Imagine this: You’re planning your dream wedding, excitedly waiting for your BTO queue number, then BAM! A massive, unexpected debt lands on your lap, threatening to derail everything. Sounds like a nightmare, right? For some young Singaporeans navigating adulthood, sudden financial shocks like this are a harsh reality.

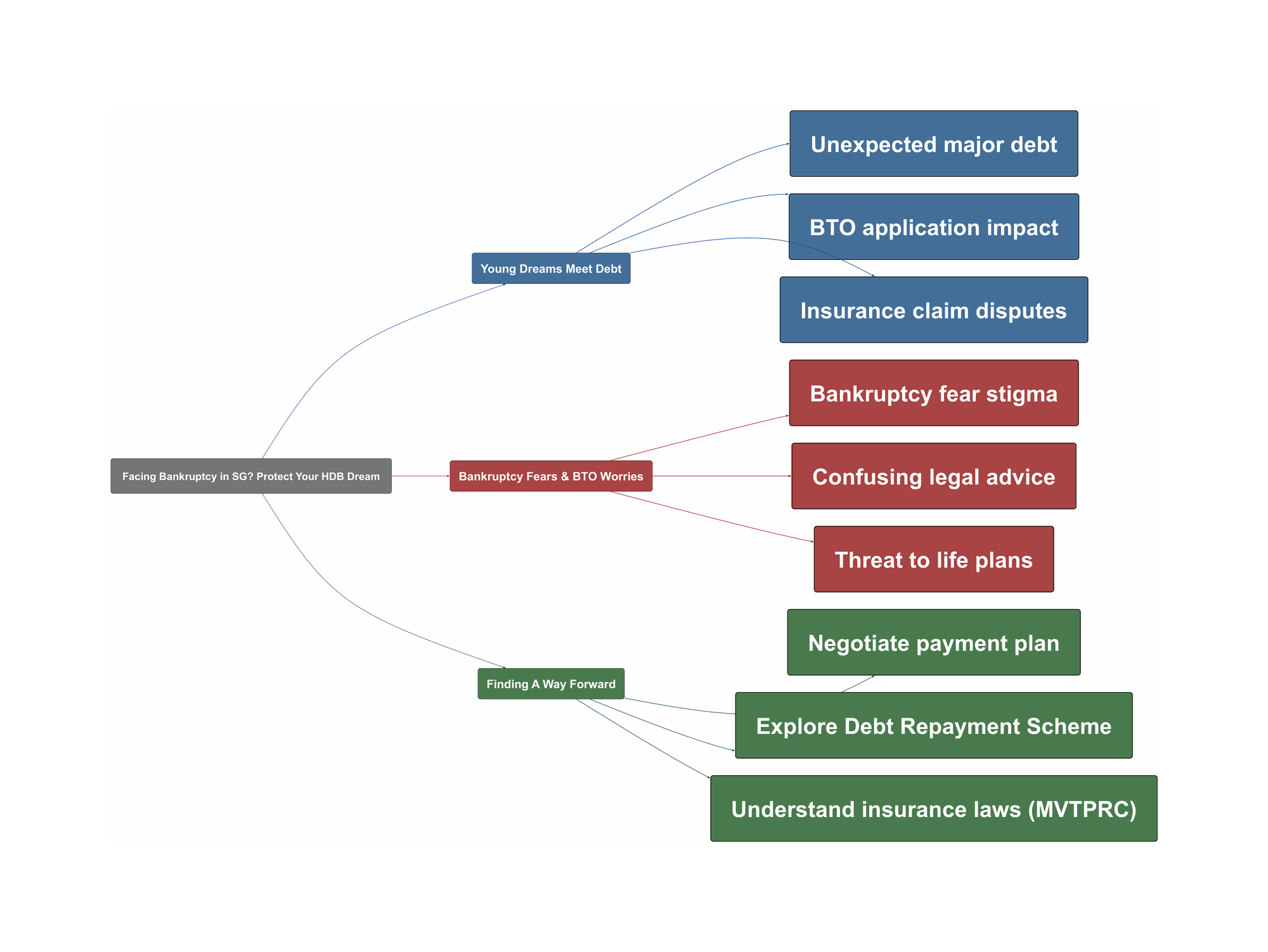

Young Dreams Meet Debt

Life throws curveballs, and sometimes they come with hefty price tags. We see young Singaporeans, maybe just starting their careers or planning major life steps like marriage and getting their first HDB flat, suddenly facing huge debts. It could be from unexpected medical bills, business setbacks, or like in one recent online discussion, a $60,000 third-party claim from a car accident where insurance complications arose.

This isn’t just about the money; it’s the crushing weight on future plans. The BTO application, the wedding bells, the stable future you envisioned – all seem at risk. It’s a stressful situation many young adults fear.

“Bankruptcy, wedding and BTO at 23. You need to hit the brakes on your life and reassess everything”

“Bro, what accident rakes up $60k accident claim?”

Bankruptcy Fears & BTO Worries

The biggest fear? Bankruptcy. In Singapore, this carries a heavy stigma and practical consequences. There’s confusion about the process, conflicting advice (sometimes even from professionals), and immense worry about long-term impact. Will you lose your BTO flat? Can you ever get a loan again?

The reality is complex. While HDB eligibility is primarily based on income (especially for HDB loans), bankruptcy or being sued can lead to a poor credit rating (like ‘HH’). This might not automatically disqualify you from a BTO booked with an HDB loan, but it severely impacts your ability to get bank loans for renovations or future needs. The uncertainty itself is a major source of stress.

“Declaring bankruptcy is a major life decision that can leave a permanent damage in your credibility for life”

“However, do be aware that if you get sued, your credit rating will immediately drop to HH, which will significantly affect your ability to obtain bank loans for repayment.”

Finding A Way Forward

Facing such a situation feels overwhelming, but bankruptcy isn’t always the immediate or only answer. There are steps you can take and resources available right here in Singapore. First, take a deep breath and evaluate priorities – sometimes, delaying big plans like a wedding might be necessary.

Explore negotiating a payment plan directly with the creditor. Many institutions prefer getting paid gradually over forcing someone into bankruptcy, which is costly for them too. Understand your rights, especially regarding insurance. For motor accident claims, the Motor Vehicles (Third-Party Risks and Compensation) Act might mean the insurer still has obligations even if they dispute your policy coverage. Also, check the limitation period for the claim (often 3 years for personal injury). For debts under $150,000, look into the Debt Repayment Scheme (DRS) managed by the Ministry of Law, which avoids bankruptcy.

“Work out a payment plan. And no need to rush on the timeline… leave the filing for bankruptcy option out.”

“For bankruptcy claims involving debts below 150k, the courts usually push for Debt Recovery Scheme (‘DRS’). DRS means the court will not grant a bankruptcy order and instead allow you to repay by instalment.”

Don’t panic. Seek reliable advice, understand your options, and remember that even tough financial situations can often be navigated with the right strategy.