Eh, check your investment app anot? See all that red, sure heart pain, right? Especially when you’re saving up for that BTO downpayment or a comfy retirement beyond your CPF. Market volatility can feel like a wild ride on the MRT during peak hour – shaky and unpredictable. But don’t worry, lah, you’re not alone in this.

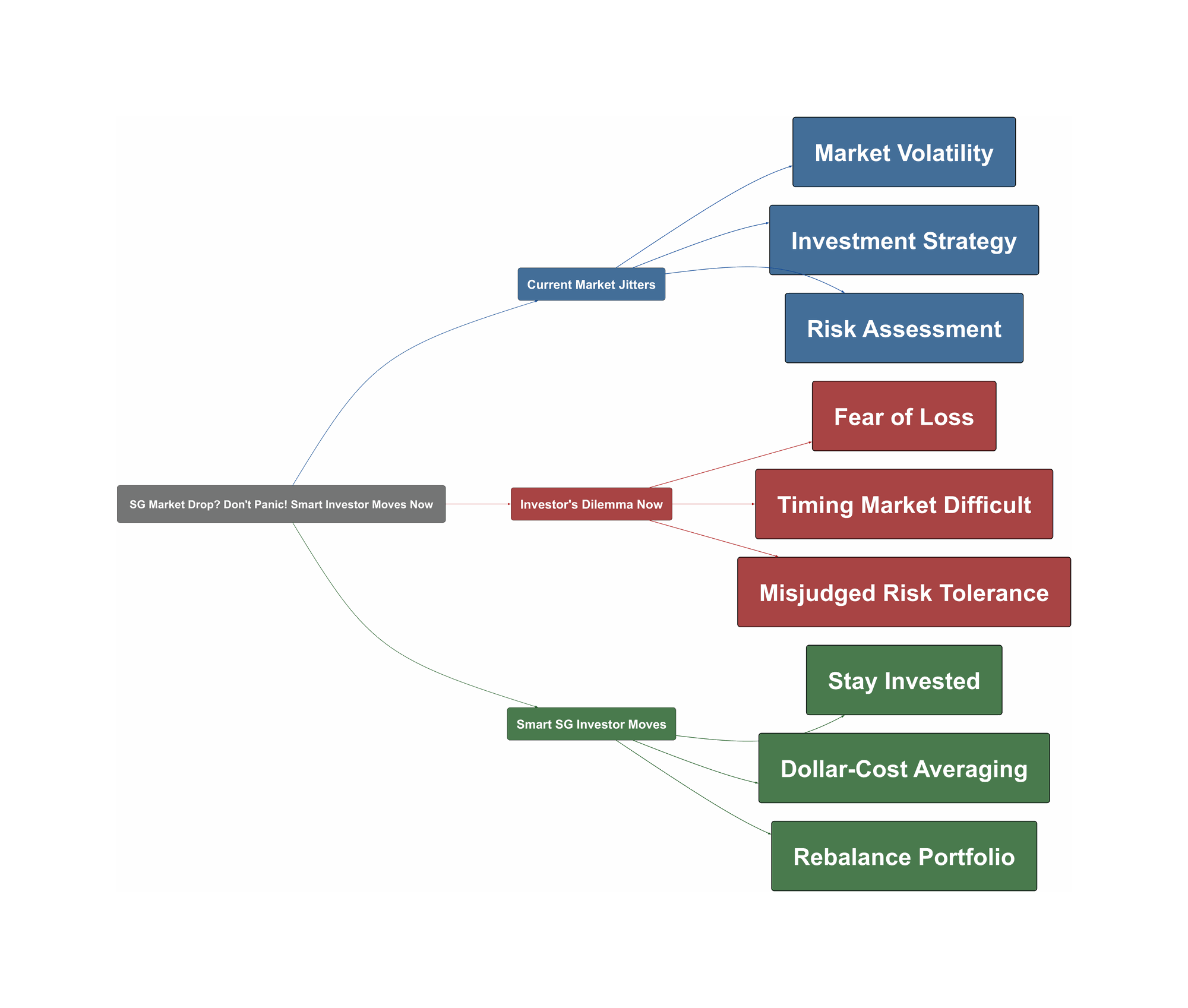

Current Market Jitters

The current market situation has many Singaporean investors on edge. We’re seeing increased volatility, which naturally causes a bit of unease, whether you’re a seasoned investor or just started dipping your toes into stocks after reading about it on HardwareZone.

- Recent Trend: Heightened market swings are making headlines and portfolios fluctuate, leading to widespread discussion and concern among local investors.

- Common Experience: Many Redditors share feelings of discomfort watching their net worth, painstakingly built up, take a hit.

“There might be your fellow Redditors here who has a large part of their net worth in the markets and might be feeling uncomfortable now.”

- Historical Context: Experienced investors remind us that markets have weathered storms like the Asian Financial Crisis, Subprime crisis, and the pandemic, eventually recovering.

- Statistical Reality: A drop of around 20% in equities, while unsettling, isn’t entirely uncommon. As one Redditor pointed out, it’s something that can happen roughly every 3 years or so.

“If a ~20% drop in equities causes you to panic or lose sleep, that’s a lesson in your own risk tolerance – consider at least partially rebalancing into something less risky, because a ~20% drop in equities is something that happens every 3 years or so.”

Investor’s Dilemma Now

When markets go haywire, it’s easy to feel stuck between a rock and a hard place. The biggest challenge is often battling our own emotions – the fear of losing more money versus the kiasu fear of missing out (FOMO) if the market suddenly rebounds.

- Key Frustration: The strong temptation to time the market – trying to sell before it drops further and buy back at the absolute bottom – is a major headache. It’s like trying to predict when the ERP gantry price will change; very tricky!

“Remember if you choose to sell and exit the market now you have to time two things correctly – you have to sell before market goes lower and buy before market goes higher.”

- Risk Realization: Some investors are finding out the hard way that their actual tolerance for risk is lower than they thought, especially if their portfolio was heavily concentrated in more volatile assets.

“This event made me realise that I don’t have the tolerance for 30% ETF and 70% Mag7. I decided to hold. But what’s the plan now?”

- Short-term Needs: If you need cash soon, say for a renovation or a big-ticket purchase, seeing your investments dip can be extra stressful, making you hesitant to commit more funds.

Smart SG Investor Moves

So, what can a savvy Singaporean investor do when the market is choppy like the ferry to Pulau Ubin on a windy day? Instead of panicking, consider these community-tested strategies.

- Stay Vested: Many experienced investors on Reddit advise weathering the storm. Markets have historically recovered; panic selling often locks in losses.

“Been through Asian financial, Subprime and pandemic crisises and markets always recovers but it’s just a matter of when. Stay vested.”

- Dollar-Cost Averaging (DCA): This is a popular strategy. Keep investing a fixed amount regularly. When prices are low, you buy more units. One Redditor mentioned being up 15% since starting DCA during COVID, feeling unfazed by current turmoil.

“This is probably one of those times to show the power of dca ? Would be interesting to know who or how much the long term dca-er is still up. Started during covid, still up by 15 per cent . Feel nothing about the current turmoil .”

- Re-evaluate and Rebalance: Use this period as a learning opportunity. Understand your true risk appetite. If you’re losing sleep, it might be time to gradually rebalance your portfolio towards assets you’re more comfortable with, like increasing your ETF allocation.

- Consider Alternatives: Some investors suggest looking into assets like gold, which can sometimes act as a hedge during volatile times.

- Emotional Detachment: A simple but effective tip? Delete your brokerage app for a while to avoid making impulsive decisions based on fear.

“don’t try to time the bottom, if u want to be abit safer buy it when theres been positive news changes… then dca into the green.”

Remember, investing is a marathon, not a sprint. Stay informed, stay calm, and make decisions that align with your long-term financial goals, whether it’s for your HDB flat or enjoying your favourite hawker food in retirement.