Is your bank account interest getting smaller? You are not imagining it. All over Singapore, savings rates are dropping. Your hard-earned money is working less hard. This makes planning for your HDB or retirement tougher. Many are now asking the same question. Where can we still get a decent return? Let’s see what people are doing.

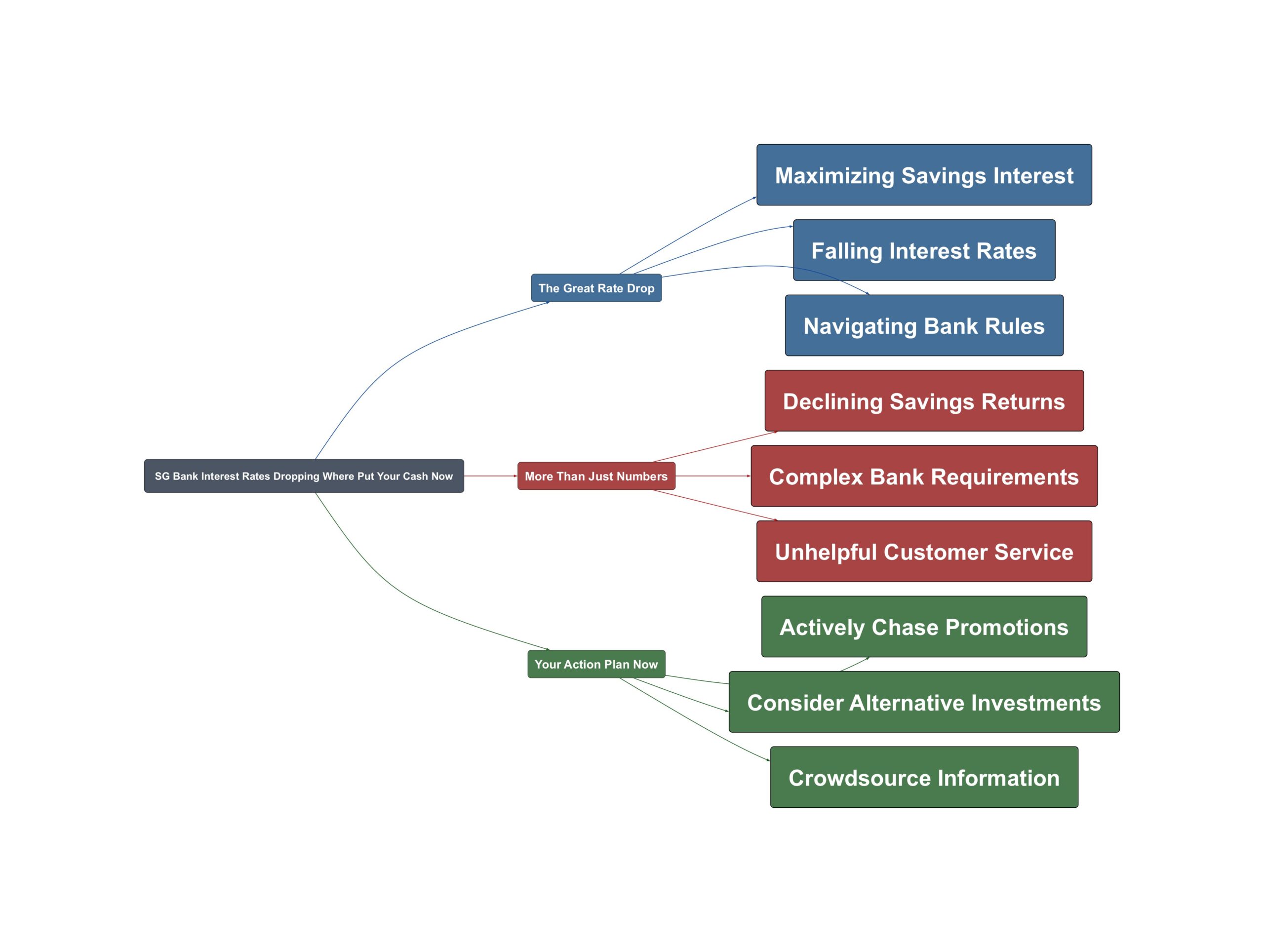

The Great Rate Drop

The golden era of high interest seems over. Singaporeans are noticing sharp declines everywhere. From popular savings accounts to fixed deposits. Even government bills are feeling the pinch. The hunt for better returns is now more competitive than ever.

- High-yield accounts are less rewarding

Banks like OCBC and UOB are adjusting their rates. The bonus interest tiers are getting harder to hit. People now use spreadsheets to track their earnings. Every dollar and cent is being scrutinised to maximise returns.

So the maths essentially are as follows (OCBC does round them down to 2 decimal places): 1. Save BI… 2. Spend BI… 3. Salary BI… total for above 3 cat = …$276.01

- Fixed Deposit promotions are disappearing

Fixed Deposits (FDs) were once a safe haven. But now, banks are cutting their rates significantly. Singapura Finance recently lowered its 12-month rate. Maybank has also withdrawn its attractive deposit bundles. Getting a good FD rate requires more searching.

Singapura Finance Vivid FD rates for 12mths just revised wef 14 Aug 2025. It dropped from 1.68% to 1.45%.

- T-Bill demand is pushing yields down

Many Singaporeans turned to Treasury Bills for safety. This huge demand has caused yields to fall. The latest T-bill auction closed with a cut-off yield of only 1.59%. This was a surprise to many applicants hoping for more.

Demand is crazy. 1.59%

More Than Just Numbers

Chasing the best interest rates is not easy. Singaporeans face several frustrating hurdles. These challenges go beyond just comparing percentages. They involve navigating complex bank rules and procedures. This adds stress to managing personal finances.

- The ‘Fresh Funds’ headache is real

Many promotions require ‘fresh funds’. This means you cannot just use money already in the bank. You must transfer new money from another bank. This creates a constant need to shuffle funds around. It is a time-consuming and confusing process for many.

Now still hv fresh fund issues , another transfer headache..

- Fund transfers can be blocked or delayed

Moving large sums of money is not always smooth. Banks often block transfers for security reasons. This can cause delays, especially near the end of the month. You might miss out on a promotion’s deadline. Planning ahead is crucial to avoid these roadblocks.

Nowadays fund transfer between banks may meet road block too, so avoid doing it last minute.

- Customer service can be unhelpful

Getting clear answers from banks is a common struggle. Many find their Relationship Managers (RMs) unresponsive. They often receive generic, copy-pasted replies. This lack of personalised support makes navigating complex products difficult. People feel like they are on their own.

every question I asked is only responded with copy-and-paste TnCs instead of personalised, authentic responses. waste of time trying to check things out with him.

Your Action Plan Now

Despite the falling rates, you can still be strategic. Taking proactive steps can make a real difference. You don’t have to accept low returns. Here are some practical solutions shared by the community. These steps can help your money work harder for you.

- Become an active ‘rate chaser’

Don’t stay loyal to just one bank. Actively move your money to where the best deals are. Keep an eye on digital banks like Maribank or GXS. They sometimes offer competitive short-term rates. Being nimble allows you to capture the best promotions as they appear.

50k no interest, might as well put in 1.88% mari.

- Look beyond regular savings accounts

Cash is safe, but its returns are low. Consider diversifying your portfolio. Look into Singapore Savings Bonds (SSBs) for flexibility. For those willing to take more risk, explore investing. Platforms like Interactive Brokers make it easier to start.

Keep less cash and invest the rest

- Use community knowledge to your advantage

You are not alone in this journey. Online communities like HardwareZone are valuable resources. People share tips, track rates, and create tools. A simple spreadsheet can help you manage multiple accounts. It ensures you meet all requirements for bonus interest.

i made a spreadsheet for my family liao. last time very fedup… now got spreadsheet they ownself enter the values it tell them exactly how much to xfer in/out on any day.

The days of easy high interest might be behind us. But Singaporeans are resourceful and adaptable. The key is to be proactive and informed. Don’t let your savings sit idle in a low-interest account. By exploring different options and staying updated, you can still achieve your financial goals. It is time to take control of your money.

Read the original discussions on HardwareZone: