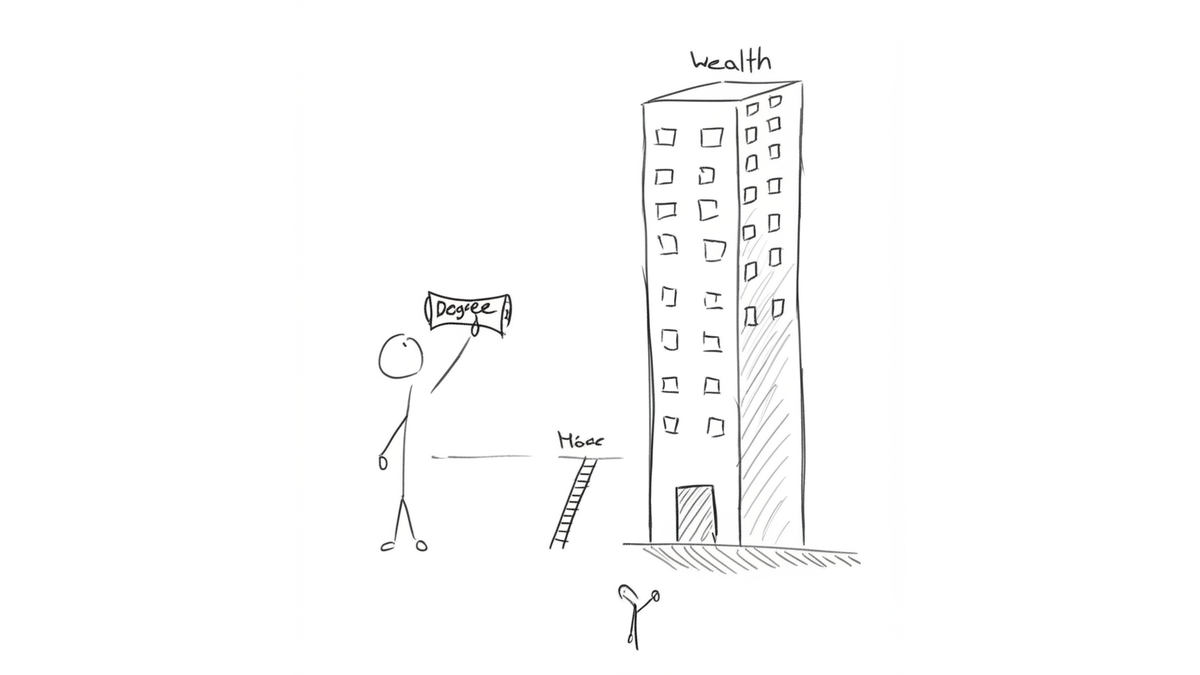

Finished uni, got your degree, but still feel like climbing the ladder to “wealthy” in Singapore is like trying to catch smoke with your bare hands? Many young Singaporeans, especially fresh grads, are nodding along. With news that 75% of private uni grads struggle to find a job within six months, the dream of a comfortable life, let alone riches, feels tougher than ever.

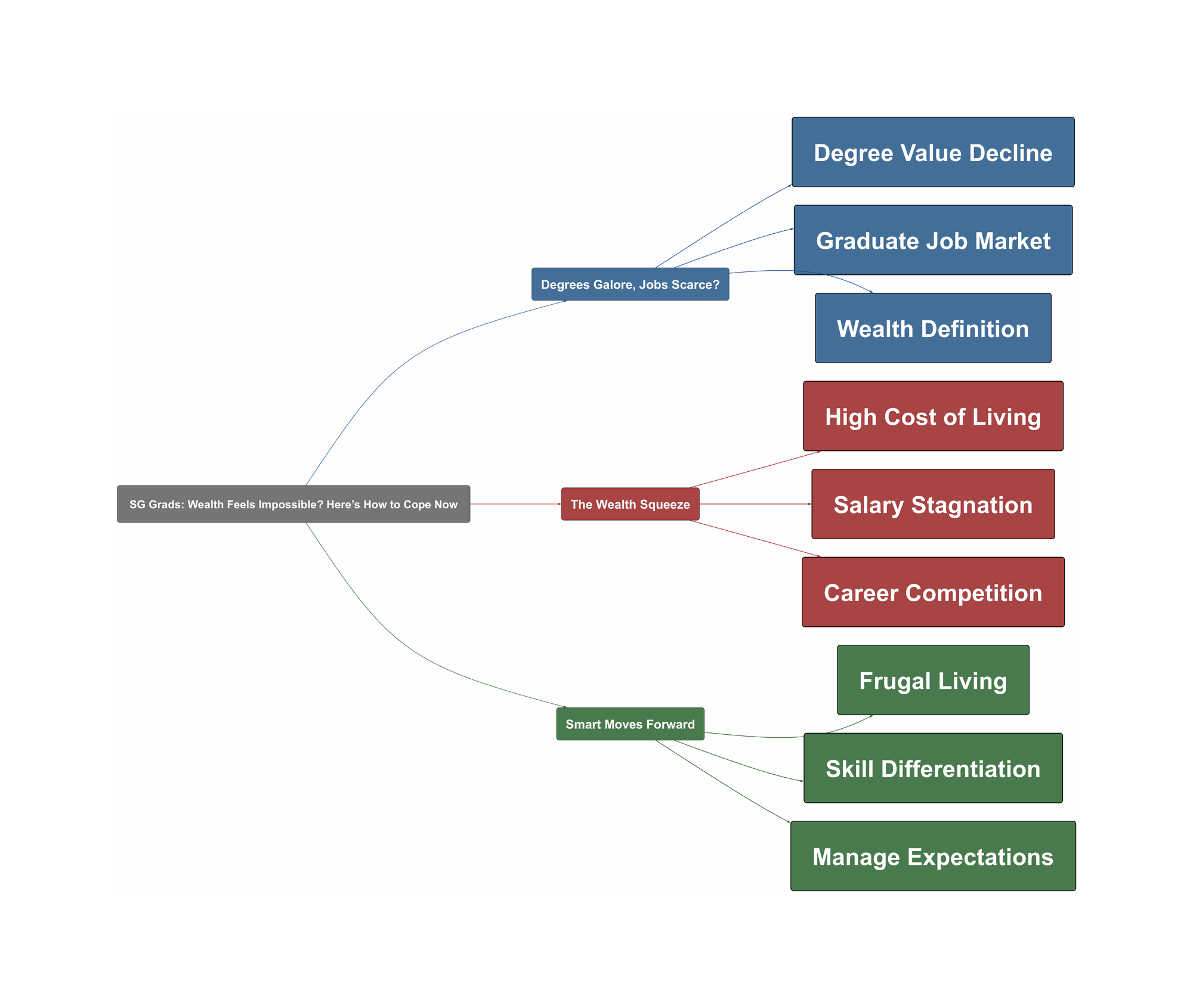

Degrees Galore, Jobs Scarce?

It’s a common sentiment echoed across Reddit: a degree isn’t the guaranteed pass to a good job it once was. With more graduates than ever, the market is saturated. As one user put it, “Now everybody and their grandma has degree. It’s as good as only O level cert these days.” This sentiment is backed by recent reports indicating significant challenges for new entrants into the workforce.

“In today’s news, BT just posted that 75% of fresh grad from private uni find it hard to get job in 6months.”

The competition is fierce, and even graduates from local universities are feeling the squeeze. The landscape has shifted, demanding more than just a paper qualification to stand out. This means young Singaporeans are starting their careers facing an uphill battle for opportunities, let alone high-paying ones that could lead to wealth.

“Now everybody and their grandma has degree. It’s as good as only O level cert these days.”

The Wealth Squeeze

So, you’ve landed a job. But then comes the next hurdle: actually building wealth in a city known for its high cost of living. Many Redditors point out the stark reality: “property prices are sky high relative to starting salaries of graduates. Capital is king in this economy.” This makes saving for big-ticket items like an HDB flat feel like a marathon.

“property prices are sky high relative to starting salaries of graduates. Capital is king in this economy”

The struggle isn’t just confined to one group; as another user noted, the general sentiment is that if top local uni grads face issues, others will too. There’s a growing frustration that the traditional paths to financial security are narrowing, and the goalposts for “wealthy” seem to be constantly moving further away, especially when everyday expenses keep rising.

“Everything still going up in price. Youth of today definitely feel the rising struggle.”

Smart Moves Forward

So, what can young Singaporeans do? It’s not all doom and gloom. The Reddit community offers some practical, albeit tough, advice. Firstly, earn an income to get started. Then, focus on differentiating yourself. As one user advises:

“You need something else to differentiate yourself, hence the push for internships and side projects.”

Managing finances wisely is crucial. “Avoid lifestyle creep, be brutally frugal,” is a common refrain, and for many, this means living with parents since “going full independent is an expensive proposition.” Beyond frugality, redefining success can also help. Perhaps “wealthy” isn’t the only goal; as one commenter suggests, “Learn to be content, we technically do not need a lot of things to live a simple life.” Focusing on building valuable skills and financial discipline, even if it’s a slower path, seems to be the consensus.

“Avoid lifestyle creep, be brutally frugal.”