Wah lau, interest rates in Singapore suddenly going up again ah? You also feeling the pinch? Don’t worry, you’re not alone. Let’s break down what’s happening and what it means for your wallet.

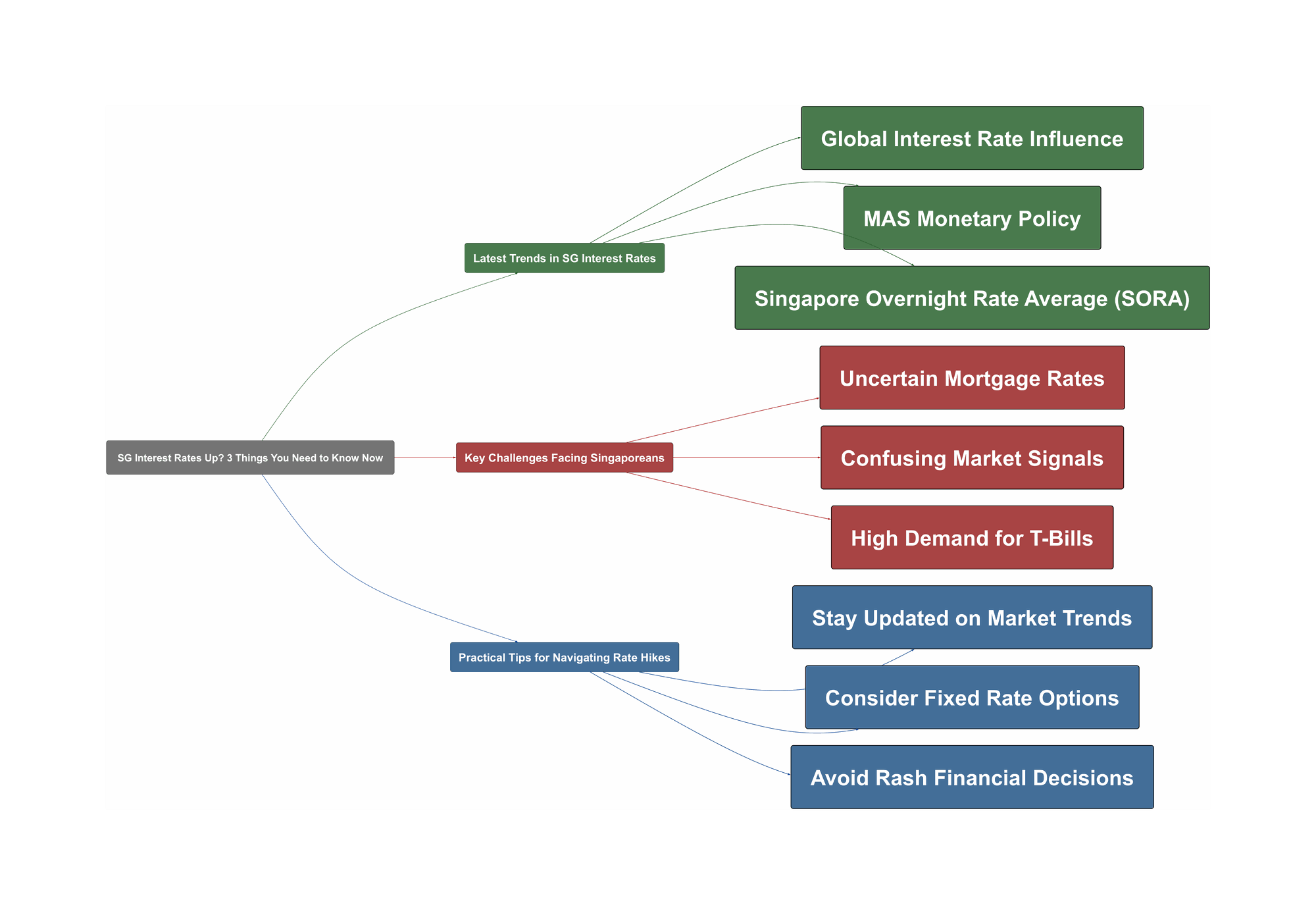

Latest Trends in SG Interest Rates

-

Global Factors at Play: Singapore’s interest rates are not just our own problem. They kena influenced by what’s happening in the US, especially their interest rates.

This is due to a confluence of global interest rates generally having moved higher over the last 3 months, and also MAS easing policy.

-

MAS Actions Affecting Rates: Our Monetary Authority of Singapore (MAS) also plays a part. They’ve been adjusting the SGD exchange rate, which indirectly affects interest rates here.

Since November 2024, speculation has been rife that the MAS would reduce the appreciation slope of the SGD NEER, which it eventually did last Fri (24-Jan).

-

SORA Spikes: You might have seen the Singapore Overnight Rate Average (SORA) going above 3% recently. This could be due to short-term cash flow issues, especially around holidays like Chinese New Year.

The recent spike above 3% in SORA is likely just a function of liquidity tightness in the very front-end of the curve over the Lunar New Year period.

Key Challenges Facing Singaporeans

-

Mortgage Rates Uncertain: With all these changes, it’s hard to know where mortgage rates are heading. It seems like the lowest rates are over for now, but things can change very fast.

I think 3Q24 was the bottom for rates for now, but of course things can change quickly.

-

Confusing Market Signals: The market is giving mixed signals. Even though interest rates are rising, banks are still lending money quite easily. This makes it hard to predict what will happen next.

Concurrently, banks have been cutting deposit rates on savings accounts and fixed deposits. And of course with the large number of commercial banks in Singapore there is fierce competition to disburse loans.

-

T-Bill Demand High: Even with higher interest rates, demand for Singapore Treasury bills (T-bills) is still strong. This means that despite the global trend, rates might not jump up that much here.

6m tbill cutoffs have been sticky at around 3% for some time now, despite a general increase in issue sizes over the last 12 months. This indicates continued strong and relatively price-inelastic demand

Practical Tips for Navigating Rate Hikes

-

Stay Updated: Keep an eye on websites like Bondsupermart for the latest info on Singapore interest rates. Knowledge is power, hor!

Check out Bondsupermart for insights on SGD rates and the local credit market.

-

Consider Fixed Rates: If you have a home loan, you might want to consider fixing your interest rate to avoid future uncertainties. Talk to your bank about your options.

-

Don’t Panic: While rates are up, the situation is complex. Don’t make rash decisions. Do your research and think carefully before making any big financial moves.