Ever found yourself stuck in an MRT jam, scrolling through social media, and dreaming of a life beyond the 9-to-5 hustle? Financial Independence, Retire Early (FIRE) in Singapore sounds like the ultimate dream, right? But what happens after you’ve meticulously planned your CPF and HDB finances and actually take the plunge? One Singaporean Redditor shared their one-year FIRE update, and it’s a real eye-opener.

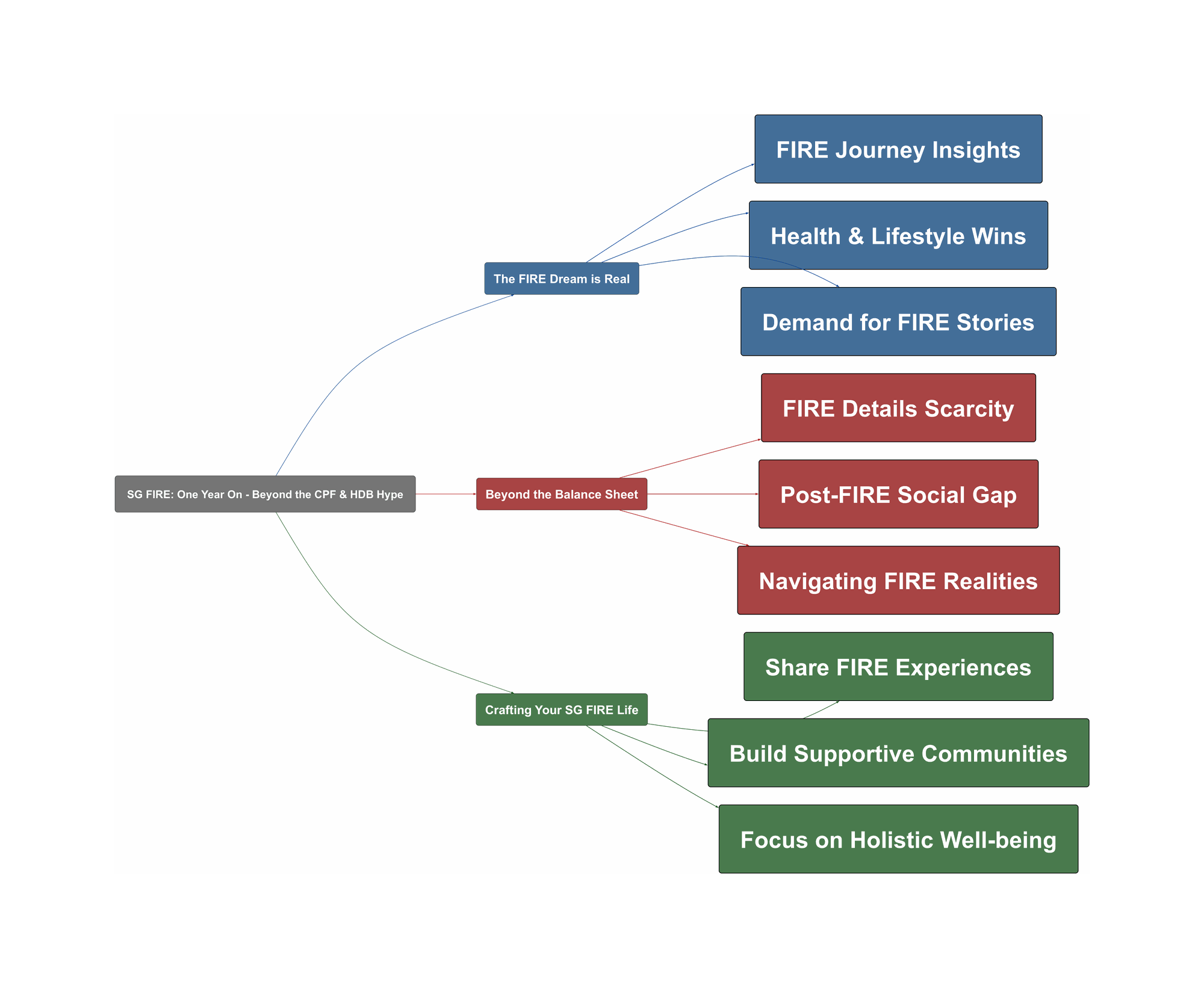

The FIRE Dream is Real

The aspiration to achieve FIRE is definitely heating up in Singapore. It’s no longer just a Western concept; more locals are crunching numbers and making plans. We’re seeing folks share their journeys, inspiring others to consider if early retirement is possible even in our expensive city. One Redditor, after a year of FIRE, highlighted significant personal wins, like an improved VO2max from 39 to 43 and a sleep score jump from the mid-50s to the mid-70s. These aren’t just financial gains; they’re life quality improvements that many Singaporeans crave.

“Thank you for sharing, this is amazing. we need more posts like these to give balanced perspectives of FIRE – both the good and bad.”

“When I grow up, i wanna be like this guy. (saying this as a middleage old sack)”

Beyond the Balance Sheet

Achieving FIRE isn’t just about hitting a magic number in your bank account; there are real-life adjustments and a thirst for more than just financial stats. Many on Reddit expressed a desire for the nitty-gritty details: age at retirement, monthly expenses, portfolio allocation, and drawdown strategies. This hunger for specifics shows that while the dream is appealing, the ‘how-to’ for the average Singaporean can feel a bit murky. The original poster, ‘lifeistoughasfuck’, also mentioned their update was “12 months late,” hinting that the transition might have its own set of challenges and adjustments before one feels ready to share. The call for a community of FIREd individuals also points to a potential gap once the office camaraderie is gone.

“Great sharing, thanks. Would love more details about how old are you, general expenses, portfolio allocation, drawdown strategy, etc.”

“Is there a community for ppl who actually has FIREd like you? I think it will be beneficial to have such community because as you said, there are few ppl who has actually done it”

Crafting Your SG FIRE Life

So, how can aspiring FIRE-starters and those already on the path navigate this? The overwhelming response to the Reddit post shows that sharing experiences is invaluable. Documenting the journey, the good and the bad, helps demystify FIRE and provides relatable insights. As the original poster aimed to give a “nuanced view,” others are encouraged to do the same. Beyond the financials, focusing on holistic well-being – like the Redditor who improved their health and started cooking more – is key. Actively seeking or even starting small communities, whether online or offline, can provide support and shared learning. It’s about building a fulfilling life post-work, not just escaping work.

“I hope this gives a nuanced view of my experience thus far.”

“Really like how balanced your perspective is and your honest sharing both the good and bad of FIRE. Looking forward to your future posts.”

Ultimately, FIRE in Singapore is achievable, but it’s a personal journey with more facets than just finances. Sharing, learning, and community can make the path clearer and the destination even more rewarding.