Scrolling through Instagram and see your friends cafe-hopping again or jetting off for another holiday? Feel that pang of FOMO while you’re diligently saving or eating cai png? You’re not alone in Singapore. Balancing saving for the future (hello, HDB downpayment!) and actually enjoying life *now* is a real struggle for many of us.

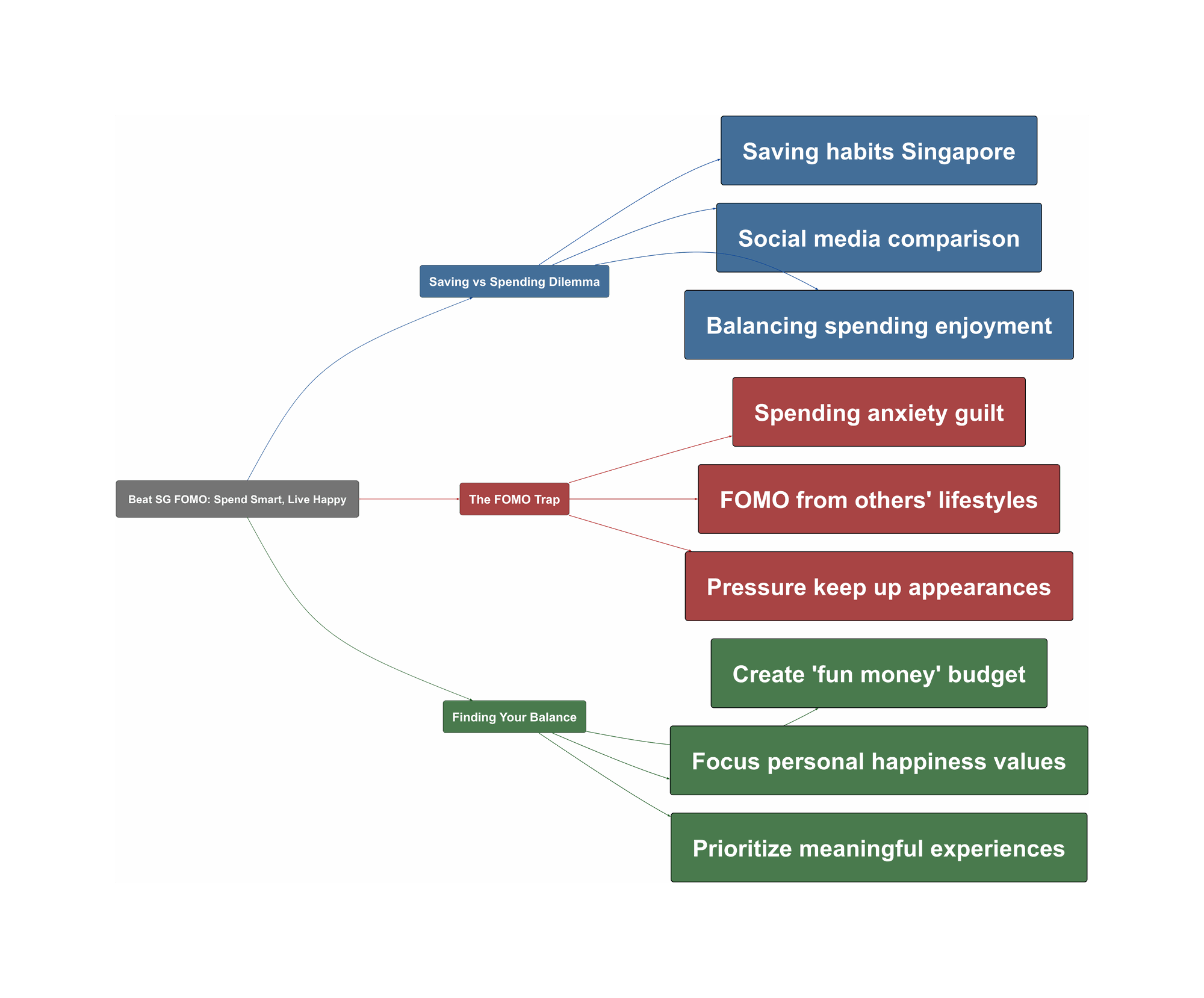

Saving vs Spending Dilemma

Many Singaporeans, especially those who grew up conscious about money, are naturally careful spenders. Choosing hawker centres over cafes, taking the MRT instead of Grab everywhere – these are common habits. Saving is deeply ingrained, often driven by necessity or upbringing. This carefulness is sensible, especially with the high cost of living here. However, this can sometimes lead to feeling like you’re missing out when others seem to be living it up.

“I tend to be quite careful with my spending, often choosing to eat at hawker centres and relying on public transport… Unless it’s a special occasion… I usually won’t splurge”

“These are habits forged by my childhood that I’ll carry with me for the rest of my life.”

There’s a constant awareness of needing to save for big goals, but also the quiet pressure, sometimes amplified by social media, to enjoy certain experiences.

The FOMO Trap

Seeing curated lives online or hearing friends talk about expensive hobbies can trigger serious FOMO. It makes you question your own choices. Are you saving too much? Are you being too ‘lian’? This can lead to anxiety, either about missing out or about spending money, even if you can technically afford it. Some even feel pressured to spend money they don’t have just to keep up appearances, which is a dangerous path.

“Also don’t believe everything you see on social media. I know too many people who who spent their way into debt to attain a certain cachet. In the end they were spending money they didn’t have to impress people they didn’t even like.”

“If you go out… and buy the iPhone 16 max, would that make you happy? Or would it make you anxious that you’re spending so much money…?”

It’s tough finding that sweet spot between being responsible and allowing yourself some enjoyment without feeling guilty or comparing yourself constantly.

Finding Your Balance

So, how to deal? The key is shifting focus from others to yourself. What truly makes *you* happy? Forget the hype. Try creating a dedicated ‘fun money’ budget each month – money you can spend guilt-free on whatever you enjoy, be it a nice meal, a small gadget, or saving up for a bigger treat. Don’t be afraid to try new experiences, but do it for yourself, not because everyone else is. Maybe fine dining isn’t your thing after trying it once, and that’s okay! Prioritise experiences that bring you joy over just buying stuff.

“I have a monthly budget that is specifically my ‘fun’ money, which means I can buy anything I want guilt free.”

“The best way to avoid fomo is to come to terms with how much money you are comfortable spending each month and to not compare with others”

“Breathe and learn to spend a bit more, especially on experiences… Saving for the future is important, but we could all drop dead at any time.”

Remember the saying “先苦后甜” (suffer first, enjoy later), but take it in moderation. Life’s short lah, find your own definition of a life well-lived, within your means.