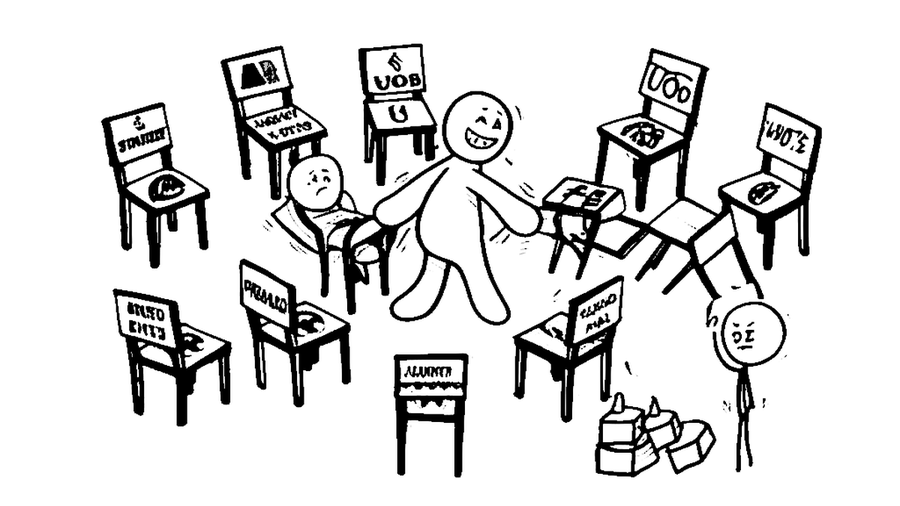

Watched your bank’s interest rate drop again? You are not alone. Many Singaporeans feel like they are playing musical chairs with their savings. One month, you find a good deal. The next month, the rate is cut. It is frustrating trying to keep up. The hunt for decent returns feels harder than ever. But you do not have to keep running in circles. There are smarter ways to make your money work for you. Let’s explore what is really happening and what you can do about it.

Rates Are Sinking Fast

The landscape for savings is changing quickly. What was a good rate yesterday might be gone today. Banks are adjusting their offers, forcing savers to stay alert. It is crucial to understand the current trends to protect your money’s growth.

- Fixed deposit and savings rates are being cut

Just a few days into the month, CIMB has cut offer rates again. … Singapura Finance has also cut.

Banks are reducing interest rates across the board. CIMB and Singapura Finance have already lowered their fixed deposit rates. This trend suggests that waiting for higher rates might not be a winning strategy right now. Savers who delay locking in a rate may face even lower options soon.

- High-yield accounts require more effort

Exactly. To achieve 4.1% need to do few things

Getting the best rates from accounts like DBS Multiplier is not automatic. You cannot just park your cash and expect high returns. These accounts require you to meet several conditions. This often includes crediting your salary, spending on credit cards, and even investing or buying insurance through the bank.

- Safe havens offer very low returns

Many people turn to Singapore Treasury Bills (T-bills) for safety. They are government-backed and secure. However, recent T-bill auctions show yields are very low. The latest 6-month T-bill offered a cut-off yield of only 1.38% per annum. This is safe, but it barely keeps up with inflation.

The Real Kiasu Struggle

Trying to maximize every dollar is a common Singaporean trait. But this chase for higher returns comes with its own set of problems. The effort can sometimes outweigh the rewards, leading to stress and potential missteps. Understanding these challenges is the first step to finding a better way.

- The hassle of constant ‘musical chairs’

Don’t you have problem moving such a big sum between banks? … Make it a few days as the max transaction each day is $200k. No choice.

Chasing the best promotional rates often means moving large sums of money. This is not always easy. Daily transfer limits, like the $200,000 cap, force you to move money over several days. This process is inconvenient and requires careful planning to avoid losing out on interest.

- Confusing terms and complex conditions

Banks design their high-yield accounts with complex rules. To get the advertised bonus interest, you must navigate a maze of requirements. It feels less like saving and more like playing a game. Accidentally breaking a rule, like withdrawing from a Save-As-You-Earn account, can cause you to lose all your bonus interest instantly.

- Risk of chasing complex, shiny products

…when you’re buying convertibles, you’re not really buying fixed-income – they’re like bonds with an equity kicker – and also you’re basically YOLOing meme stocks.

In the search for higher yield, some might consider complex investments like convertible bonds. Forum experts warn these are not simple fixed-income products. They are high-risk investments tied to volatile stocks. For most savers, these ‘shiny things’ are too risky and best avoided.

Your Smart Money Playbook

Instead of frantically chasing every new deal, a clear strategy works better. Focus on sustainable habits that fit your life. Here are three actionable steps you can take. They will help you build wealth without the constant stress. These moves put you back in control of your financial future.

- Master one account that fits your lifestyle

OCBC and SCB requires many more times commitment to achieve the same outcome. However, choose what’s the best for your life situation…

Stop jumping between every bank. Pick one high-yield account like UOB One, OCBC 360, or DBS Multiplier. Study its requirements carefully. Align your salary credit and card spending to consistently hit the highest interest tiers. This is much easier than constantly changing your setup for a small promotional gain.

- Use ‘new-to-bank’ promos strategically

Banks offer huge welcome bonuses for new priority customers. For example, bringing $200,000 to StanChart for 6 months can yield an effective rate of over 4.2%. This includes cash gifts, referral bonuses, and promotional interest. You can even open a joint account with a family member to qualify again later.

- Balance high yield with easy access

actually 2.5% is very good considered safe and liquidity

The highest rate is not always the best. Sometimes, a decent, stable rate with no conditions is better. An account like UOB One offers a solid 2.5% with simple requirements. This provides good returns while keeping your cash liquid and accessible, which is perfect for your emergency fund.

The era of easy high interest is fading. But that does not mean your savings cannot grow. Stop the frantic chase. Instead, build a simple, smart strategy. Choose the right accounts for your lifestyle. Use big promotions wisely. By focusing on a clear plan, you can beat the falling rates and secure your financial peace of mind. What is the one change you will make today?

Read the original discussions on HardwareZone: