Eh, Singaporeans, let’s talk about something nobody likes to think about: what happens to your money when you… well, you know. It’s a bit paiseh (embarrassing) to bring up, but planning ahead is super important, especially in our fast-paced, high-cost-of-living society. Imagine your loved ones suddenly scrambling to figure out your CPF, investments, and bank accounts. Not a good look, right? Let’s make sure your kaki (friends/family) are taken care of, yeah?

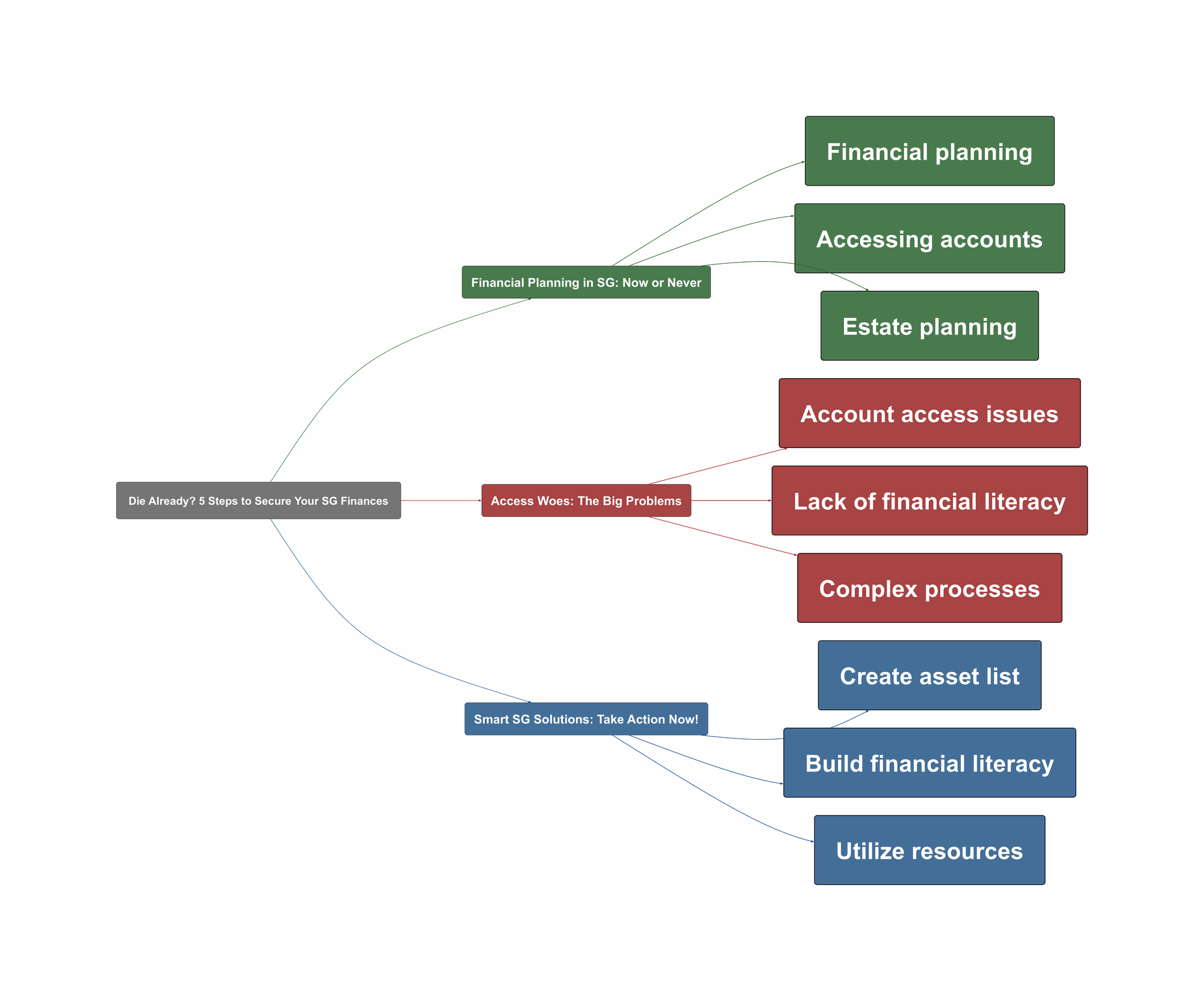

Financial Planning in SG: Now or Never

- Recent developments or trends

“This actually happened to a family that lives in my block. The guy passed away suddenly at like 45 and he had 2 kids and a wife who was a SAHM and didn’t know how to access even the basic finances, let alone the investment accounts etc.”

- Relevant statistics for Singapore

A recent study found that 72% of Singaporeans who are confident in managing their finances learned these skills from family members. Many households still operate with one primary financial decision-maker.

- Common experiences shared on Reddit

“If the unfortunate event I pass away, how can she access my bank accounts, brokerage accounts (IBKR, Kayhian, etc), government bonds etc?”

- Current state of the topic in SG

Many Singaporeans, especially those who manage the household finances, are concerned about their family’s access to their investments and savings after their passing. This is a widespread issue in Singapore.

Access Woes: The Big Problems

- Common frustrations discussed on Reddit

“Even I write down my login details for her, nowadays most of these accounts use FaceID authentication (tied to my phone and my face) and she won’t be able to log in”

- Obstacles unique to Singapore

The complexities of international brokerages and tax implications, especially with US-based accounts, create added hurdles. Many Singaporeans find dealing with overseas assets challenging.

- Contradictions between expectations and reality

While many assume that accessing local bank accounts and CPF is straightforward, the reality is that the process can still be time-consuming and require specific documentation.

- Complex situations requiring solutions

“I manage most of the money matters in my household and my wife isn’t very financial/tech savvy.”

Smart SG Solutions: Take Action Now!

- Steps Singaporeans can take

“Make sure you did your nomination AFTER getting married. This should tide over short term needs.”

- Community-tested approaches

Many Singaporeans are creating a schedule of assets, listing all accounts, account numbers, and login details. Some are also making joint accounts.

- Local resources and options

“Get help, sir.”

Utilize resources like the MyLegacy website to find information and start the process. You can also use OCBC’s will generator as a starting point.

- Preventive measures

“Start with quarterly ‘money dates’ where both partners review accounts, make investment decisions together, and practice accessing various platforms”

Consider adding your spouse’s face to FaceID for phone access, and create a digital vault to store important credentials. Simplify your financial structure to make it easier to manage.

So, don’t kiam siap (stingy) about this. Take action now to protect your family’s future. It’s a small effort that can make a huge difference. Jia you (add oil)!