Your savings account interest just dropped again. Feels familiar, right? You work hard for your money. But it seems your bank is not. With rates falling across Singapore, many are wondering where to park their cash. The old ways of saving are not enough anymore. So what are savvy Singaporeans on HardwareZone doing? They are not just sitting back. They are making smart moves to protect and grow their wealth. Let’s find out what they are.

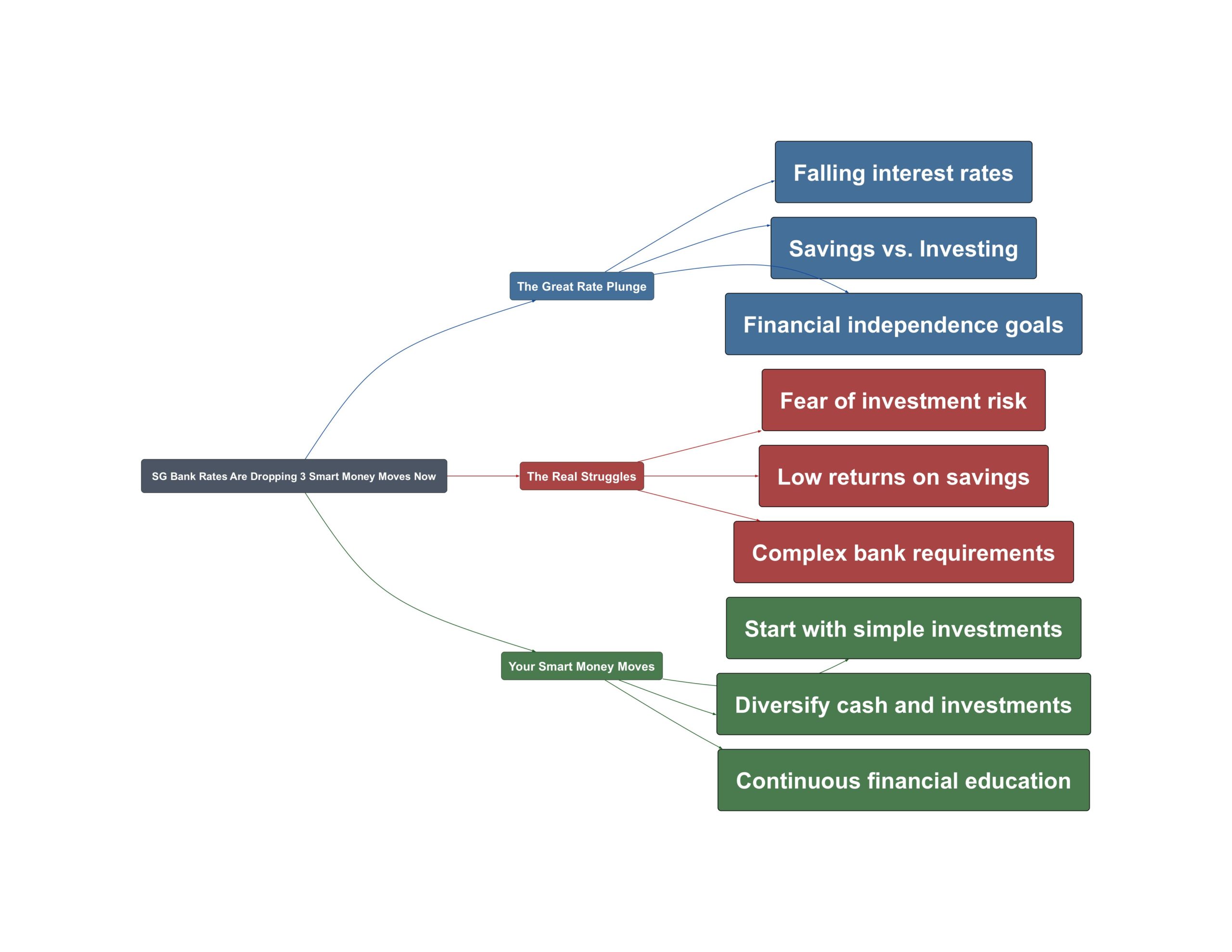

The Great Rate Plunge

The financial landscape in Singapore is changing fast. High-yield savings accounts that were once attractive are now offering less. This trend is causing many to rethink their financial strategy. It is a wake-up call for everyone holding cash in the bank. The era of easy interest is fading.

- High-yield accounts are losing their shine

Banks are cutting interest rates one by one. Savers are feeling the pinch as returns diminish. What was a good deal last year is average today.

Wow. Within 1 year . From 3% to 2% in July and now 1.5% oct for the 1st $10000. It is still better than nothing!

- Banks are making it harder to earn bonus interest

To get higher rates, you often have to jump through hoops. Banks are constantly changing the rules for accounts like the DBS Multiplier. These temporary promotions make it difficult to plan long-term.

Aiya, for 3 months only

- Even ‘safe’ options offer lower returns now

Singapore Savings Bonds (SSB) and T-bills were reliable choices. But even their rates are not as high as before. This leaves savers with fewer simple, safe places to grow their money effectively.

The Real Struggles

Lower rates create real problems for Singaporeans. Planning for the future becomes much harder. Whether it is for a new HDB, retirement, or just beating inflation, the path is getting tougher. People are feeling the pressure to find better solutions. But that comes with its own set of challenges.

- Fear of the stock market is a major hurdle

Many people view investing as complex and risky. The thought of losing their hard-earned money is scary. This fear keeps them in low-interest accounts, even when they know it is not enough.

We are not familiar with US market let alone Options, which is an art by itself.

- Retirement goals seem further away

The dream of a comfortable retirement requires significant savings. With low interest rates, reaching that goal takes much longer. The numbers can be daunting.

The harsh reality is you need 2m sgd to live a carefree and active retirement but the typical man in the street has 0.2m sgd.

- Keeping up with complex bank rules is exhausting

Banks constantly update their terms and conditions. It feels like a full-time job to track which account offers the best deal. This complexity leads to confusion and inaction.

Your Smart Money Moves

Despite the challenges, there is a clear path forward. You do not have to settle for low returns. Forum members are sharing practical steps to take control. These strategies are not about getting rich quick. They are about building sustainable wealth in today’s environment. It starts with small, informed decisions.

- Start investing with a simple, proven strategy

You do not need to be an expert to invest. Start with broad market ETFs like the S&P 500. It is a way to participate in market growth without picking individual stocks. It is a solid first step away from cash.

I put my foot in the US stock market by just buying S&P 500 few years ago and saw very good growth back then

- Diversify beyond a single savings account

Do not put all your eggs in one basket. Use a mix of financial tools. Keep some cash in a high-yield account for emergencies. Consider staggering T-bill subscriptions for short-term stability. Then, allocate a portion to investments for long-term growth.

I staggered T-bill subscriptions over the past few years so that they mature over several months rather than all at once.

- Commit to continuous learning

The financial world never stands still. Take time to learn about different investment options. There are many resources available online to help you understand concepts like options or ETFs. Knowledge builds confidence.

There is alot of tutorial videos out there about it.

The days of earning high interest from a simple savings account are over for now. But this is not a reason to lose hope. It is an opportunity to take charge of your financial future. By diversifying your approach and educating yourself, you can build a stronger financial foundation. Your money can, and should, work just as hard as you do.

Read the original discussions on HardwareZone: