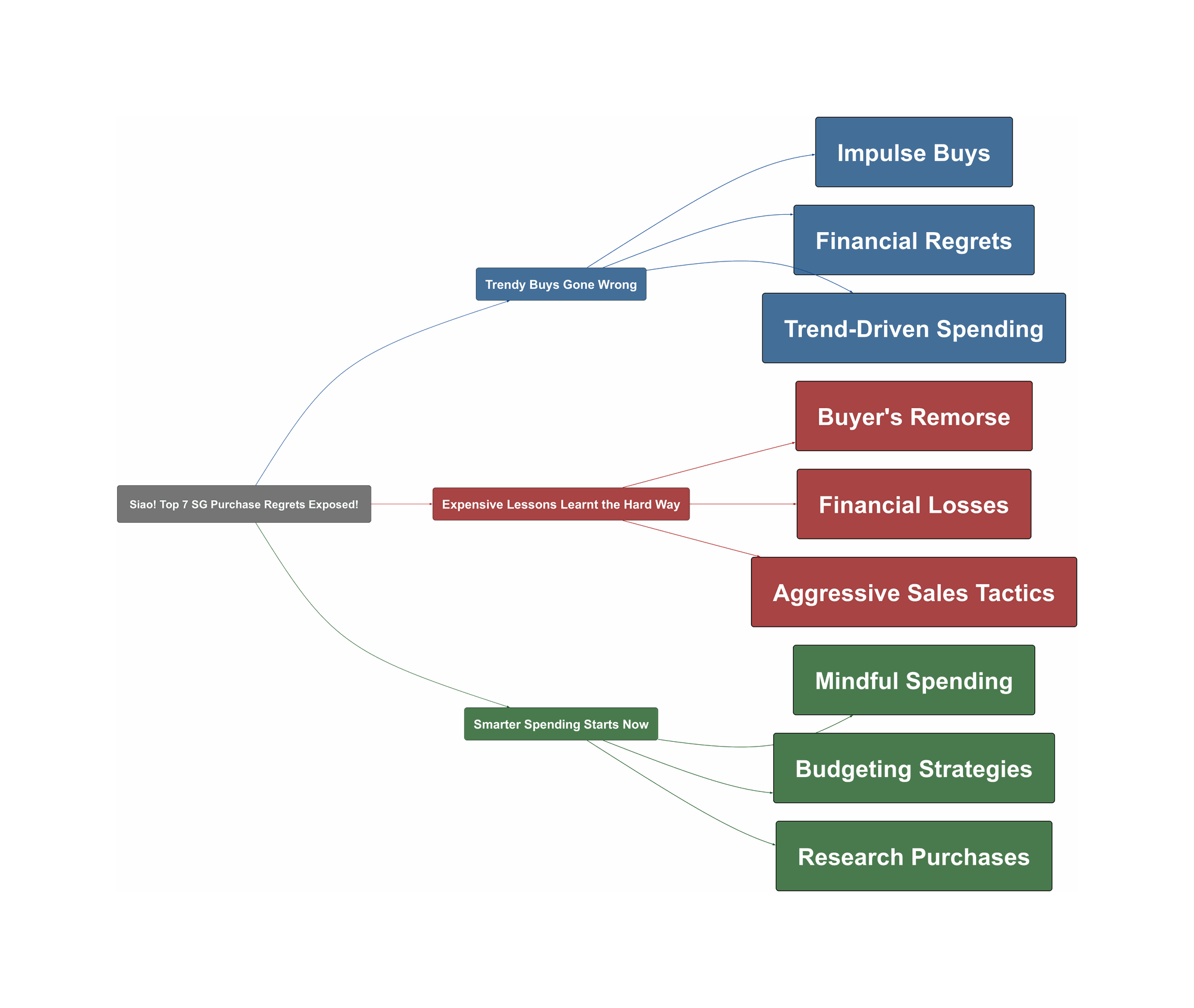

Eh, Singaporeans, how many times you bought something and then *kena* regret later? We all been there, *right*? From *kiasu* buys to trendy fads, let’s spill the tea on the things we wish we never spent our hard-earned Singdollar on. This post is *bojio* – we’re diving deep into common purchase regrets among Singaporeans, straight from the Reddit trenches.

Trendy Buys Gone Wrong

- Blind boxes and collectible toys are a common regret. The initial excitement fades, leaving behind dusty shelves and a lighter wallet.

First time i discovered blind boxes it was so fun i got 10 boxes in one day.. but now they are collecting dust

- Gym memberships often go unused, with Singaporeans citing lack of time and motivation.

Gym 6 month membership… went less than 5 times 💀

- Branded bags gather dust in wardrobes, seldom seeing the light of day.

Branded bag. Now seldom even take out to use

Many Singaporeans fall prey to impulse buys driven by trends or the fear of missing out (FOMO). The thrill of the purchase quickly dissipates, leaving behind buyer’s remorse. According to a recent survey, over 60% of Singaporeans admit to making impulse purchases at least once a month. The pressure to keep up with the latest trends, coupled with the convenience of online shopping, contributes to this phenomenon. This can lead to cluttered homes and financial strain.

Expensive Lessons Learnt the Hard Way

- Investment-linked policies (ILPs) can result in significant losses upon cancellation.

ILP was the worst.. $7k loss when I cancelled.

- Salon packages often involve aggressive hard-selling tactics, leading to forfeited balances.

Salon package: Everytime I went they would hard sell like crazy till I stopped going and forfeited a few hundred dollars balance. 🙁

- Whole life insurance policies are sometimes regretted due to their long-term commitment and perceived lack of flexibility.

Whole life insurance

Singaporeans often face pressure to invest in financial products they may not fully understand. The complexity of these products, coupled with aggressive sales tactics, can lead to costly mistakes. Many feel trapped in long-term contracts with limited options for withdrawal. This is further complicated by the high cost of living in Singapore, which makes it difficult to recover from financial setbacks. Approximately 40% of Singaporeans express concerns about their long-term financial security.

Smarter Spending Starts Now

- Before making a purchase, take a step back to consider if it’s a need or a want.

Consider if you really need it before buying it

- Research and compare prices before committing to a purchase, especially for big-ticket items.

Research thoroughly before investing.

- Set a budget and stick to it to avoid impulse buys.

Singaporeans can adopt a more mindful approach to spending by prioritizing needs over wants and conducting thorough research before making purchases. Community support and shared experiences can also help individuals make informed decisions. Consider seeking advice from trusted friends or family members before making significant financial commitments. Remember, every dollar saved is a dollar earned! Let’s be *kayu* and make smarter financial choices, *can*?