Is now a good time to buy property in Singapore? You check property portals every day. You see prices going up. But you also hear whispers of a ‘silent recession’. It feels like a huge gamble. Your CPF is ready. Your savings are waiting. But making the wrong move could cost you dearly. So, what should you do? We dived into HardwareZone forums to see what real Singaporeans are saying. Here is what we found.

The Market’s Mixed Signals

The property market is sending confusing messages. On one hand, things seem very active. On the other, there are signs of a slowdown. Understanding these signals is key to making a smart decision. Here are the top trends forum members are watching closely.

- New launches are flooding the market.

More choices are coming for buyers. Several big projects are launching soon. These are in the Rest of Central Region (RCR) and Core Central Region (CCR). This new supply could impact prices across the board.

Got 3 RCR projects coming online liao ahh so got choices mah.. 1 in Zion, 1 in Queenstown and 1 in Upper BKT.

- Property agents are making big money.

The success of property agents suggests high market activity. Transaction volumes are still strong. This shows many people are still buying and selling property. It is a sign of underlying confidence in the market.

U look at Propnex share price u will know agents huat till siao

- Flipping for profit is getting much harder.

The days of easy flipping might be over. Buyers of recent launches face a challenge. Their entry prices are already high. For them to make a profit, future property prices must climb even higher. This is becoming a risky bet for many.

The Buyer’s Big Worries

Buying a home is a huge financial commitment. It is natural to feel worried. Forum discussions show that potential buyers share common fears. These concerns shape their decisions and add stress to the process. Here are the main roadblocks people are facing.

- Fears of a ‘silent recession’ are growing.

Many feel the economy is slowing down. Yet, property prices remain high. This mismatch creates a lot of uncertainty. People worry about buying at the peak, just before a potential downturn.

So quiet…..silent recession?

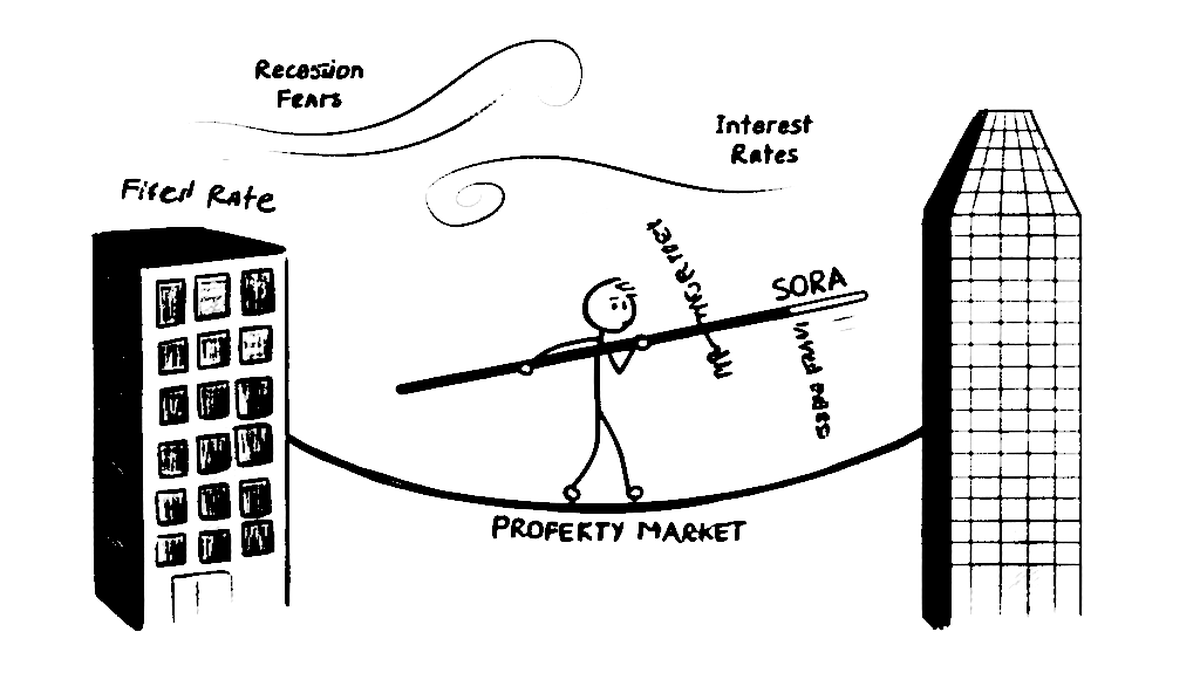

- Choosing the right mortgage is confusing.

Should you pick a fixed rate or a floating SORA package? This is a major headache for buyers. Floating rates seem cheaper now. But they can increase suddenly. Fixed rates offer stability but might be more expensive.

The choice between SORA floating and fixed rates depends on your view of interest rates over the next 1–2 years and your comfort with risk.

- High entry prices create financial risk.

New condos are launching at record prices. This makes it hard for many to enter the market. Taking on a massive loan feels dangerous. Especially when the future of the market is unclear. Buyers are cautious about over-leveraging themselves.

Your Smart Money Moves

Despite the challenges, there are smart ways to navigate the market. Experienced forum members shared practical advice. These tips can help you make a confident choice. Focus on strategy, not speculation. Here are three actionable solutions.

- Choose a flexible mortgage plan.

Do not lock yourself into a long-term fixed rate now. Market conditions are changing. Consider a floating rate package. Or choose a short 1-year fixed term. A 2-year fixed loan with free conversion is also a good compromise.

I am leaning toward floating rate or even a 1-year fixed for now, to keep flexibility.

- Focus on buying for long-term stay.

Trying to time the market is stressful. A safer strategy is to buy for your own needs. Think about a home you can live in for many years. Freehold properties are a great option for this. They offer stability and peace of mind.

Aiya buy evergreen FH condos for own stay can stay till old age also no worries

- Always do your own research.

Do not just follow the hype. Every buyer’s situation is different. Research locations and compare prices carefully. Understand your own finances before you commit. This is the most important advice of all. Your own due diligence is your best protection.

Navigating Singapore’s property market is tough. There are many new launches, but also many risks. The key is to stay informed. Focus on long-term stability over short-term gains. Choose financial products that give you flexibility. With careful planning, you can make the right move for your future. What is your next step?

Read the original discussions on HardwareZone: