Your Fixed Deposit is maturing. You check the new interest rates. They are shockingly low. Does this sound familiar to you? Many Singaporeans are facing this problem today. Our traditional ways of saving are not keeping up. Your hard-earned money is barely growing. It feels like you are running on a treadmill. You put in the effort, but you are not moving forward. So, how can we make our money work harder for us in Singapore? It is time to explore other options.

The Savings Squeeze

The financial landscape in Singapore is changing fast. What worked for our parents may not work for us. Interest rates are falling across the board. This directly impacts every Singaporean saver. We need to understand what is happening to protect our future. The numbers paint a clear picture of this new reality.

- Fixed Deposit rates are falling hard

Major banks in Singapore are cutting their rates. Bank of China, ICBC, and Bank of India have all announced reductions. This trend is likely to continue. Your savings in the bank now earn much less than before. This makes it difficult to grow your wealth through traditional FDs.

“Banks of course want more ppl to put monies in FD or HYSA. They basically want to use YOUR monies, invest it and gain way way more returns from your deposited monies, and then just give you a measly 2 to 4 percent interest to make you happy, while they pocket the remainder…”

- Government bonds offer low returns

Singapore Savings Bonds (SSB) are known for their safety. However, the returns are not very attractive right now. Projections for the upcoming SSB show an average return of only 1.81% over ten years. This rate may not even beat inflation. Your purchasing power could actually decrease over time.

- Some investors are finding new paths

Faced with low returns, some Singaporeans are looking overseas. They are exploring the US stock market. A popular strategy discussed online is selling options. One forum member claims this method is more lucrative than starting a business in Singapore. It offers a way to generate income from capital, not just save it.

Facing The Fear

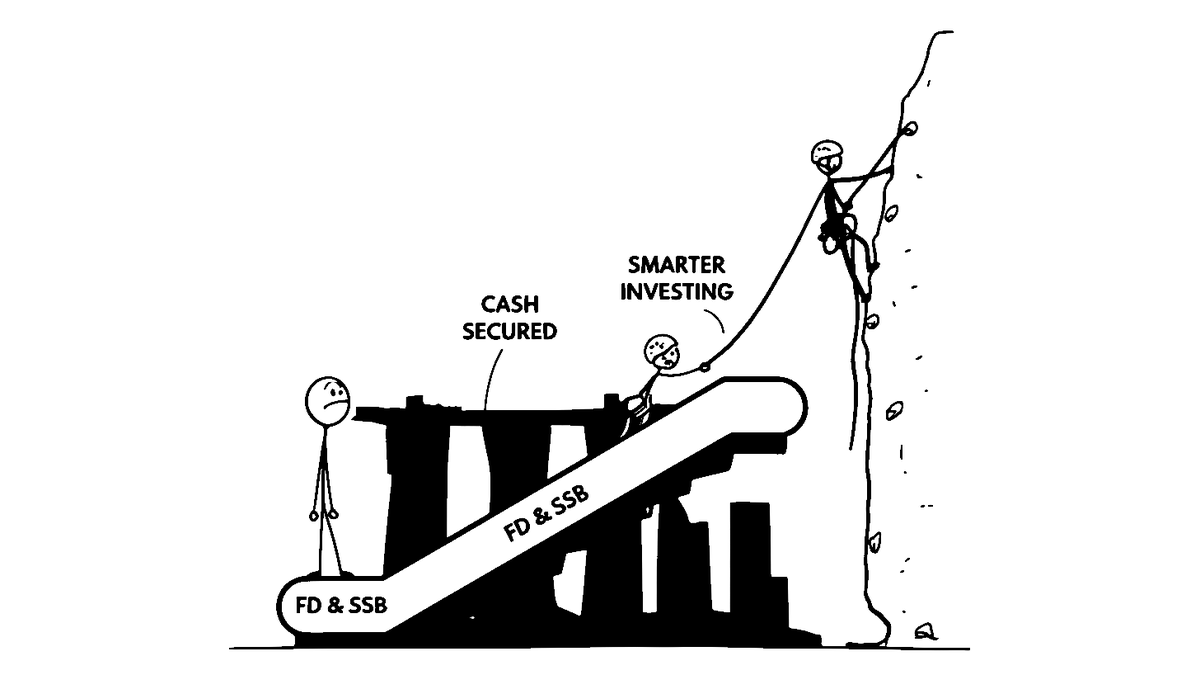

Moving beyond FDs and SSBs can be scary. The world of investing seems complex and full of risks. These fears are valid and shared by many in our community. Understanding these challenges is the first step to overcoming them. Let’s look at the main concerns Singaporeans have.

- Investing feels too risky for many

The stock market can be volatile. Many of us worry about losing our hard-earned money. This fear is especially strong for older Singaporeans. Their capital is meant for retirement. They do not have decades to recover from a market downturn. This makes them stick to safer, low-yield options.

“We don’t have much time to play our capital with as we need it for retirement.”

- New strategies seem very complicated

Terms like ‘selling options’ or ‘covered calls’ sound confusing. It can feel like a secret language for financial experts only. This complexity can be a major barrier. It stops people from even trying to learn more. The fear of making a mistake is powerful.

- High returns create deep skepticism

When someone shares stories of high returns, we often feel suspicious. It can sound ‘too good to be true’. We might think it is a scam or a bluff. This skepticism is a defense mechanism. But it can also close us off from legitimate opportunities to grow our wealth.

“The WhatsApp group owner ban me say I bluffing and using paper account. I not even gaining any single cent from any of them, just sharing how I earn from options, also tio removed”

Your Action Plan

Growing your money requires a plan. You do not have to take huge risks. Small, informed steps can make a big difference. The key is to move from being a passive saver to an active investor. Here are three practical steps you can consider. They are based on discussions from fellow Singaporeans.

- Start with education, not speculation

Do not jump into investing blindly. Take time to learn the basics first. There are many free tutorial videos and articles online. You can start with simpler products. For example, buying an S&P 500 ETF is a common first step. It allows you to invest in the broader market without picking individual stocks.

“I put my foot in the US stock market by just buying S&P 500 few years ago and saw very good growth back then, which is why i started putting my feet on using options for individual stocks.”

- Use safer, cash-secured strategies

You do not need to use risky methods like borrowing to invest. Focus on strategies that are ‘cash-secured’. This means you only invest money that you actually have. For options, it means you have the cash to buy the stocks if needed. This approach significantly reduces your risk.

“It’s only risky if one uses a margin account. I am all cash secured and I choose my stocks that I happy to play and wheel. So I nv once find it risky…”

- Match your strategy to your age

Your investment plan should fit your stage in life. Younger investors have a longer time horizon. They can afford to take more calculated risks. If you are nearing retirement, safety is your priority. You might choose to invest only a small portion of your portfolio. The goal is to grow your money wisely, not gamble it away.

Read the original discussions on HardwareZone: