Ever scrolled through Instagram, seeing friends flaunt lavish holidays or designer bags, and wondered if it’s all real? In Singapore, where the pursuit of success often feels like a national sport, the pressure to “look rich” can be immense. But sometimes, what glitters isn’t gold. We’ve all seen it – the flashy car, the branded outfit, the casual mention of an expensive trip – but are these truly signs of wealth, or just a masterful performance?

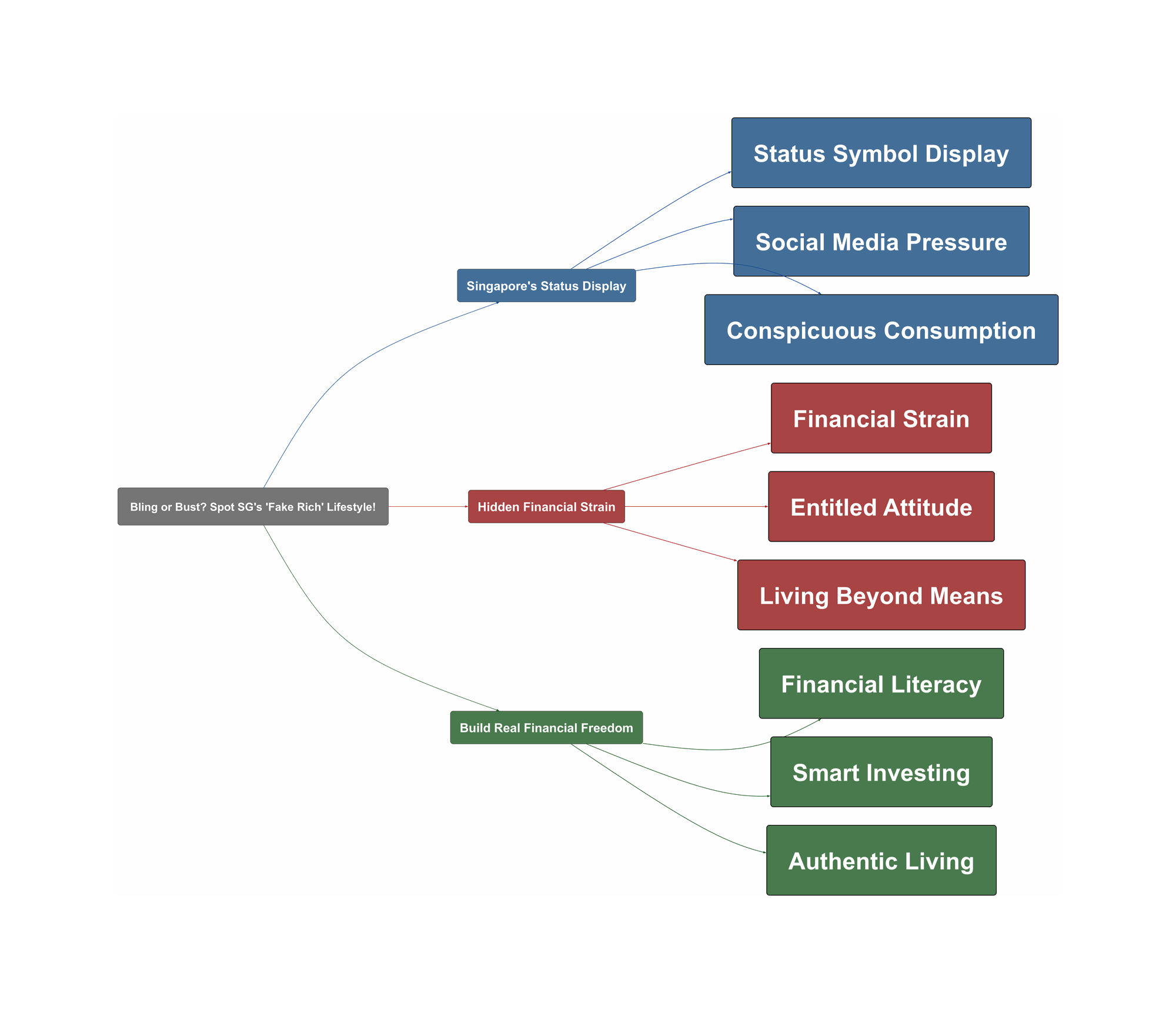

Singapore’s Status Display

In our competitive Lion City, appearing successful is often equated with being successful. Social media amplifies this, creating a culture where visible consumption becomes a key marker of status. From luxury cars battling for space in HDB carparks to designer goods prominently displayed, Singaporeans are adept at showcasing their perceived affluence. This trend isn’t just about showing off; it’s often driven by a deep-seated desire to fit in and gain respect in a society that values material indicators. Reddit discussions frequently highlight the prevalence of these superficial displays.

“Loud designer clothing”

“Cybertruck in apartment parking stall.”

Hidden Financial Strain

The problem arises when the pursuit of an opulent image comes at a significant financial and emotional cost. Many fall into the trap of living beyond their means, maxing out credit cards, and accumulating debt just to maintain a facade. This “fake rich” lifestyle often leads to immense stress, anxiety, and a constant need to uphold the illusion. Reddit discussions reveal that some individuals have maxed out three credit cards or more, just to keep up appearances. It can also manifest as an entitled or dismissive attitude towards service staff, perhaps as a way to assert perceived superiority or mask deep insecurities about their true financial standing.

“complaining that her treating us was putting financial strain on her.”

“A shitty entitled attitude toward service staff.”

Build Real Financial Freedom

Instead of chasing fleeting status symbols, true financial well-being in Singapore comes from smart choices and sustainable habits. Focus on building genuine wealth through budgeting, investing wisely, and living within your means. Consider consulting financial advisors to plan for long-term goals like HDB upgrades or retirement with CPF. Prioritise experiences and personal growth over material possessions. Remember, genuine wealth often whispers, while pretense shouts. Cultivating a humble and respectful attitude towards everyone, regardless of their perceived status, is a true mark of class and confidence, reflecting genuine security rather than insecurity.

“When people talk about how rich they are, it’s tacky, pretentious and lacks class! 🙄Maybe they have it, maybe they don’t. It’s still meh either way.”

Ultimately, financial freedom isn’t about how much you spend, but how much you save and invest for your future. Let’s shift the narrative from “looking rich” to “being financially secure” in Singapore.