Is your HDB or condo loan eating up your salary? You are not alone. But what if you could lower your monthly payments? Interest rates in Singapore are changing fast. HardwareZone users are buzzing about the best deals. Many homeowners feel stuck with their current rates. They worry about making the wrong choice. This guide breaks down the latest trends. It gives you clear steps to save money on your mortgage.

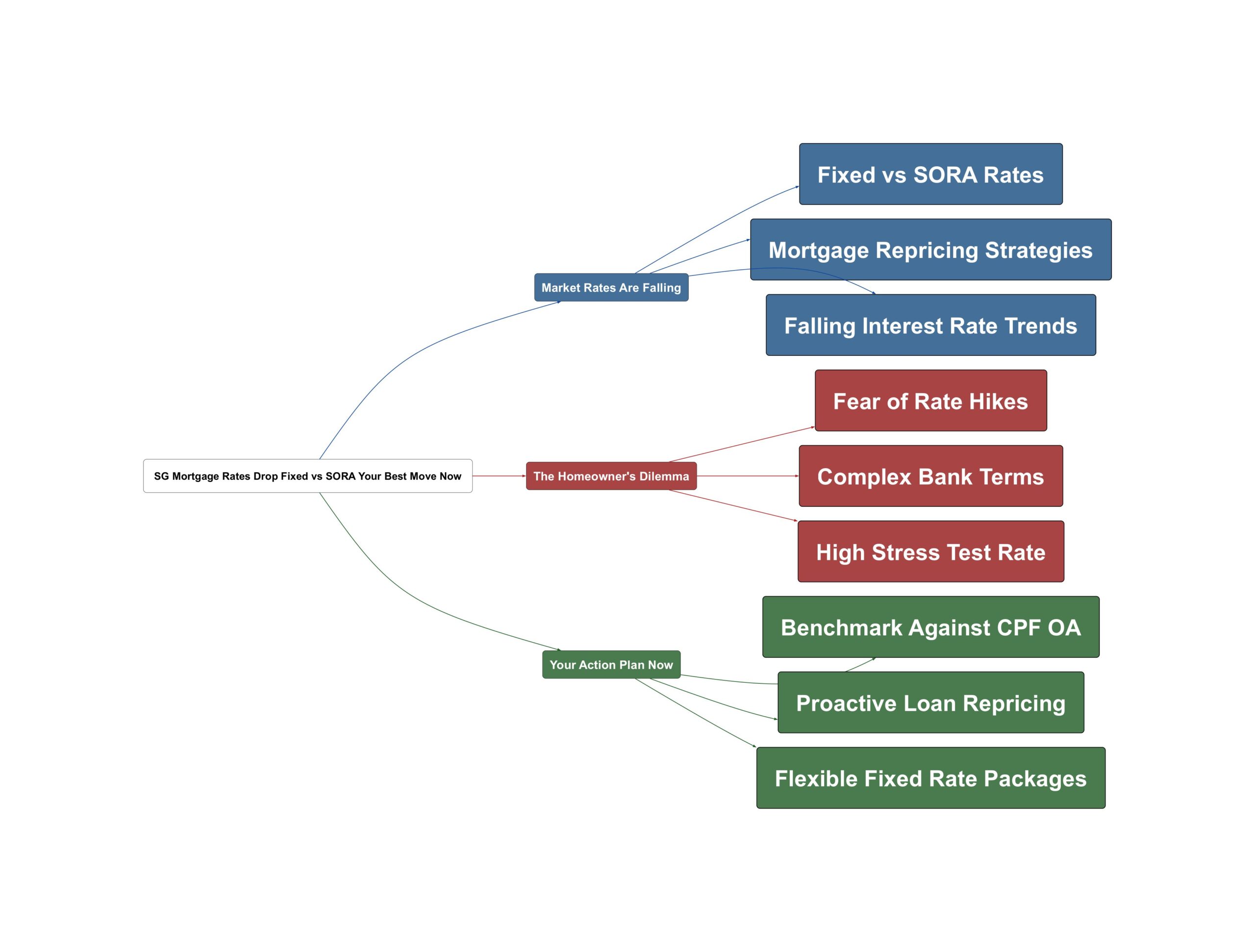

Market Rates Are Falling

The mortgage market is shifting. Banks are now offering much lower rates. This is great news for Singaporean homeowners. Understanding these new rates is the first step. It helps you decide on your next move. Smart decisions now can save you thousands of dollars over your loan period.

- Fixed rates are now below the CPF OA rate

Many banks now offer fixed rates below 2%. This is lower than the 2.5% interest your CPF Ordinary Account earns. This makes fixed-rate packages very attractive for risk-averse owners. You get stability and a good rate.

That person is getting 2.5% interest on a CPF Ordinary Account, so it works well enough.

- SORA floating rates remain very low

Floating rates based on SORA are also low. The 1-month SORA is around 1.31%, while the 3-month is 1.53%. With the bank’s spread added, the total rate is still very competitive. This is for those who think rates will stay low.

Generally sora package is 1m/3m sora + 0.3%~0.5% (Depending on your loan amount).

- Banks expect rates to drop further

Some banks are offering 3-year fixed rates as low as 1.65% for large loans. This signals that they are confident rates will continue to fall. Locking in a good rate now could be a very smart move.

Got one bank offering 1.65% fixed for 3 years already.. Which means bank are confident that rates will be coming down.

The Homeowner’s Dilemma

Lower rates are exciting. But choosing the right package can be stressful. Homeowners face several key challenges. You need to weigh stability against potential savings. Understanding the risks is crucial. Making an informed choice prevents future regret and financial stress.

- Fear of choosing the wrong package

The biggest worry is picking a floating rate, only for it to shoot up. A fixed rate provides peace of mind. But you might miss out if rates fall further. It feels like a gamble on the future economy.

If bet wrongly and increase goes to 3% then I die lo

- Navigating confusing bank terms

Different banks have different rules. Some offer waivers on sale penalties during the lock-in period, while others do not. You must read the fine print. These small details can cost you a lot of money later on.

DBS bank offers “Waiver of penalty due to sale during lock in period”. OCBC dont~

- High stress test rates affect loans

Even though market rates are low, banks still use a high stress test rate. This is currently around 4%. This rate is used to calculate your loan eligibility. It can limit how much you can borrow, making it harder to refinance.

So far bank stress test is still 4% despite SORA drop alot.

Your Action Plan Now

Don’t just wait and see. You can take control of your mortgage. A few simple steps can lead to big savings. Here is a clear action plan. Follow these tips to secure a better home loan rate. It’s time to make your money work harder for you.

- Benchmark against your CPF OA rate

Your CPF Ordinary Account earns 2.5%. Use this as your guide. If a bank offers you a mortgage rate below 2.5%, it is a good deal. Your CPF savings are earning more than your loan is costing.

Typically if the offered rate is below 2.5% (the OA rate) it’s worth at least considering.

- Proactively ask for repricing offers

Do not wait for your bank to contact you. About three months before your lock-in period ends, ask for a repricing offer. You can often do this online. This starts the conversation and shows you are a savvy customer.

About 11 weeks before your fixed interest rate period ends, ask DBS (I assume it’s DBS) for a repricing offer.

- Choose packages with flexibility

If you are worried about risk, look for flexible options. Some banks offer a 2-year fixed rate with a free conversion after the first year. This gives you a good balance. You get stability now and flexibility later if rates drop.

For clients who are very risk-averse, a 2-year fixed with free conversion after 1 year is a good compromise.

Read the original discussions on HardwareZone: