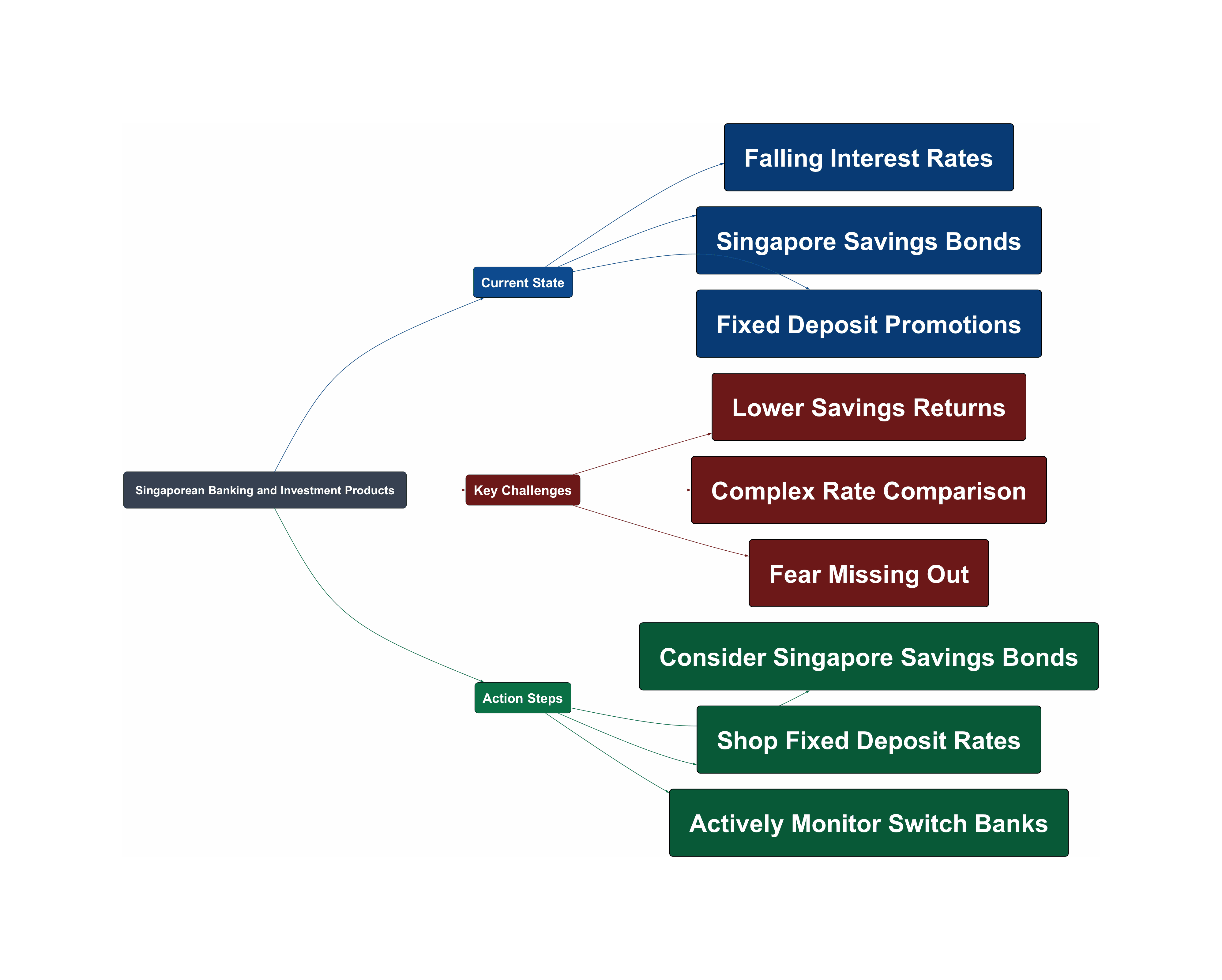

Feeling the pinch as Singapore banks slash interest rates? You’re not alone! Many Singaporeans are seeing their savings returns shrink faster than their cai png portions. But don’t lose hope lah! This guide breaks down what’s happening, the challenges you face, and actionable steps to protect your hard-earned cash, straight from the HardwareZone community.

Spotting Rate Drops

- Rates are falling across the board. The T-bill yield is down to 2.75%, pushing banks to cut rates on savings accounts and fixed deposits.

“The interest rates in sgd has been dropping very quickly in February. The tbill yield now is only 2.75%, and as a result the banks are cutting rates to ‘catch up’ to the reality of the market.”

- Even popular high-yield accounts are affected. MariBank’s rate dropped to 2.28%, and Trust Bank followed suit, reducing its EIR to 2.75%.

“maribank drop to 2.28% also. Dropping like flies.”

- Promotional rates are disappearing quickly. Many attractive promotional rates offered at the end of the year are no longer available, leaving Singaporeans searching for alternatives.

Facing Savings Hurdles

- Lower returns on savings. With rates dropping, it’s harder to grow your savings and achieve your financial goals.

“If everywhere is paying 0.05% while this vehicle pays 1%, suddenly it becomes damn attractive at this point in time”

- Increased complexity in finding the best deals. Banks are constantly changing their rates and terms, making it difficult to compare options and choose the most suitable account.

- Fear of missing out (FOMO). The rapid changes in the market create anxiety about missing out on better opportunities and locking in rates at the wrong time.

Smart Action Steps

- Consider Singapore Savings Bonds (SSBs). SSBs offer a relatively safe and flexible investment option with decent returns, especially in a falling rate environment. The April 2025 SSB has an average return of 2.85% per year over 10 years.

“SBAPR25 GX25040F Bond Details…Average return per year % [1] 2.73 2.73 2.73 2.75 2.77 2.78 2.80 2.82 2.84 2.85”

- Shop around for fixed deposit (FD) promotions. While rates are generally declining, some banks still offer competitive FD promotions. HL Bank, for example, offered 2.80% for a 6-month FD.

“HL Bank offer: S$100,000 6 months 2.80%”

- Stay informed and be ready to switch. Actively monitor interest rates and be prepared to move your funds to higher-yielding accounts when better opportunities arise. Don’t be afraid to “chase” the best rates.

“Everyone will be out by end Mar If they dun hv any promo interest lah…”

Don’t just kena the rate cuts and siao liao! By understanding the current landscape, acknowledging the challenges, and taking proactive steps, you can navigate this tricky period and maximize your returns. Stay vigilant, compare your options, and don’t be afraid to switch banks to get the best deals. Your wallet will thank you!

Read the original discussions on HardwareZone: