Feel like Singapore property prices are running away from you? You check the listings. Everything seems to be climbing higher and higher. It is a stressful feeling many Singaporeans share. You are not alone in wondering if you can ever afford your dream home. But what is really happening on the ground? We dived into HardwareZone forums to find out.

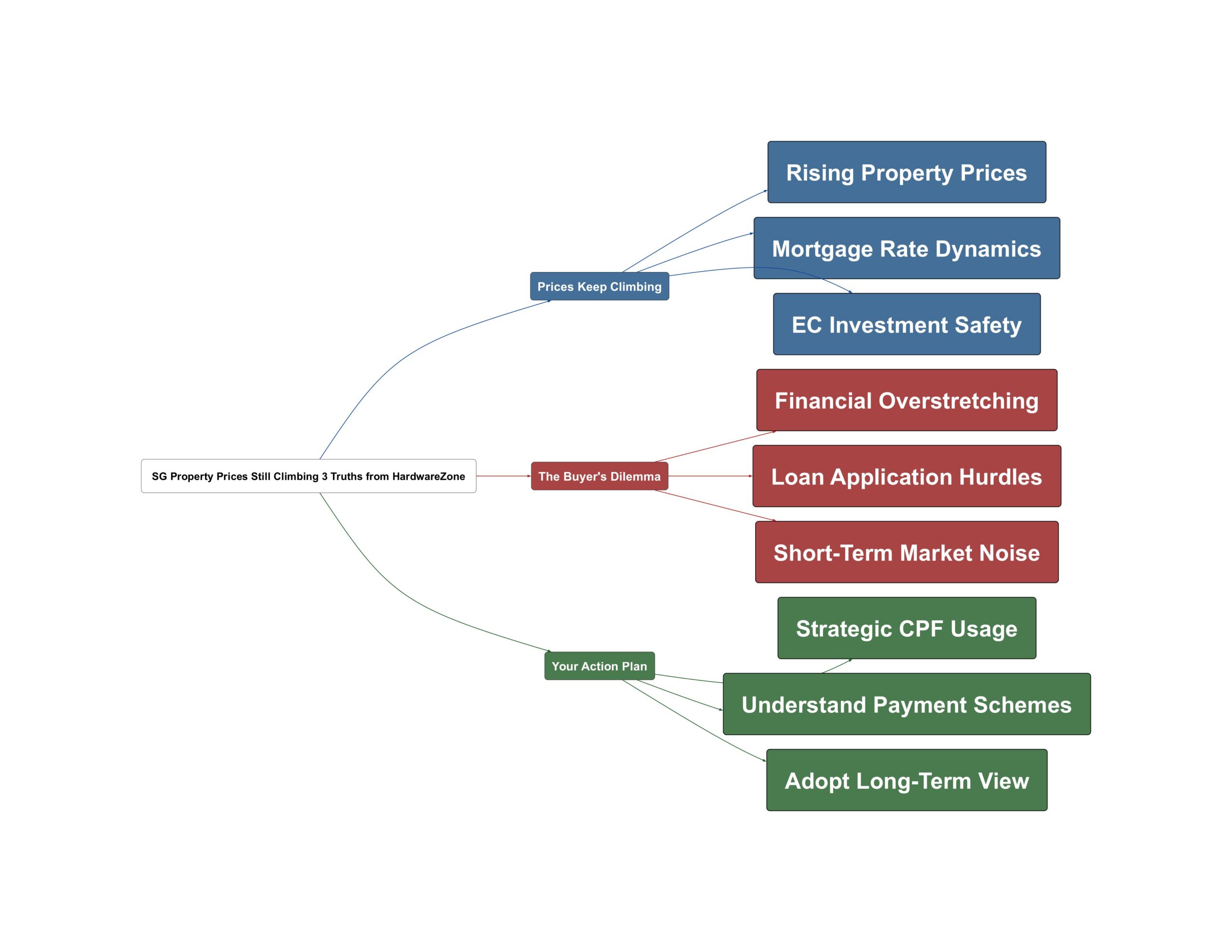

Prices Keep Climbing

The numbers do not lie. Property prices in Singapore continue their upward trend. This affects everything from HDBs to private condos. Forum users see a clear chain reaction in pricing.

- Property prices create a ripple effect

If resale EC is $1.5mil, resale condo will be $1.8mil. If new EC is $1.8mil, new condo sure $2.2mil.

- Mortgage loan spreads are increasing

Even with potential rate cuts, banks are getting smarter. They are increasing the spread on floating rate loans. This means your mortgage could still be expensive.

So far most of the banks started to increase the bank spread since last month. it is around 3m sora + 0.4% for now.

- Executive Condos (ECs) are a safe bet

Many Singaporeans view ECs as a low-risk investment. The potential for profit is high. Losing money on an EC is considered very unlikely.

I feel for EC to lose money, you need to be ultra suay. This is like failing an exam despite your professor give you the exam paper in advance.

The Buyer’s Dilemma

Buying a property is more than just about the price tag. Singaporeans face real challenges and pressures. These hurdles can make the journey incredibly stressful.

- The stress of being overstretched financially

High prices mean bigger loans and monthly payments. This financial commitment weighs heavily on many buyers. It is a constant source of worry.

Will it be overstretched? Quite stressful right?

- Securing the right loan amount is tough

Sometimes, the bank’s loan offer is not enough. Buyers then face difficult choices. Some must resort to methods like “show cash” to get approved.

One bank offered 50k lower than the loan limit i was looking for. When i asked how to fulfil the extra 50k, the bank asked for either 40k+ FD for 2 years or show 150k of liquid cash (no lock-in).

- Dealing with social pressure and noise

Everyone has an opinion on property. It can be hard to think long-term. Many just nod along when friends complain about high prices.

I actually always “agree” with my peers (mostly no investment property) when they are talking about simi crazy high HDB/Condos prices…..i js armchio and nod my head

Your Action Plan

Navigating this market is tough, but not impossible. HardwareZone members shared some practical strategies. These can help you make smarter decisions for your future.

- Decide your CPF and cash strategy

Should you empty your CPF for the downpayment? Or keep more cash on hand? This is a major debate with valid points on both sides.

I always empty CPF for downpayment and keep as much cash on hand……how come so funny never touch CPF at all for both properties.

- Understand different payment schemes

For new launches, you have options. Progressive payment and deferred payment schemes work differently. It is crucial to know which one suits your financial situation best.

Actually if u can pay full why nid deferred payment scheme for ec? Wouldnt regular progressive payment for buc makes more sense?

- Adopt a long-term investment mindset

Property is not a short-term game. Stop focusing on the next 2-3 years. A longer view of 10 years or more often leads to better outcomes.

This thread doesn’t make sense when you all keep talking about 2-3 years time People hold property is for long term. 10 years.

The Singapore property market remains a hot topic. Prices are high, and the journey is stressful. But knowledge is your best tool. By understanding financing options, focusing on the long term, and filtering out the noise, you can make a sound decision. It is about playing the long game. Your dream home might be closer than you think with the right strategy.

Read the original discussions on HardwareZone: