Remember anxiously checking your bank balance before buying cai png? Or stretching that last $10 till payday? Many Singaporeans who grew up with less know this feeling all too well. But what happens when you finally achieve financial stability? Does that ‘kiasu’ mindset ever truly leave, and how do your money habits change?

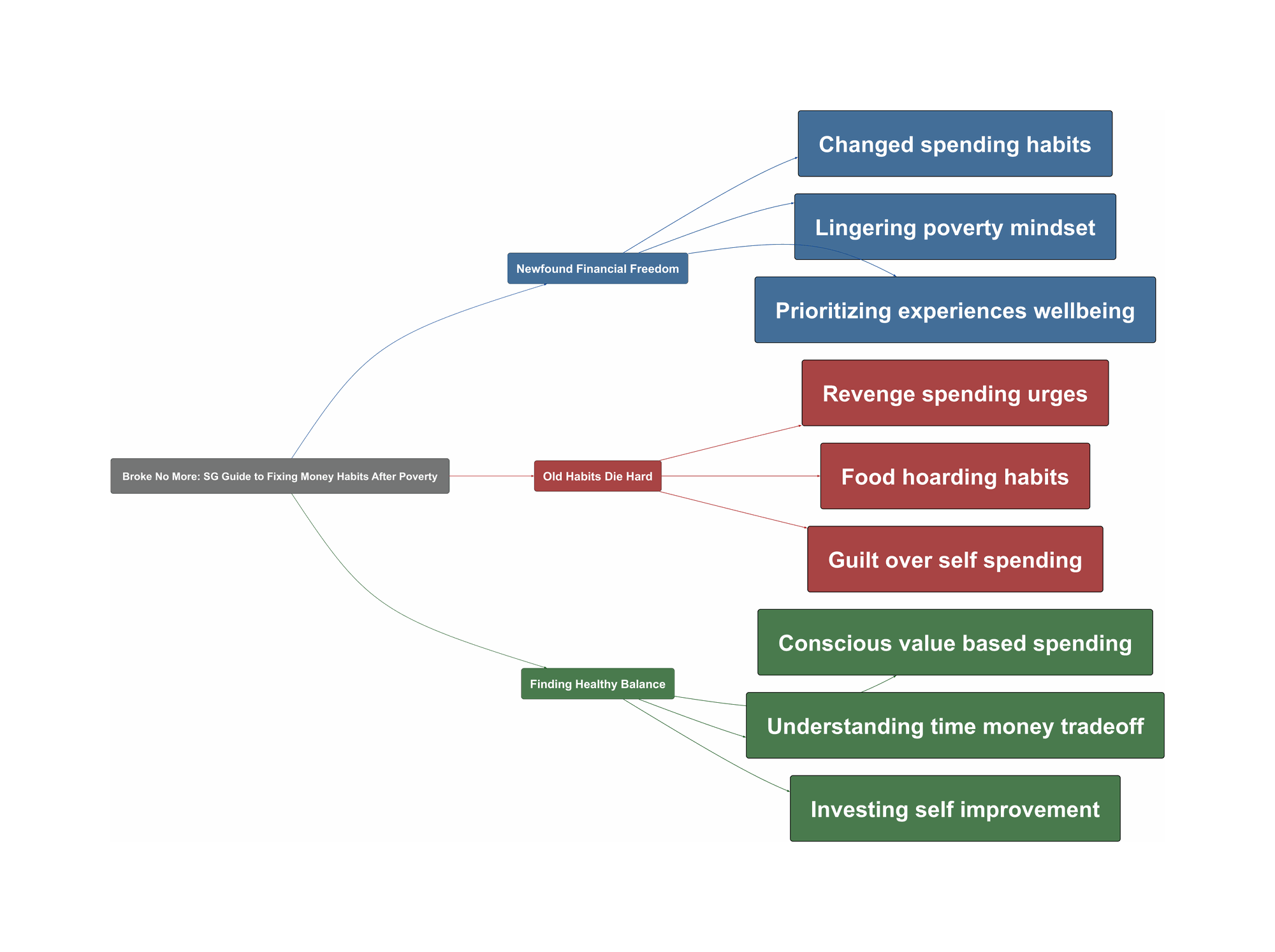

Newfound Financial Freedom

The biggest change many notice is the sheer relief of not having to constantly count pennies. Moving from surviving to thriving means finally affording things previously out of reach, whether it’s splurging on hobbies, necessary self-care like dental work, or simply buying groceries without intense price comparison. It’s about upgrading from a Blue CHAS card existence to having more breathing room, maybe even hitting the median income for your field.

- The relief is palpable for many.

“not having to peep balance every time I entered any shop feels so relieving”

- Spending shifts towards meaningful improvements.

“I prefer to spend on things that can provide tangible improvement or meaning to my life, like gym membership, dental surgery, enrichment courses, social events with close friends etc. While putting the rest of it into safe financial investments.”

- There’s a sense of making up for past deprivations.

“In a way I make up to my childhood self by buying the things and pursuing the interests that I was denied”

Old Habits Die Hard

However, escaping poverty doesn’t magically erase old habits. Many grapple with lingering financial anxieties or unhealthy coping mechanisms developed during tougher times. Some fall into “revenge spending,” overcompensating for past lack by splurging, especially on pampering the ‘inner child’ or vanity, leading to poor savings despite a good income. Others retain extreme frugality habits, like hoarding food well past its expiry date, unable to shake the fear of scarcity. There’s also the tendency to work excessively hard, sometimes finding it easier to give to others than spend on oneself.

- “Revenge spending” and poor financial habits can emerge.

“Quite a bit of ‘revenge spending’ and pretty poor financial habits overall. I spend a lot pampering my inner child who had little growing up… Fairly good income but pretty bad savings and investment rate overall.”

- Extreme frugality habits persist, like food hoarding.

“I splurge on my hobbies without much thought but can’t seem to throw expired food away till it’s nearly attained sentience.”

“But I still have a bad habit of hoarding food even beyond the expiry. Everything in the fridge ‘can still be eaten’… even after 20 years, we still eat mouldy bread out of habit.”

- Difficulty spending on oneself despite working hard is common.

“work insanely hard and somehow give others a lot but can’t seem to spend on myself enough”

Finding Healthy Balance

The key is moving towards a healthier relationship with money. This involves conscious effort and shifting priorities. It means learning to evaluate the time-versus-money tradeoff – is spending a bit more on Grab worth avoiding a packed MRT during peak hour, or is automating chores with a dishwasher or part-time cleaner worth the cost to gain family time? It’s about focusing spending on experiences, wellbeing (therapy, health), and meaningful goals like saving for travel or that HDB downpayment, rather than just accumulating stuff. Hard work pays off, but finding balance is crucial.

- Prioritize spending based on personal values and goals.

“It also helps if you know where your priorities are. For me it is all about family, work is secondary.”

- Understand and leverage the time vs. money tradeoff.

“Previously: Wah these people are damn lazy. Wash one plate also don’t need so much time why need to use dishwasher. Now: dishwasher frees up my time so I can play with my kid”

- Invest in experiences and long-term goals.

“Oh yeah I’m also saving up for long solo trips since I was too broke for exchange in uni even with financial aid :’)”

- Consistent effort leads to stability.

“Work hard and work harder. I grew up sleeping outside the living room and now own my own hse.”