Are your savings earning less interest? You are not alone. Banks across Singapore are cutting their rates. Your hard-earned money is losing its power. This makes saving for your HDB or retirement much harder. So, where should you park your cash now for the best returns? HardwareZone’s savviest savers have been sharing their strategies. We’ve compiled their top insights to help you navigate this tricky financial landscape. Don’t let your savings sleep. It’s time to make your money work smarter for you.

The Great Rate Drop

The trend is clear across the board. Banks are tightening their belts. This means lower returns for everyday Singaporeans. Understanding the current situation is the first step to protecting your savings.

- Fixed deposit and savings rates are plunging

Many local and international banks have reduced their promotional rates. Savers who relied on these offers are now searching for new options. The easy days of high interest seem to be over for now.

All are down down down

- High-yield accounts demand more from you

Getting top-tier interest now requires serious effort. Accounts like the DBS Multiplier have complex criteria. You often need to credit a high salary and transact in multiple categories. It is not as simple as it used to be.

in order to max need to clock >30k income every mth……how?

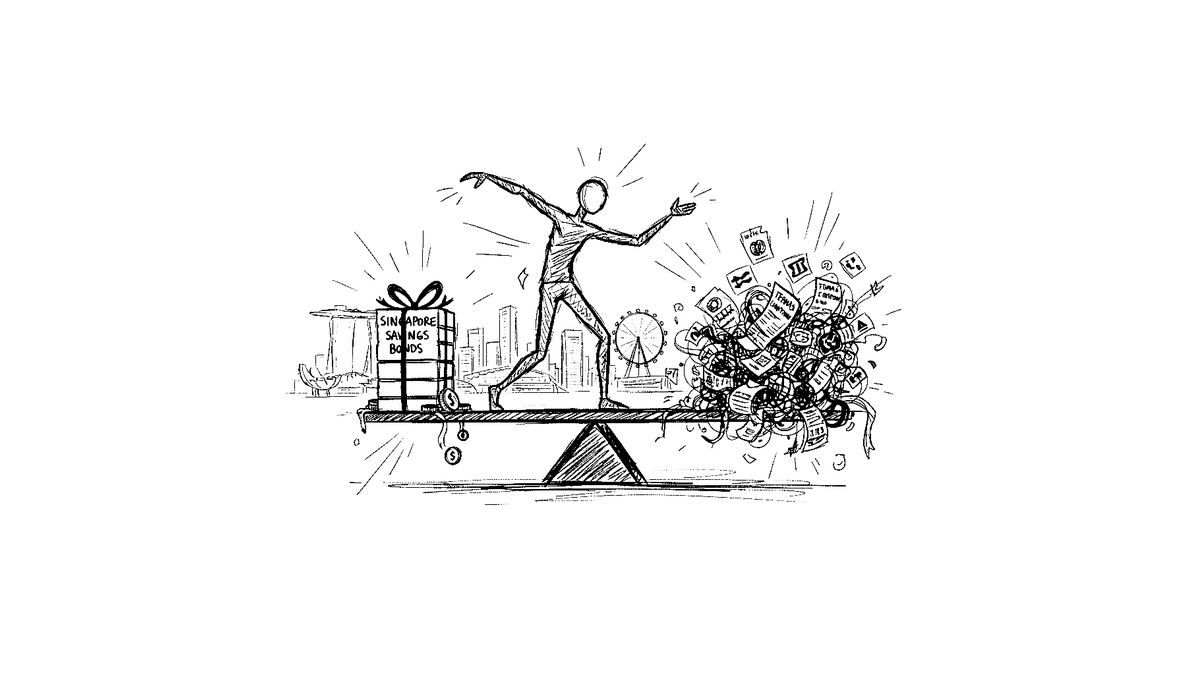

- Singapore Savings Bonds (SSBs) offer stability

While bank rates fall, SSBs remain a safe choice. The returns are not spectacular, but your principal is guaranteed. The latest SSB offers an average return of around 1.93% over ten years. It is a reliable foundation for any savings plan.

Your Biggest Hurdles

Navigating the world of savings accounts is not easy. Singaporeans face several key challenges. These roadblocks can stop you from maximizing your money’s growth. Here are the main pain points discussed online.

- Confusing terms and conditions

Bank promotions often come with tricky rules. Some savers get locked into lower rates by mistake. For example, Standard Chartered’s e-invite system can be less attractive than its public offers. You must read the fine print very carefully.

E-invite no mention of wealth holdings so I presume only get 1.75% for Aug to Oct.

- The constant hassle of chasing promotions

To get the best rates, many people move money between banks. This strategy, known as cycling, can be tiring. It requires constant monitoring of different promotion periods. Missing a date could mean losing out on bonus interest for the month.

Your scenario won’t work in Oct as your Joint will be comparing with Aug ADB, which is high.

- The temptation of chasing risky high yields

With safe returns so low, some look to riskier assets. Junk bonds and complex ETFs promise higher yields. However, they also carry a much higher risk of losing your capital. Experts on the forum warn against jumping in without understanding the dangers.

Don’t buy junk bonds now.

Actionable Savings Hacks

Despite the challenges, there are smart ways to grow your savings. You just need the right strategy. Here are three actionable hacks from HardwareZone users to help you get better returns on your cash.

- Master the ‘wealth holding’ trick

Many banks offer higher interest if you have investments with them. You can unlock this bonus without taking big risks. The trick is to buy a very small amount of a low-cost stock. This small purchase can qualify you for a much better savings rate.

For myself I have 100 unit of Nam Cheong which cost $72 now. This acts as a base for me and I’m not selling.

- Combine accounts to conquer criteria

Don’t rely on just one bank account. Use a combination of accounts to meet different goals. For instance, use UOB One for your daily spending. Then, use another account for salary crediting and savings. This approach helps you maximize the bonus interest from each bank’s unique structure.

- Build a foundation with safe havens

Before chasing higher yields, secure your base. Use instruments like Singapore Savings Bonds or T-bills. These government-backed options protect your principal. They provide a stable, predictable return. This safety net allows you to explore other options with less worry.

if they want highly assured return of at least (nominal) Singapore dollar principal then choose Singapore Savings Bonds, bank fixed deposits

Interest rates may be falling, but you are not powerless. By staying informed and using smart strategies, you can still make your money grow. Review your current savings plan today. A few small changes could lead to significant gains over time. Take control of your finances and build a stronger future.

Read the original discussions on HardwareZone: