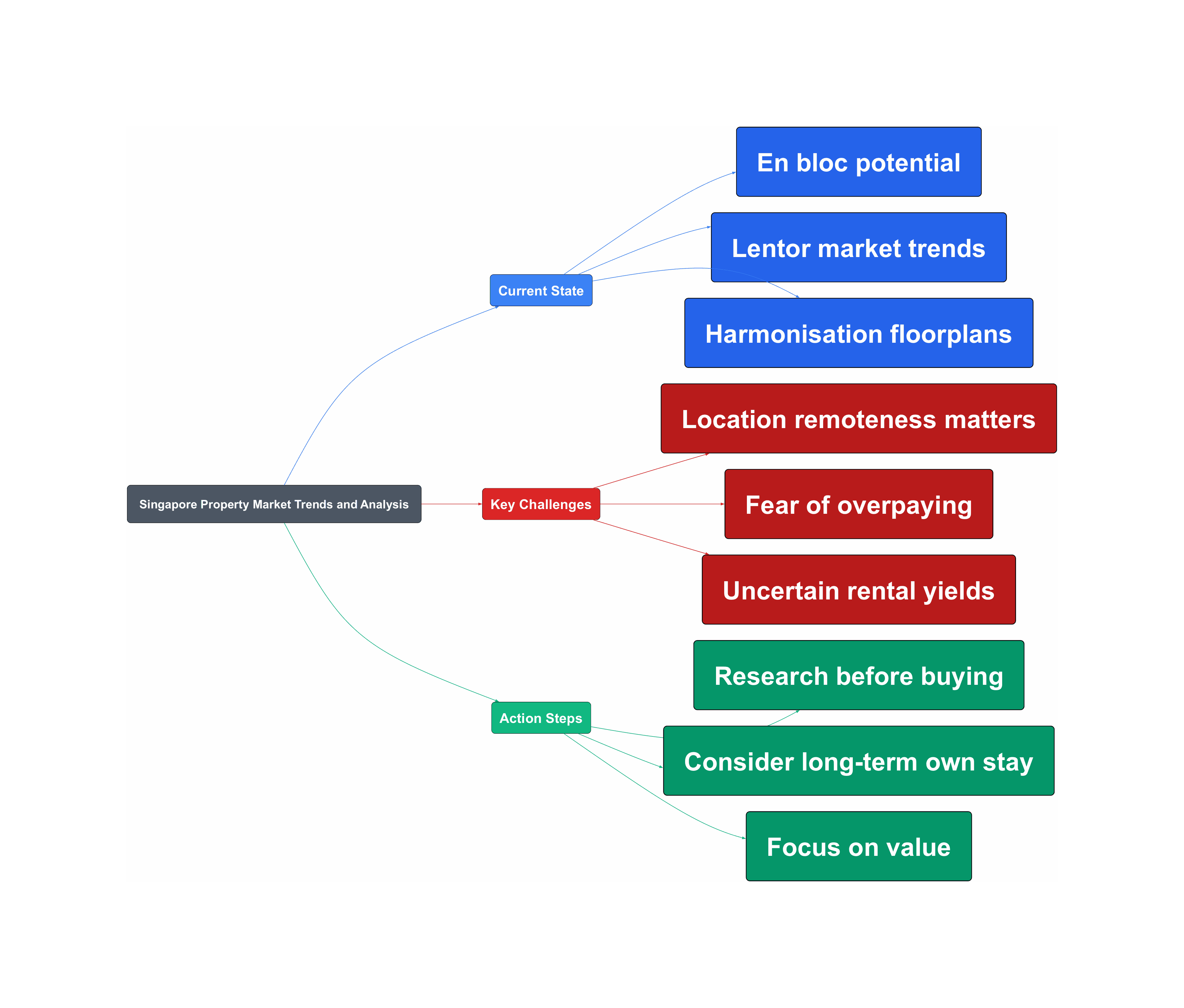

Worried about kena chop carrot in this crazy Singapore property market? You’re not alone! From potential en blocs to the hype around Lentor, Singaporeans are buzzing about property. Let’s dive into the latest HardwareZone discussions and see what’s really going on, ah.

Market’s Hot Potato

- En bloc fever is back, potentially driving up prices. With Thomson View gone, other developments like Lakeview are eyeing en bloc sales, fueled by the promise of a good payout.

“Waiting for this Lakeview enbloc .. going to enbloc this round after Thomson view successfully enbloc .. the residents are very motivated with the good payout for each unit”

- Lentor’s popularity is undeniable, but prices may be stabilising. Despite initial concerns about its location, Lentor is seeing strong demand, but land prices for new GLS sites are showing signs of cooling.

“More alarming is Bloomsbury, land price 1191 ppr… the newer site awarded one year later is 1037 ppr, almost 10% lower… meaning the same developer viewed the land in the area to have decreased in value over time and other bidders think so as well”

- Harmonisation is changing floor plan layouts for the better. New developments are focusing on maximizing usable space by removing bay windows and other wasted areas.

“Lentor Central floor plan layouts look quite good n spacious, especially the 3 and 4 bedders. I am starting to like this harmonisation thing…May start a good trend among developers to maximise useable spaces, and remove wasted things like bay windows, ac ledge, super large balconies.”

Real Headache Starts

- Location, location, location still matters. While Lentor has gained traction, its perceived remoteness was initially a concern, highlighting the importance of location in property value.

“I think what used to be considered remote for lentor is clearly no longer the case / market has accepted it as a new township? Otherwise no reason why there’s only 6%? left in the entire inventory. Coupled with fomo and the area’s attractive price for HDB upgraders.”

- Overpaying is a real fear for buyers. With so many new launches, Singaporeans worry about buying at the peak and potentially facing losses if the market cools down.

“Then the 24xx and 25xx psf pre harmo ones how?…3 years coming liao can sell 3xxx psf pre-harmo or not and make 25%”

- Rental yields are uncertain. Some areas, like One North, are seen as rental plays, but the overall demand for rental properties is questionable.

“One North area more for rental play. But then who is buying for rental nowadays lol”

Smart Action Steps

- Do your homework before buying. Don’t just follow the hype. Research the area, compare prices, and understand the potential risks and rewards.

“Acty no need to slam here and there lah I feel.. buy already just live with it.. cannot sell for profit then own stay or what lor.”

- Consider long-term own stay. If you’re not looking to flip, focus on finding a property that suits your needs and budget, regardless of short-term market fluctuations.

“For own stay, I think buying 3-4 bedders at Lentor central around $2k-2.1k psf seem reasonable to me, especially when prices elsewhere are going crazy. “

- Focus on value, not just prestige. Don’t be afraid to consider less popular locations like Flora Drive if you’re looking for affordability and spacious units.

“Ya I won’t look down on Flora drive or anywhere in Singapore. I have family members who bought in Flora drive many years ago for own stay. Very cheap, spacious units, quiet and freehold. Can be more than half price of many launches for same size.”

So, what’s the bottom line? The Singapore property market is a complex beast. Don’t simply kaypoh and follow the crowd. Do your research, understand your own needs, and make informed decisions. Don’t get burnt, ah!

Read the original discussions on HardwareZone: