Buying a home in Singapore feels like a puzzle. Prices are high. Interest rates are a mystery. Should you get that BTO, resale HDB, or a condo? It is a tough call for many Singaporeans. The market is sending mixed signals. Let’s break down what is really happening on the ground.

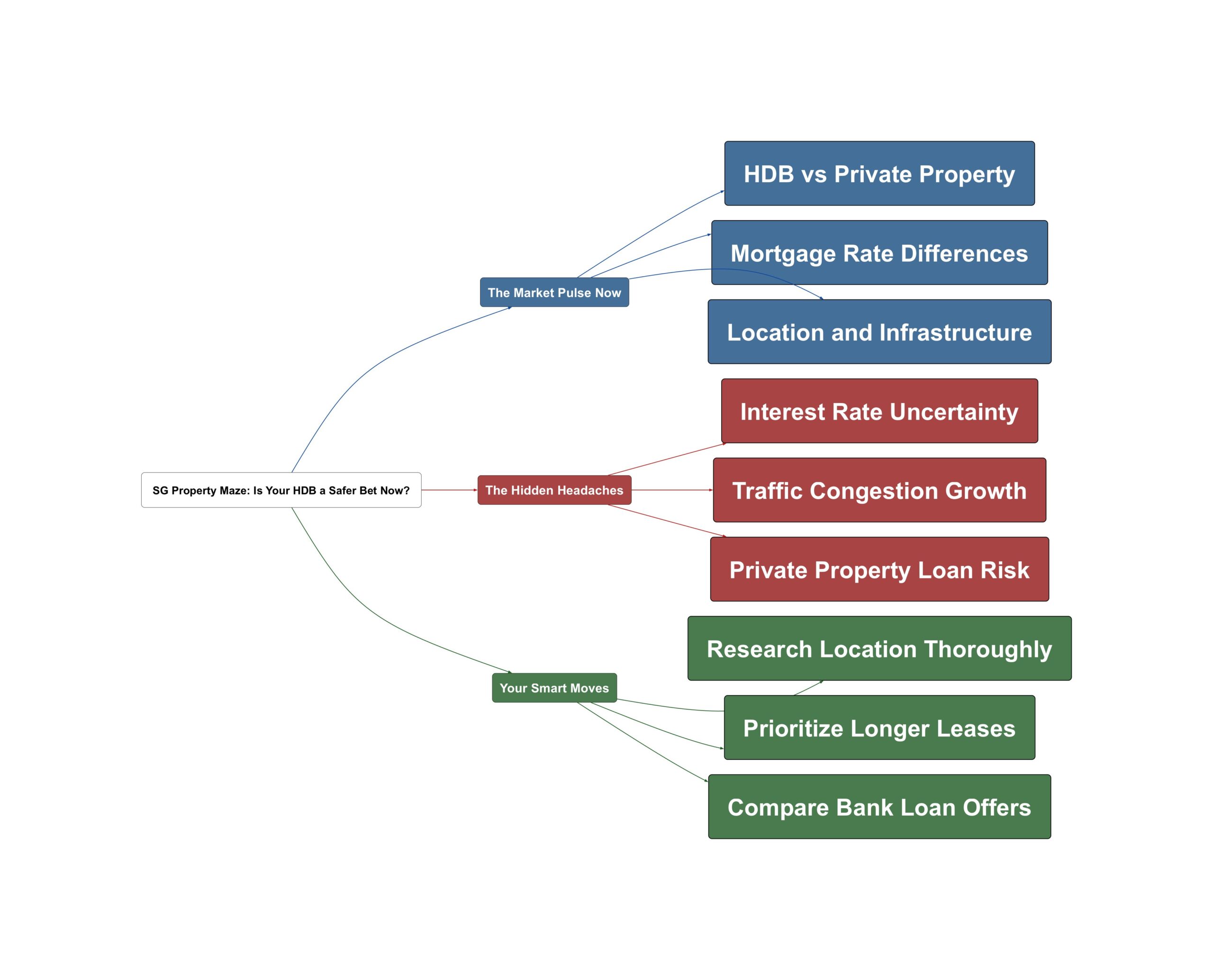

The Market Pulse Now

The property scene is changing quickly. What was true last year is different today. We looked at what people are saying to understand the current mood. Here are the key trends you need to know about right now.

- Resale HDB prices are hitting new highs.

Some mature estates are seeing record sales. For example, a 5-room flat in Bukit Batok recently sold for $1.02 million. This shows strong demand for well-located resale flats with good amenities. People are willing to pay a premium for convenience and space.

- New launch condo hype seems to be cooling.

There is less chatter about new private property launches. This suggests buyers are becoming more cautious. High prices and economic uncertainty might be making them wait on the sidelines.

Looks like everyone run out of names to buy houses anymore which explains why there’s hardly any discussion on new launches now.. LOL!!!

- Banks favor HDB owners with better loan rates.

A major difference has appeared in the mortgage market. Banks are offering attractive long-term fixed rates for HDB loans. You can find 5-year fixed rates as low as 1.78%. However, these deals are not available for private properties.

No banks are offering 5 years fixed for private property at the moment. So far the lowest 5 years fixed is 1.78% (300k HDB and above).

The Hidden Headaches

Chasing your dream home in Singapore comes with challenges. Beyond the price tag, there are other issues that can cause major stress. These are the top concerns shared by homeowners and buyers on the ground.

- Future interest rates are a huge unknown.

This is the biggest worry for many. While HDB owners can lock in rates for 5 years, private property owners cannot. Their 2 or 3-year fixed terms will end, exposing them to unpredictable floating rates. This makes financial planning very difficult.

Nobody can predict exactly what future interest rates will be, and that’s especially true with interest rates more than 3 years from now.

- Infrastructure is struggling to keep up.

New estates like Tengah are booming. But this rapid growth is causing problems for nearby areas. Roads in places like Bukit Batok are becoming very congested. What was a 15-minute drive can now take 25 minutes or more.

It feels like another punggol 15-20 years ago to me.

- Private property owners face higher risks.

With shorter fixed-rate loan periods, private property owners face a big question mark. After 3 years, their mortgage payments could jump significantly. This uncertainty adds a layer of financial risk that HDB owners currently do not face.

now private property must wait 4 years to sell 3 years of fixed means 4th year will be a question mark

Your Smart Moves

Navigating this complex market requires a smart strategy. You cannot just follow the crowd. Here are three actionable steps you can take to make a better decision for your future home and financial health.

- Research locations beyond the floor plan.

Go down to the area yourself. Feel the environment. Check for traffic congestion during peak hours. Consider future developments like new MRT lines or potential noise from airbases. A convenient location is more than just being near an MRT station.

- Prioritize flats with a longer remaining lease.

Lease decay is a real concern in Singapore. It might be wiser to pay more for a newer flat. A unit with 89 years left is often a better long-term asset than a cheaper one with only 75 years. It will be easier to sell later on.

I think more worth to fork out another 120k given the much longer remaining lease, high floor and proximity to MRT and facilities than 900k with 75 years mid floor units.

- Actively shop around for the best mortgage.

Do not just accept the first loan offer you get. Different banks have different promotions. Some relationship managers are more eager to secure deals. Contact multiple banks to compare their packages. A little effort can save you thousands of dollars.

So far my HSBC banker still very hungry for sale. I think it might be the individual RM issue.

The Singapore property market is at a crossroads. HDBs currently offer more stability with long-term fixed loans. Private properties demand a bigger appetite for risk. Your best move is to do your homework. Plan carefully for the long term. Make a choice that secures your future, not just your dream address.

Read the original discussions on HardwareZone: