Are you checking your bank app again? Wondering why your bonus interest seems lower this month? You are not alone. Singapore’s high-yield savings accounts are changing. It feels like the goalposts keep shifting. One wrong move, and your expected interest vanishes. It’s frustrating when your hard-earned money isn’t growing as fast. So, where should you park your cash now for the best returns? Let’s break down what’s happening and what you can do about it.

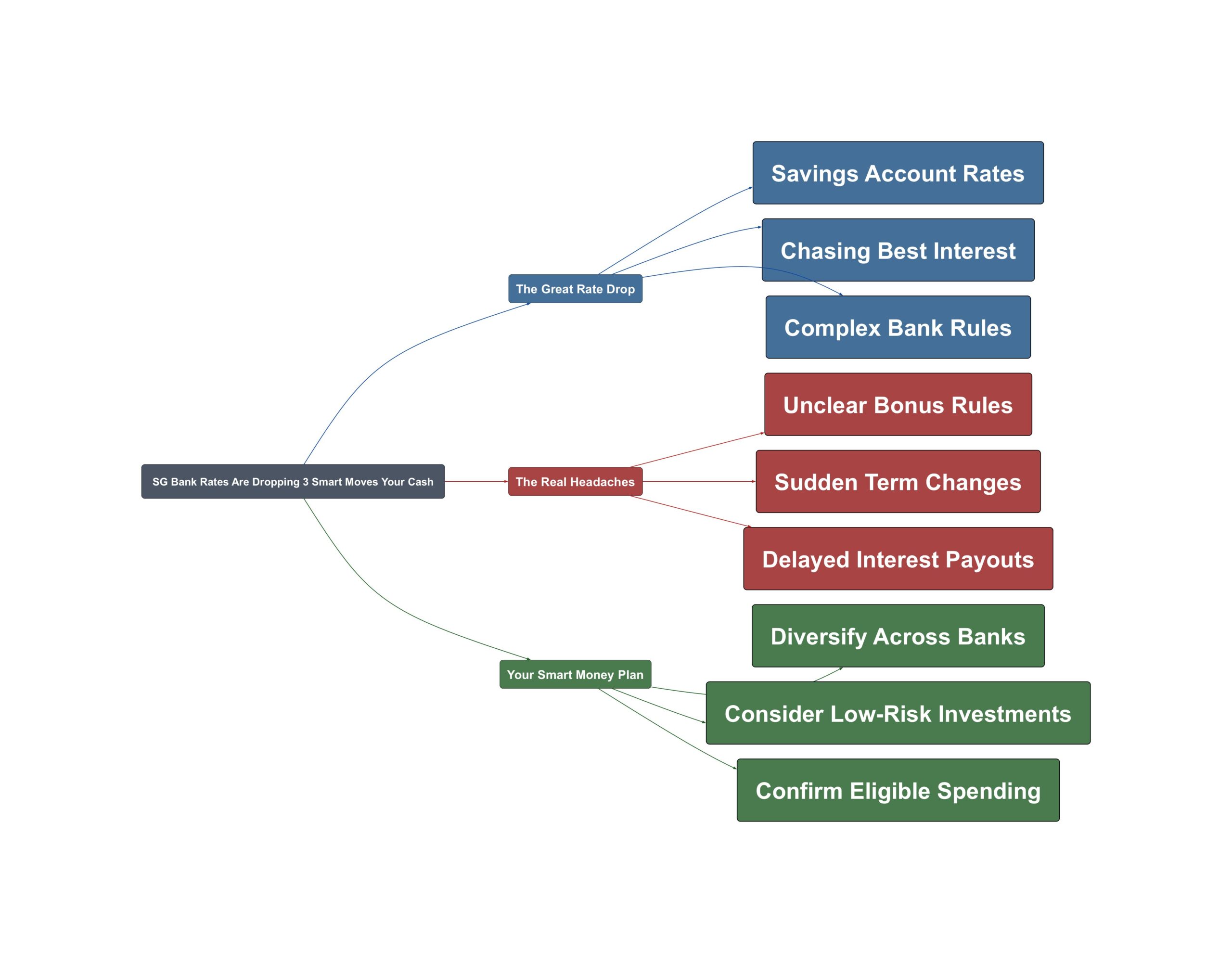

The Great Rate Drop

The golden era of high interest rates seems to be fading. Banks across Singapore are adjusting their rates downwards. This trend affects everyone with a savings account. It is now harder to find a simple, high-yield option. Understanding these changes is the first step to protecting your savings.

- Banks are cutting rates across the board.

Forum users have spotted rate cuts from multiple banks. RHB and Trust Bank have already lowered their rates. This is happening because broader interest rates, like T-bills, are also falling. Banks no longer need to offer high rates to attract cash deposits.

All banks in Singapore are likely to cut because short-term T-Bills yields are also dropping. All interest rates might just converge to +/- 25bps of each other.

- High-yield accounts have more complex rules.

Getting bonus interest is becoming a real challenge. For example, UOB One users found that some spending, like at SingHealth, is no longer eligible. This is due to changes in Merchant Category Codes (MCC). You now have to check every detail to qualify.

looks like now uob now is getting so difficult to earn those interest! MCC = 9399 … SINGHEALTH Singapore

- Singaporeans are actively moving their money.

To fight falling rates, people are not staying loyal to one bank. A popular strategy shared online involves splitting cash. Many are moving funds between OCBC 360 and UOB One accounts. They do this to maximize the interest earned on different tiers.

The Real Headaches

It’s not just about lower rates. The entire process of saving has become more complicated. Singaporeans are facing new frustrations. These headaches make managing personal finance feel like a full-time job. Keeping up with the changes requires constant attention.

- Unclear terms and conditions.

Bonus interest often comes with confusing rules. For some accounts, you need to have ‘wealth holdings’. But the definition can be vague. How much do you need to invest? Does a small US stock purchase count? Getting clear answers is difficult.

For wealth holdings, is there a min amount to buy in order to fulfil the criteria? If i were to buy US stock, i.e $10 usd,wld i fulfil the wealth holdings condition?

- Delayed or incorrect interest payments.

Many are confused about when they will receive their bonus interest. It often doesn’t appear on the first day of the month. The base interest comes in first. The bonus portion can take weeks to be credited. This makes it hard to track if you’ve been paid correctly.

What you get was the base interest lah. Bonus interest don’t come in so early one, usually a week to as much as 3 weeks later in the next month.

- Forced changes and tech upgrades.

Sometimes, banks force changes on customers. HSBC, for instance, updated its app requirements. Customers with older phones on Android 10 or iOS 14 can no longer use the app. This forces an unexpected and costly phone upgrade just to do your banking.

HSBC app can only work on Android 11 & IOS 15 & above. Yikes!!! now this bank forces customer to purchase newer phone models.

Your Smart Money Plan

Feeling frustrated is understandable. But you can still take control of your finances. With a few smart moves, you can navigate this new banking landscape. Here are three actionable steps you can take today. These strategies will help you make your money work harder for you.

- Diversify your savings across multiple banks.

Don’t put all your eggs in one basket. Follow the lead of savvy forum users. Split your savings between two or more high-yield accounts. For example, place your first $100,000 in OCBC and the next portion in UOB. This strategy helps you maximize the highest interest tiers of each bank.

got one genius on reddit/r/singaporefi calculate everything liao ocbc for first 100k then the rest in uob (if you have less than 132k).

- Look beyond standard savings accounts.

With inflation, just saving may not be enough. Cash in the bank can lose value over time. Consider other options for your money. Younger savers should look into assets that compound. This could include low-risk bonds or equities. These can offer better long-term growth.

Inflation is compounding. Thats why FD is only good for old retirees. Younger ones must invest in assets that will compound in value over time.

- Stay vigilant and verify everything.

In this environment, you must be proactive. Double-check that your spending meets the criteria for bonus interest. If your interest payment seems wrong or is delayed, don’t hesitate. Pick up the phone and call your bank to get clarification. It’s your money, after all.

Then it might be due to the tracker date not updated till current. Else call UOB and ask.

The era of easy high interest might be over for now. But this doesn’t mean your money can’t grow. It just requires a bit more work. By staying informed, diversifying your funds, and exploring new options, you can stay ahead. It’s time to make your money work smarter, not just harder. Your financial future is in your hands.

Read the original discussions on HardwareZone: