Want to escape the 9-to-5 grind in Singapore? The FIRE (Financial Independence, Retire Early) movement is gaining traction, but is it just a dream? Let’s dive into what HardwareZone forum members are saying about achieving financial freedom and retiring early in Singapore, plus some practical tips to get you started.

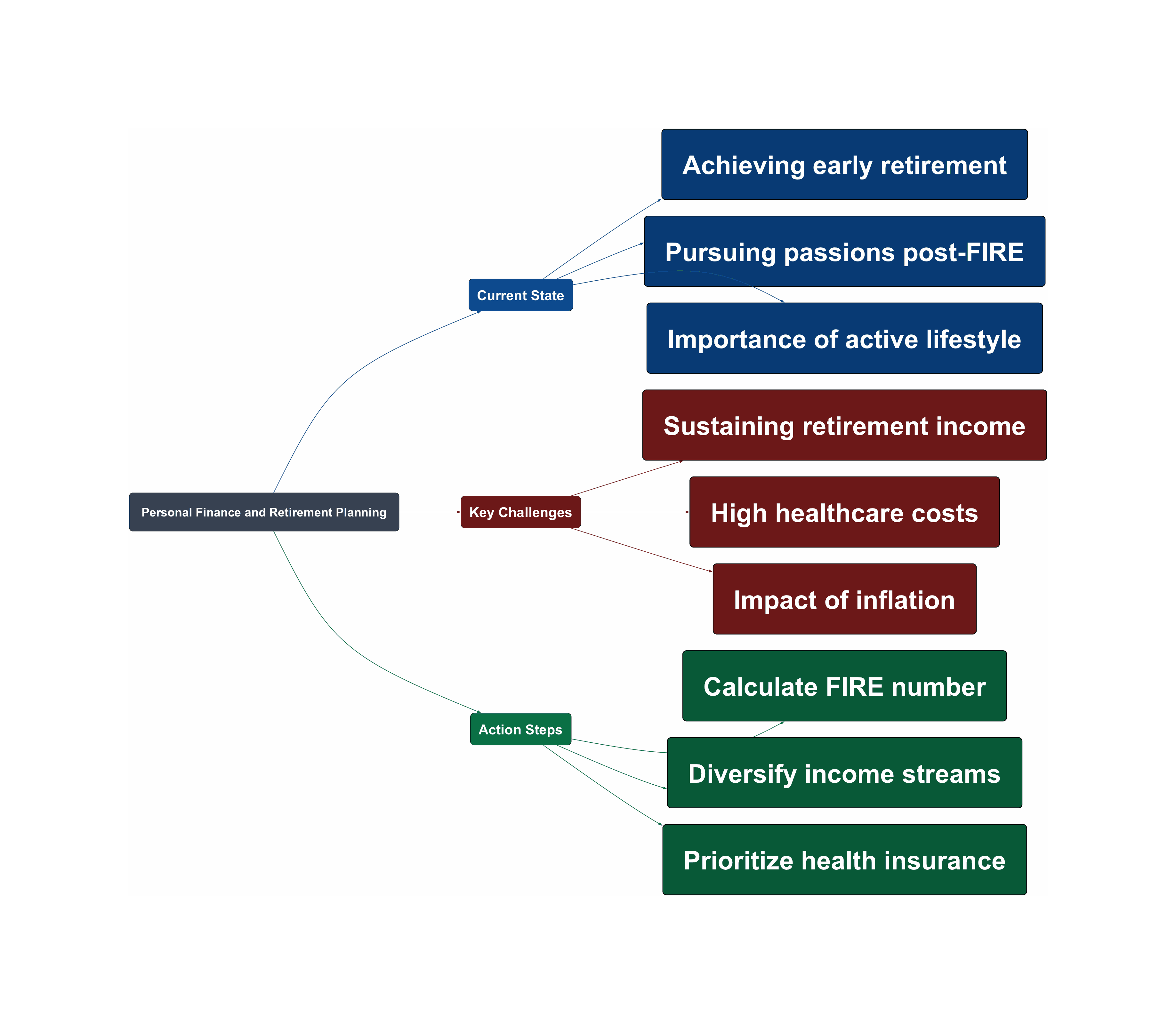

Current FIRE State

- Early retirement is achievable for some. While it requires careful planning and dedication, some Singaporeans are already enjoying the fruits of their labor.

“Probably but I am 40 and retired. So I am very free to plan my fun time and also have spare time to chill with the kids. They don’t get in the way.”

- FIRE isn’t just about stopping work; it’s about pursuing passions. Many who achieve FIRE actively seek new challenges and learning experiences.

“I am a sucker for challenges and learning something new. thats why I’m learning stock trading even though my passive income is more than enough. will probably do half-marathons and maybe trail running for the next challenge – also gives me an excuse to fly business to different countries so that my legs are fresh.”

- Staying active and healthy is crucial for a fulfilling early retirement. Maintaining physical and mental well-being allows you to enjoy your newfound freedom to the fullest.

Real FIRE Struggles

- Sustaining income during retirement. Ensuring a steady stream of passive income is a major concern for those considering FIRE in Singapore, given the rising cost of living.

“Game of Throne battle for his inheritance.”

- Healthcare costs can derail your FIRE plans. Unexpected medical expenses can quickly deplete your savings, highlighting the importance of adequate insurance coverage.

- Inflation erodes purchasing power. The rising cost of goods and services in Singapore can impact your retirement nest egg, requiring careful investment strategies to mitigate the effects of inflation.

Smart Action Steps

- Calculate your FIRE number. Determine how much you need to save to cover your living expenses in retirement, considering factors like inflation and healthcare costs.

Hi, below GE quote 100k multipay eci till age 70 & Age 75 Only to age 65: $1276.20/year Only to age 85: $2498.40/year 500k term, Tpd and CI till 65/70/75 To 65: $2257.05/year To 70: $2411.90/year To 75: $2681.15/year Cheers

- Diversify your income streams. Explore various passive income options, such as dividend investing, rental properties, or online businesses, to create a more resilient financial foundation.

- Prioritize health and insurance. Invest in a comprehensive health insurance plan and adopt healthy lifestyle habits to minimize healthcare costs and maximize your quality of life in retirement.

Achieving FIRE in Singapore is a challenging but potentially rewarding journey. By learning from the experiences of others on HardwareZone, carefully planning your finances, and prioritizing your well-being, you can increase your chances of enjoying a fulfilling early retirement. Don’t just dream it, plan it, and make it happen!

Read the original discussions on HardwareZone: