a referral from an existing customer… extra $500 if you qualify and opt as an Accredited Investor”

- Set clear boundaries during the onboarding process to avoid unwanted sales calls.

“If you not keen to meet or buy stuff i guess they wont bother you.”

- Maintain a minimum balance to keep access to priority hotlines for faster service.

The premier hotline is a lifesaver when your funds are blocked. It bypasses the long wait times of standard customer service. This is especially important for large overseas transfers or urgent issues. Keep your contact details updated to receive priority red packets. Some banks still send physical perks to their top-tier clients. These small gestures make the banking experience more pleasant. Always review your strategy every six months to stay ahead. The banking landscape in Singapore changes very quickly.

In conclusion, chasing the best rates requires some effort and planning. You can earn significantly more than the average Singaporean by being proactive. Do not be afraid to move your money between banks. Loyalty rarely pays as much as a new customer promotion. Stay informed by reading the latest forum discussions and terms. Your path to wealth is built on these small, smart decisions. Start optimizing your bank accounts today for a better tomorrow. Happy hunting for those high yields and huat big time!

Read the original discussions on HardwareZone: