Remember when a simple meal out didn’t break the bank? Or when concert tickets felt like a treat, not a luxury only for the ultra-rich? If you’re feeling the pinch lately, you’re not alone. Singaporeans on Reddit have been openly discussing what’s become so expensive it’s just “not worth buying anymore.”

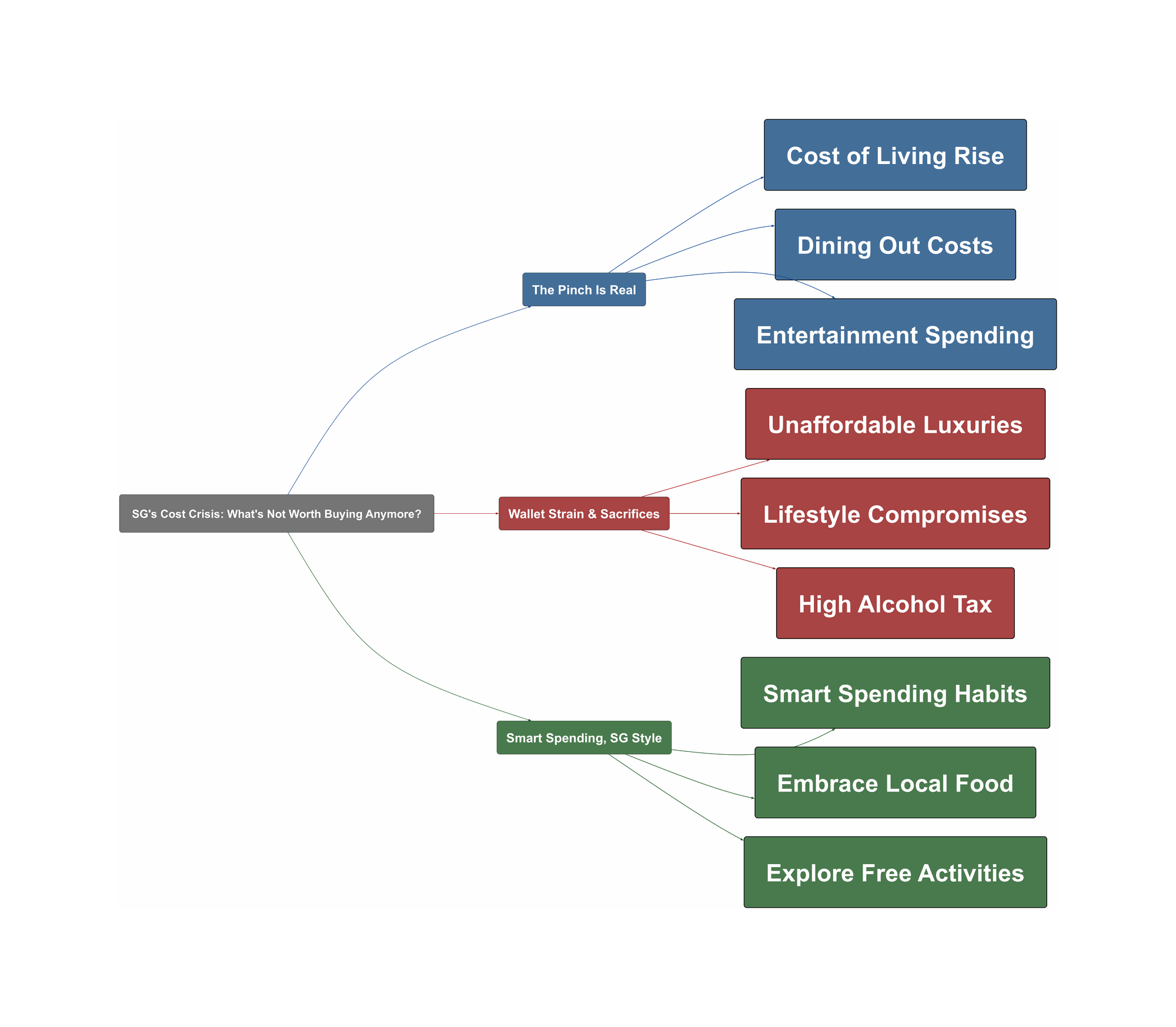

The Pinch Is Real

From daily kopi to big-ticket items, Singaporeans are increasingly feeling the squeeze. Recent trends show a significant rise in the cost of living, with inflation impacting everything from food prices to entertainment. Many are noticing that what used to be affordable indulgences are now straining their wallets. For instance, the price of a typical fast food meal has seen a notable jump, and dining out at even mid-range restaurants has become a luxury rather than a regular affair. This sentiment is widely shared online.

“Gestures broadly at everything”

Even basic pleasures like a meal at a casual eatery are now under scrutiny. Singapore’s unique market conditions, coupled with global inflationary pressures, mean that consumers are constantly re-evaluating their spending habits. It’s no longer just about luxury goods; the everyday necessities are seeing price hikes too.

“Dining out.”

Wallet Strain & Sacrifices

The rising costs create a dilemma: how do you maintain your desired lifestyle when everything seems to get pricier? Many Singaporeans face the frustration of being priced out of activities they once enjoyed. The dream of owning a new car, for example, is increasingly out of reach due to exorbitant COE prices, making public transport or ride-hailing services the only viable options for many. Similarly, attending major concerts or sports events, once a common pastime, now requires significant financial planning or outright sacrifice.

“Rock concert tickets.”

One of the most frequently cited frustrations revolves around discretionary spending, particularly on items with high taxes like alcohol. The contradiction between wanting to unwind and facing steep prices leads many to reconsider their habits. This isn’t just about cutting back; for many, it’s about a fundamental shift in how they view leisure and entertainment, prompting difficult choices.

“Alcohol!!!!!! I stopped drinking back in February and I swear I have saved so much money while eating out and also just by not buying bottles of alcohol anymore. I’m so happy with my decision to stop drinking.”

Smart Spending, SG Style

While the cost of living feels daunting, Singaporeans are finding clever ways to adapt and stretch their dollar. The key lies in strategic budgeting, re-evaluating priorities, and embracing alternative solutions. Many are turning to home-cooked meals or sticking to affordable hawker fare over pricier restaurant options. Community forums are abuzz with tips on where to find the best deals or how to enjoy entertainment without breaking the bank.

- Embrace Hawkers & Home Cooking: Prioritise affordable local food or prepare meals at home.

“I stopped drinking back in February and I swear I have saved so much money while eating out and also just by not buying bottles of alcohol anymore.”

- Re-evaluate Discretionary Spending: Look critically at habits like frequent drinking or impulse purchases.

- Seek Free/Low-Cost Entertainment: Explore Singapore’s parks, free exhibitions, or community events.

Others are finding value in second-hand markets for items like toys or collectibles, proving that a little creativity can go a long way. Ultimately, it’s about being mindful of where your money goes and making conscious choices that align with your financial goals, ensuring you still enjoy life in Singapore without the constant worry of overspending.