Eh, Singaporeans, ever feel like you need a degree just to buy a condo these days? So many new launches, so many choices – it’s enough to make your head spin! And let’s be real, with CPF and all, it’s not just about finding a nice place; it’s about making a smart investment. We’ve been seeing some heated discussions on HardwareZone about the new Parktown Residence and the buzz around Lentor. So, which one’s the better bet? Let’s break it down, SG style.

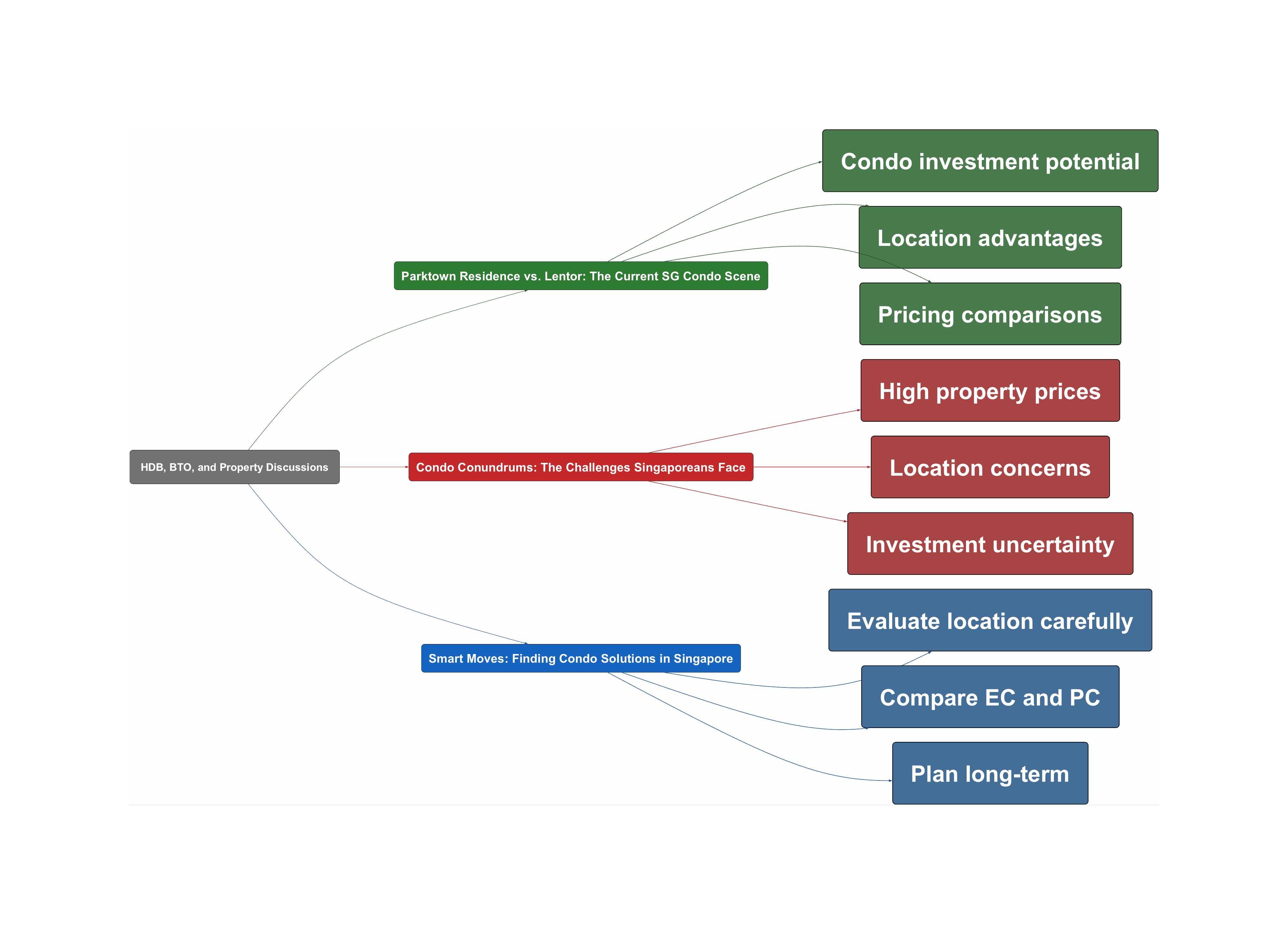

Parktown Residence vs. Lentor: The Current SG Condo Scene

- Tampines’ Popularity: Tampines is seeing a lot of new condo projects, but the location is key, not just the name.

“Tampines got many condo actually, all along Tampines AVE 10 and nearby, though I didn’t total up to compare which area has more units. We can’t be fixated with name of the area. Just because we call it ‘Tampines north’, we easily associate it with Tampines. And just because ‘Lentor’ isn’t called ‘AMK North’, we see as not-tested area.”

- Lentor’s Appeal: Lentor is attracting HDB upgraders, with good MRT access and a quick ride to the city center.

“I think Lentor has its own appeal and seems to be attracting HDB upgraders from areas like Serangoon and Toa Payoh. It also benefits from an established MRT station, with a reasonable 20-minute ride to Orchard/CCR area.”

- Price Matters: Indicative prices for Parktown are out, with 1+S units starting from $1.07M, and 3B units from $2.07M.

Condo Conundrums: The Challenges Singaporeans Face

- EC vs. PC Dilemma: Some feel ECs near integrated developments like Parktown can be a cheaper option and a good investment when MOP.

“I see an integrated development having a nearby EC as a downside because with a gap of 700psf, say for a 1000sf 3b, aurelle owners can sell 700k cheaper than parktown when mop while enjoying the same amenities/convenience as those who bought PTR in resale.”

- Location Perception: Some Singaporeans view Lentor as an expensive version of Yishun, while others feel Tampines is too far from the city.

“To me Lentor is an expensive cousin of Yishun”

- Investment Risks: Concerns about cooling measures and OCR prices above $2.2kpsf make some wary of immediate flips after SSD.

Smart Moves: Finding Condo Solutions in Singapore

- Consider Location: Focus on the actual location of the condo, not just the area name, and assess MRT access.

“What is more important is the actual location.”

- Assess the Price Gap: Compare prices between integrated developments and nearby ECs to see which offers better value.

“Will go for parktown than lentor if price gap is close. Lesser supply in tampines also mean easier to exit. Tampines resales performance tested and proven, lentor not yet.”

- Think Long-Term: With current market conditions, be prepared for a mid-to-long-term holding period to see decent gains on your investment.

Read the original discussions on HardwareZone: