Feeling your heart drop faster than the stock market ticker when things get volatile? You’re not alone, lah. Many Singaporean investors are watching the recent market ups and downs with a bit of ‘kancheong’ (nervousness), wondering if their hard-earned money is safe. So, what’s a savvy SG investor to do when the markets get choppy?

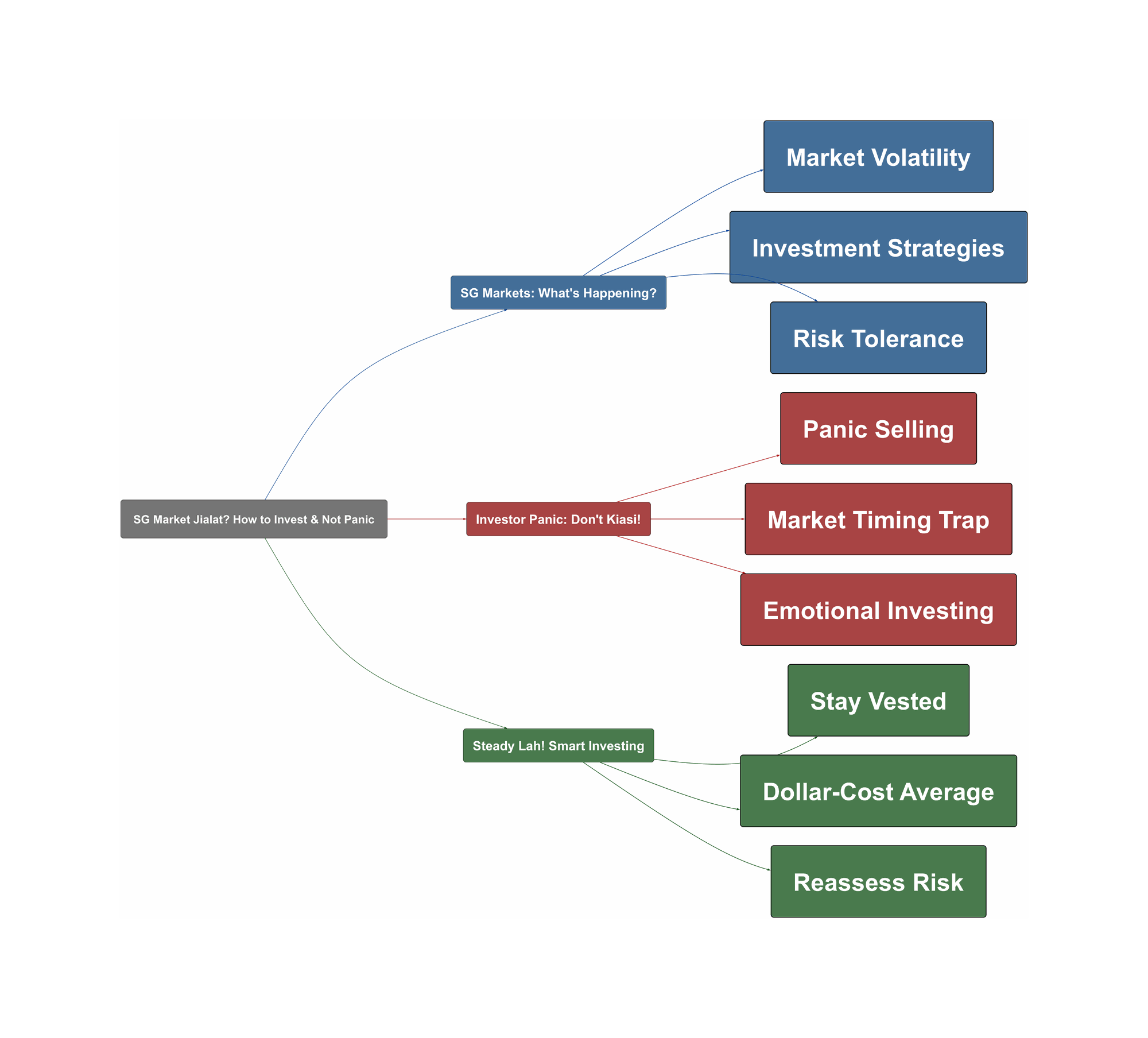

SG Markets: What’s Happening?

Recent times have seen increased volatility across global markets, and Singapore is no exception. This isn’t new; experienced investors have seen cycles like this before. For newer investors, however, a significant dip can be a real test of nerve. It’s a stark reminder that investing comes with risks. Many discussions online reflect this, with some feeling uneasy and others seeing it as part of the investment journey.

- Market drops test investor risk tolerance.

“If a ~20% drop in equities causes you to panic or lose sleep, that’s a lesson in your own risk tolerance – consider at least partially rebalancing into something less risky, because a ~20% drop in equities is something that happens every 3 years or so.”

- Experienced investors often view volatility as cyclical.

“Been through Asian financial, Subprime and pandemic crisises and markets always recovers but it’s just a matter of when.”

- Current conditions show heightened market uncertainty.

Investor Panic: Don’t Kiasi!

When markets tumble, our own emotions are often the biggest challenge. The ‘kiasi’ fear can lead to rash decisions. Trying to time the market – selling low hoping to buy back even lower – is a common pitfall. Another frequent issue is the sudden realisation that your portfolio doesn’t match your actual comfort for risk, especially when faced with real paper losses. This often prompts a mid-turmoil questioning of one’s entire investment strategy.

- Timing the market is extremely difficult.

“Remember if you choose to sell and exit the market now you have to time two things correctly – you have to sell before market goes lower and buy before market goes higher.”

- Downturns reveal true risk tolerance levels.

“This event made me realise that I don’t have the tolerance for 30% ETF and 70% Mag7.”

- Impulsive actions can stem from market excitement or fear.

“Got abit too excited last week and fired too many shots before it really dropped”

Steady Lah! Smart Investing

So, how to navigate these choppy waters? Many Singaporean Redditors advocate for a ‘steady pom pipi’ approach. Long-term strategies and emotional discipline are key. Instead of trying to catch the absolute bottom, focus on consistent actions and a resilient mindset. For those with funds to invest, a gradual approach is often wiser than going all-in at once. And remember, understanding your own limits is paramount.

- Dollar-Cost Averaging (DCA) is a proven, steady strategy.

“This is probably one of those times to show the power of dca ? … Started during covid, still up by 15 per cent . Feel nothing about the current turmoil .”

- Staying invested for the long term is often advised.

“Stay vested. Just not the options or futures. Super volatility = Gambling.”

- Sometimes, detaching emotionally helps maintain composure.

“This is the time when I will delete my broker app.”

- Reassess and rebalance your portfolio according to your risk appetite.