See another condo launch hit $2 million? Feel like your dream home is getting further away? You are not alone. Many Singaporeans feel the heat from rising property prices. The coffee shop talk is always about how expensive things are. But what is really happening? We dived into HardwareZone forums to get the real story. Here is what insiders are saying about the market right now.

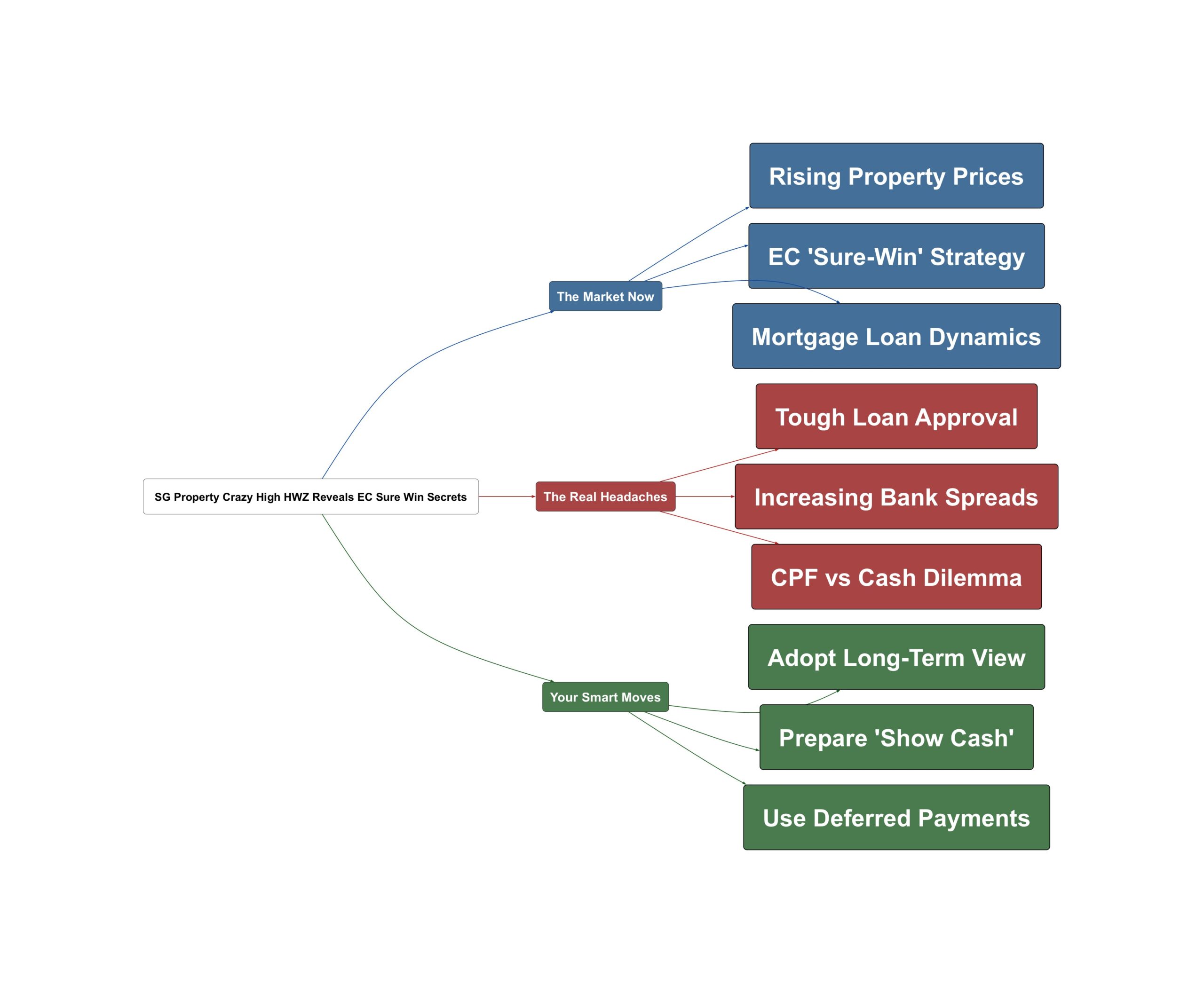

The Market Now

The property market is moving fast. Prices for both new and resale homes are climbing. But some clear trends are emerging. Understanding them can give you an edge. Here are the key things forum members are seeing on the ground.

- Property prices show a clear chain reaction

When one type of property gets more expensive, it pulls others up with it. This domino effect means waiting might cost you more. It is a constant upward push across the board.

“If resale EC is $1.5mil, resale condo will be $1.8mil. If new EC is $1.8mil, new condo sure $2.2mil.”

- Executive Condos (ECs) are seen as a ‘sure-win’

Many believe ECs are a safe bet for property investment. They bridge the gap between public and private housing. The potential for profit after the Minimum Occupation Period is high.

“I feel for EC to lose money, you need to be ultra suay. This is like failing an exam despite your professor give you the exam paper in advance.”

- Low interest rates are pushing buyers into property

When bank savings earn very little, people look for better returns. Property becomes an attractive option. This increased demand helps to keep prices high. Agents use this to encourage faster buying decisions.

“Low interest rates meaning those buyers bey song getting pennies for their monies park in banks, so take out whack condo lor.”

The Real Headaches

Buying property in Singapore is not a simple walk in the park. Beyond the high prices, there are real challenges. These are the hurdles that buyers face daily. They can make the journey stressful and confusing. Here are the top concerns shared by the community.

- Securing a large enough loan is a major hurdle

Banks are becoming stricter with loans. They often require buyers to show significant cash savings. This ‘show cash’ method can be a big roadblock. It is a hidden requirement that catches many off guard.

“When i asked how to fulfil the extra 50k, the bank asked for either 40k+ FD for 2 years or show 150k of liquid cash (no lock-in).”

- Mortgage loan terms are getting more complex

Even if interest rates like SORA seem low, banks are finding ways to earn more. They increase the ‘spread’, which is their profit margin. This means your total interest payment could be higher than you expect.

“Actually alot of banks have priced in the forecast cut already. Most of the banks have increase the floating rate spread since last month.”

- The CPF versus cash payment dilemma

Deciding how much CPF to use is a big decision. Some prefer to empty their CPF to maximize cash on hand. Others save their CPF for retirement. There is no one right answer. It depends entirely on your financial strategy.

“I always empty CPF for downpayment and keep as much cash on hand……how come so funny never touch CPF at all for both properties.”

Your Smart Moves

Feeling overwhelmed? Do not be. With the right strategy, you can navigate the market. Knowledge is your best tool. Forum veterans share practical advice to help you succeed. Here are actionable steps you can take to make smarter property decisions.

- Adopt a long-term investment mindset

Property is not for quick profits. Think in terms of a decade, not just a few years. This helps you ride out market fluctuations. Also, remember the Seller’s Stamp Duty (SSD) period to avoid unnecessary taxes.

“This thread doesn’t make sense when you all keep talking about 2-3 years time People hold property is for long term. 10 years.”

- Understand and prepare for the ‘show funds’ requirement

Talk to your banker early. Find out exactly how much cash you need to show. This gives you time to save or arrange the funds. Being prepared makes the loan application process much smoother.

“alternatively borrow even more then show funds at 3 points; on application, before loan disbursement etc. then you no need to pledge…”

- Explore different payment schemes for new launches

For buildings under construction (BUC), look into your options. A deferred payment scheme can ease your initial cash outlay. It gives you more time to save before the bulk of the payment is due upon completion.

“My one is BUC and defer payment. I intend to pay full when TOP and move in.”

The Singapore property market is tough, but not impossible. By understanding the trends, preparing for the challenges, and making smart moves, you can still achieve your dream. Do your homework, plan carefully, and focus on your long-term goals. Your property journey is a marathon, not a sprint.

Read the original discussions on HardwareZone: