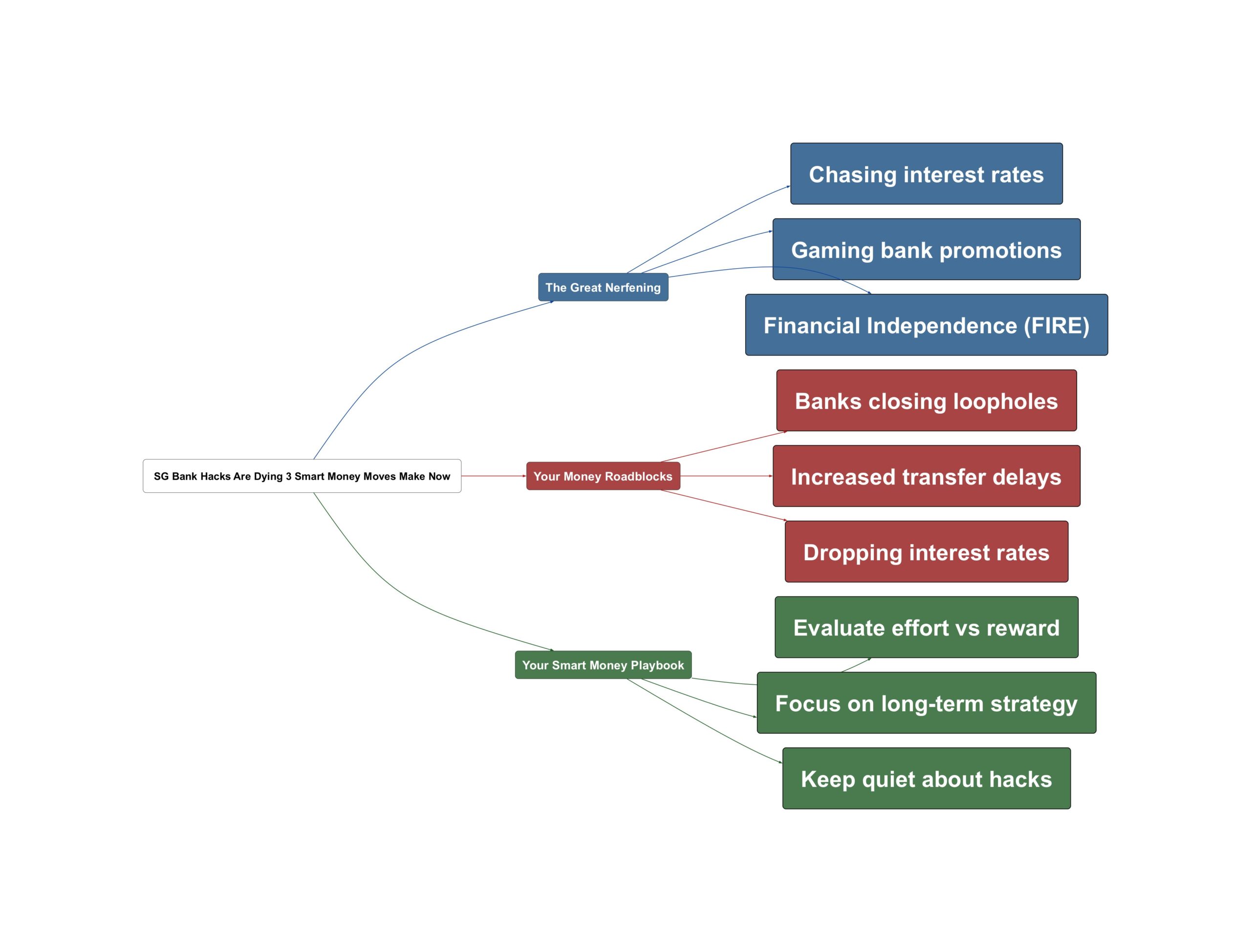

Are your favourite bank lobangs disappearing? You’re not the only one. One day you have a great savings hack. The next day, the bank nerfs it. This cat-and-mouse game is getting tiring. The old tricks to earn high interest are fading fast. But don’t worry, there are new ways to grow your money. You just need to change your strategy.

The Great Nerfening

The golden era of easy bank hacks seems to be ending. Banks are closing loopholes faster than we can find them. This is what Singaporeans are seeing on the ground right now.

- Popular hacks are getting shut down

Banks are cracking down on popular workarounds. The famous DBS Multiplier $1 investment trick is a key example. Many used it for years to unlock higher interest. Now, that loophole is gone.

“Been doing that for donkey years since like 2021, until recently ppl start discussing about $1 to unlock investment cat, then almost immediately tio nerf”

- Interest rates are falling across the board

It’s not just about hacks. Base interest rates are also dropping. Banks like OCBC, CIMB, and Maybank have all announced rate cuts. This makes it harder to earn decent interest on your savings.

“now I put maybank isavvy.. higher than this cimb FD .next month headache liao coz Maybank will be dropping..”

- New rules make fund-hopping a hassle

New regulations are causing transfer delays. Moving money between banks can now take 24 to 48 hours. This makes the classic ‘musical chairs’ strategy less effective. The small extra interest may not be worth the delay and effort.

Your Money Roadblocks

Growing your savings is getting tougher. Beyond falling rates, Singaporeans face new obstacles. These challenges require a smarter approach to personal finance.

- Banks are watching the forums

Don’t assume your discussions are private. Bank employees actively read forums like HardwareZone. When a good lobang gets too popular, it gets shut down. This is why many users warn against oversharing.

“Loose lips sink ships. And will continue to sink ships.”

- Stricter security creates delays

While security is important, it can also be a headache. Some banks have fraud monitoring systems that are too aggressive. They can hold your transfers for hours, requiring long phone calls to resolve. This adds unnecessary friction to managing your money.

“HSBC’s uplifting the transfer hold process and response time definitely has lots to improve… Their time taken to provide transfer hold details or calling clients to verify transfer is pathetic”

- Requirements are getting higher

Banks are also raising the barrier to entry. For example, HSBC recently increased its income requirement for new credit cards from $30,000 to $65,000. This makes it harder for some to access premium banking products and perks.

Your Smart Money Playbook

The game has changed, but you can still win. It’s time to shift from short-term tricks to long-term strategies. Here are three actionable steps you can take.

- Stop being penny wise, pound foolish

Calculate if chasing small interest gains is worth your time. A user calculated that a 48-hour transfer delay for just $12 more in interest was not worth the stress. Your time and sanity have value. Focus on what gives you the best return for your effort.

“We now need to stop being penny wise pound foolish and think if our time and sanity is worth to do musical chairs for just this $12 difference.”

- Focus on stable, long-term plays

Instead of constantly moving cash, build a stable foundation. Look into reliable options like cashback credit cards for your daily spending. Consider putting funds into Singapore Savings Bonds (SSBs) or low-risk money market funds for steady growth.

“Personally prefer money market funds am already familar with hence went that route.”

- Aim for the real prize: FIRE

Shift your mindset from earning a few extra dollars to building real wealth. The Financial Independence, Retire Early (FIRE) movement is gaining traction. Forum members have shared milestones of crossing $300k and even $1 million in their portfolios. One even retired at 45. This is the ultimate goal.

“Finally crossed the $1m milestone.”

The era of easy bank hacks may be over. But this is a good thing. It pushes us to be smarter investors, not just clever gamers. By focusing on long-term strategies, you can build sustainable wealth and achieve true financial freedom. Your journey starts with the first smart decision today.

Read the original discussions on HardwareZone: