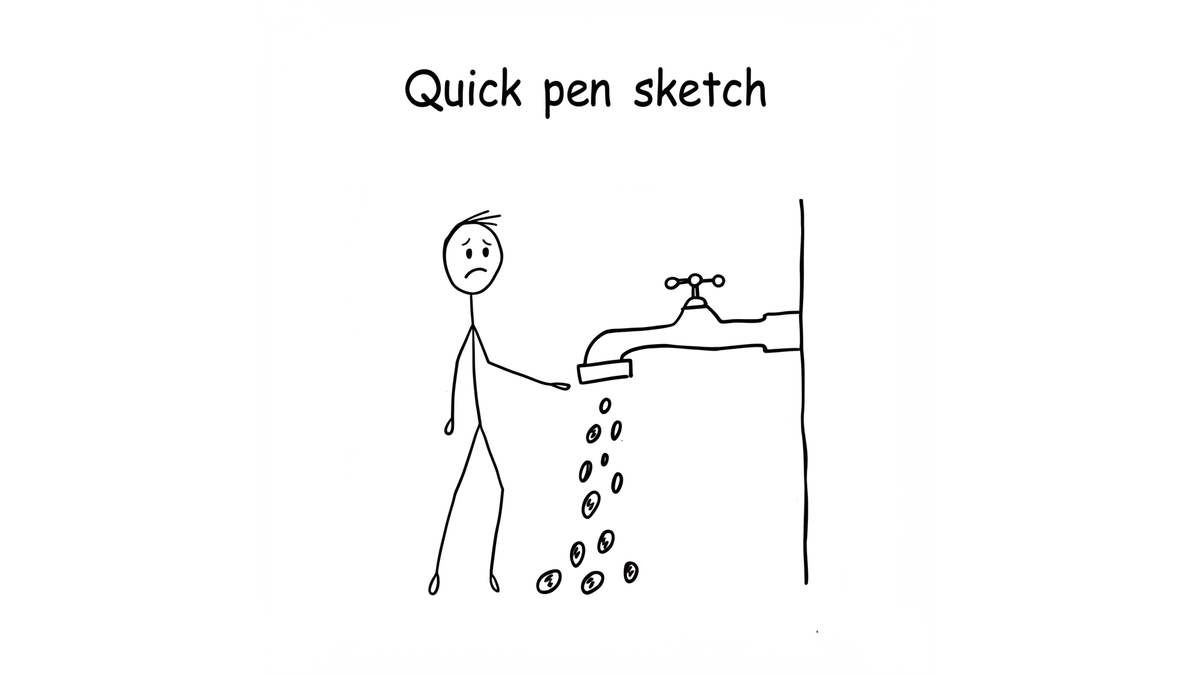

Feeling the pinch from rising utility bills in your HDB flat? We all know costs are going up in Singapore. But what happens when simple daily routines, like taking a morning shower, start feeling like a luxury your family budget can’t handle? Let’s dive into a common scenario many Singaporean families might relate to.

Family Budget Under Pressure

Times are tough for many households in Singapore right now. When one parent is the main breadwinner supporting the whole family, every dollar counts. This pressure often translates into watching utility usage like a hawk – water, electricity, gas. Younger family members, influenced by online discussions or personal preferences, might want things like an extra shower, unaware of the financial stress it adds.

- Recent times tough, family struggling financially

“recently times have been tough, and my family is struggling financially. My dad (60M) is sort of the sole breadwinner, and has to feed 5 mouths.”

- Desire for morning shower influenced by trends

“with all the debate about showering in the morning, I wanted to start showering in the morning too.”

- Focus on managing household expenses

The Real Cost of Showers

It’s not just about getting clean; it’s about the actual cost. Turning on the water heater twice, using lights, and potentially (though debated) needing more laundry cycles adds up. For a parent already stressed about making ends meet, this extra expense, however small it seems, can feel significant. It highlights a common friction point in Singaporean households: balancing individual wants with the family’s financial reality.

- Heated water seen as a luxury

“But having heated water is really a luxury, which by your own admittance, may not be something your family can afford.”

- Parental stress over small expenses

“If he is so stressed about a few dollars he is obviously seriously struggling – have some understanding and don’t take him for granted.”

- Clash between personal desires and family finances

Finding Smart Solutions Together

So, how to navigate this without causing more family stress? The Singaporean spirit of practicality kicks in! Many suggest embracing cold showers – refreshing and saves on heating costs. Simple adjustments like shorter showers or ensuring lights are energy-saving can help. For teens, finding ways to contribute, even small amounts, towards bills shows understanding. If home showers are a persistent issue, exploring alternatives like school facilities or ActiveSG gyms could be an option. Communication and empathy are key.

- Embrace cold showers

“get used to cold water, freshens me up every morning”

- Contribute towards bills

“Contribute to water and electricity bills”

- Explore alternatives

“find a public shower facility at the public pool or active sg.”

- Use water heater alternatives

“fill up a pail with water then add hot water which you boil using a kettle and bath with it.”

Ultimately, it’s about finding a balance that respects both personal needs and the family’s situation. A little understanding and willingness to compromise can go a long way.