Dreaming of your new condo? But the bank loan gives you a headache. You are not alone. Singaporeans on HardwareZone are talking. They are sharing secrets about rising interest rates. And how to navigate the tricky mortgage market. It is tough, but you can get ahead. Here is what the community says you need to know right now.

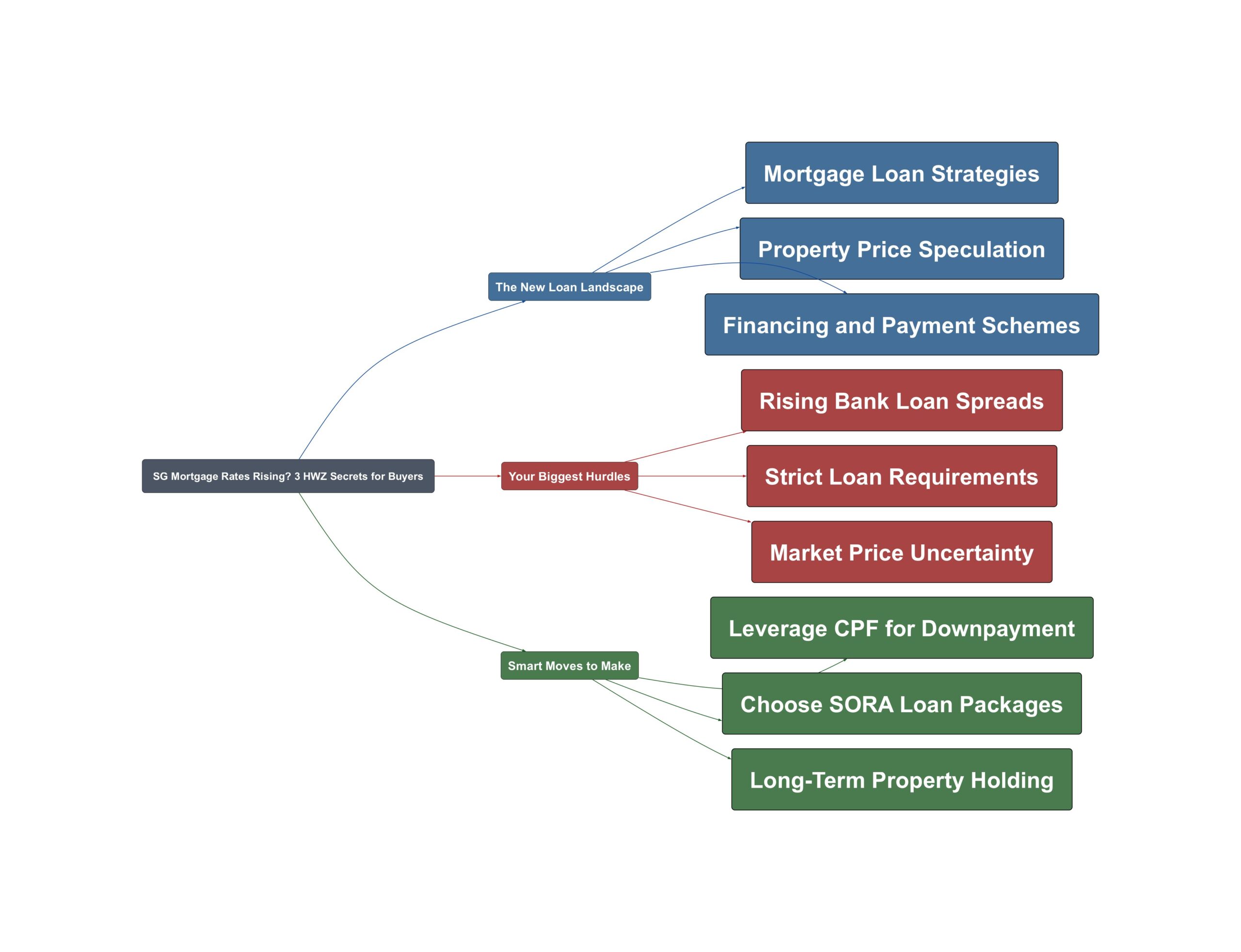

The New Loan Landscape

The property loan market is changing fast. Banks are adjusting their strategies. This directly affects your monthly payments. Understanding these shifts is your first step to securing a better deal. Forum members have noticed some key trends you should be aware of before you sign anything.

- Banks are increasing their loan spreads

So far most of the banks started to increase the bank spread since last month. it is around 3m sora + 0.4% for now.

- SORA packages remain the top choice

Alot of clients are taking SORA package currently. Perhaps this has spurred them to increase the spread due to the demand as well.

- Future rate cuts are already priced in

Actually alot of banks have priced in the forecast cut already. Most of the banks have increase the floating rate spread since last month.

Your Biggest Hurdles

Getting a home loan in Singapore is not easy. Buyers face several major roadblocks. These challenges can feel overwhelming. From strict bank rules to market pressure, the stress is real. Knowing these pain points helps you prepare for what is ahead. Here are the top concerns shared online.

- The difficult ‘Show Cash’ requirement

When i asked how to fulfil the extra 50k, the bank asked for either 40k+ FD for 2 years or show 150k of liquid cash (no lock-in).

- Pressure from market ‘noise’ and opinions

I actually always “agree” with my peers (mostly no investment property) when they are talking about simi crazy high HDB/Condos prices…..i js armchio and nod my head

- The real fear of being financially overstretched

Will it be overstretched? Quite stressful right?

Smart Moves to Make

Feeling stressed? Do not worry. The HardwareZone community also shares powerful solutions. These are practical steps you can take. They can help you secure a better loan. And they can reduce your financial anxiety. Focus on these actionable strategies to make your property dream a reality.

- Use your CPF funds strategically

I always empty CPF for downpayment and keep as much cash on hand……how come so funny never touch CPF at all for both properties.

- Focus on long-term property ownership

This thread doesn’t make sense when you all keep talking about 2-3 years time People hold property is for long term. 10 years.

- Consider an Executive Condominium (EC)

I feel for EC to lose money, you need to be ultra suay. This is like failing an exam despite your professor give you the exam paper in advance.

The Singapore property market is challenging. But you are not navigating it alone. By learning from others, you can make smarter choices. Focus on a long-term plan. Use your CPF wisely. And understand the real risks and opportunities. With the right strategy, you can build your future with confidence.

Read the original discussions on HardwareZone: