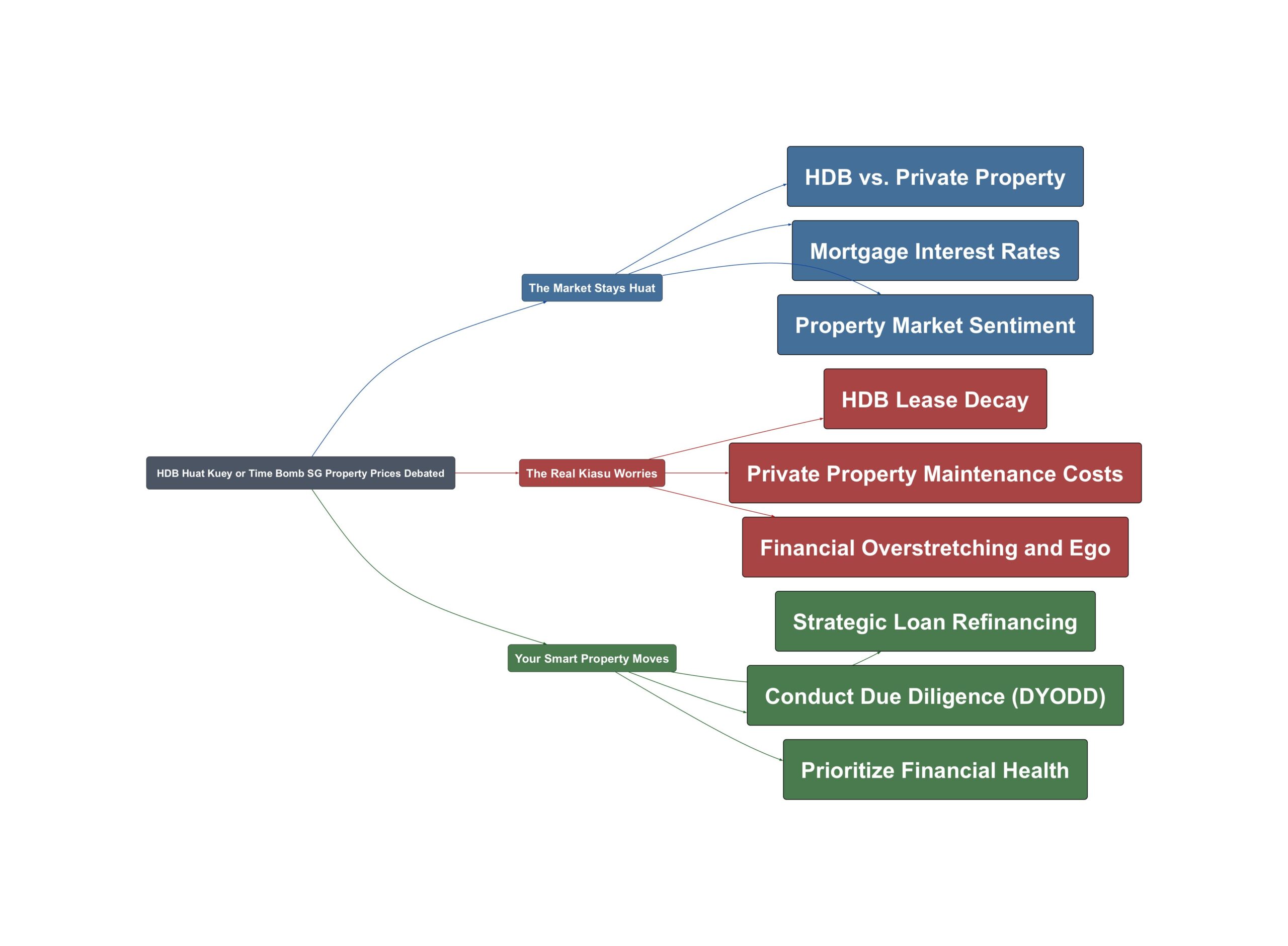

Is your HDB a goldmine? Or is its value a ticking clock? These are the questions Singaporeans are debating online. Property prices feel sky-high. Mortgage rates are constantly changing. Everyone is wondering what the right move is for their future. You see friends upgrading and wonder if you should too. Let’s dive into what people on HardwareZone are really saying about the Singapore property market right now.

The Market Stays Huat

Despite all the talk, the property market is still buzzing. Forum users point to several signs that things are moving fast. The data shows strong interest in both new and resale properties. It seems many Singaporeans are still confident about investing in a home.

- Strong demand for new condo launches

New projects, especially in popular districts, are seeing good results. Buyers are snapping up units, and early investors are seeing profits from sub-sales. This shows confidence in the private property market.

Wah Liv MB 3 sub-sale not bad performance

- Huge price gap between BTO and resale HDBs

The ‘huat kuey’ effect is very real for many HDB owners. Some flats bought through Sale of Balance Flats (SBF) have doubled in price on the resale market. For example, a 4-room flat bought for $220k can now sell for over $500k.

You can check the ‘actual’ price of that area when hdb launch sbf. I saw sbf 4 room of that blk selling at $220k, lease 58yrs. Check resale property sites, that blk selling $500-550k

- Falling mortgage interest rates

Good news for borrowers is on the horizon. Experts on the forum predict that banks will soon offer much lower interest rates. Floating rates could dip to around 1.8%, and fixed rates may fall below 2%. This makes taking a loan cheaper.

banks will be pressured to adjust fixed rate packages to well below 2% in 4-6 weeks time

The Real Kiasu Worries

Behind the positive numbers, Singaporeans have deep concerns. The dream of owning property comes with its own set of unique challenges. From expiring leases to the pressure of keeping up appearances, the worries are real and pressing. These are the issues that keep potential buyers and current owners up at night.

- HDB lease decay is a major fear

The biggest worry for HDB owners is the 99-year lease. As flats get older, their value will eventually fall to zero. This is a hard truth that many are starting to face, especially those with flats that have less than 50 years left on the lease.

Some flats left 40 years bro no to mention some took the poison of lease buy back or short term leases

- Private property comes with hidden costs

Upgrading to a condo isn’t always a dream come true. Many complain about the high maintenance fees and sinking funds. These costs add up over time and can become a significant financial burden. Unlike HDBs, there are no government-subsidized upgrades.

Actually staying in private is a bad idea. Still need to deal with all the funny maintenance fees.

- Social pressure and ego drive decisions

Some people stretch their finances to buy private property just to ‘show off’. The fear of ‘losing face’ can lead to poor financial choices. This pressure to maintain a certain lifestyle can be a heavy weight to carry.

There’s nothing stopping one from going back to HDB other than a perceived loss of face to one’s friends or relatives.

Your Smart Property Moves

Navigating the property market requires a clear head and a solid plan. Forum members shared practical advice based on their experiences. Instead of following the crowd, focus on making smart, calculated decisions. These steps can help you secure your financial future without unnecessary stress.

- Time your mortgage refinancing strategically

With interest rates expected to drop, patience is key. Don’t rush to reprice or refinance your home loan. Waiting a few weeks could help you lock in a much better rate for the next few years. This simple act of waiting could save you thousands.

hold off repricing/refinancing if you can. of course as usual DYODD

- Do your own thorough research (DYODD)

Don’t just rely on what agents or friends say. Check official sources for transaction data. Compare the initial BTO or SBF prices with current resale values in the same area. This helps you understand the true market price and avoid overpaying.

- Align your home choice with your finances

The most important advice is to live within your means. A home should be a source of security, not stress. Make a decision that fits your budget comfortably. Ignore the social pressure and focus on what is truly best for you and your family.

If one can get past their ego, one should make the appropriate decision in alignment with their financial means.

The Singapore property market is full of opportunities and risks. The HDB versus private condo debate will surely continue. Ultimately, the best path is the one that is well-researched and financially sound for you. Stay informed, think critically, and build a secure future for yourself.

Read the original discussions on HardwareZone: