Decoding Your Investment Options in Singapore: T-Bills, SSBs, and More

With a dynamic economic landscape, Singaporean investors are constantly seeking the best avenues for their funds. Recent discussions highlight a keen interest in Treasury Bills (T-Bills), Singapore Savings Bonds (SSBs), and other deposit products. Let’s explore these options to help you make informed decisions.

Treasury Bills (T-Bills): A Short-Term Bet

Singapore T-Bills have garnered attention, with recent cut-off yields around 2.2% p.a. (as seen in a May 2025 auction where S$7.5 billion was allotted out of S$18.1 billion applied). These are short-term government securities, typically for 6 months. The bid-to-cover ratio was 2.41, with non-competitive applications fully allotted.

Investors should note that T-Bill yields can fluctuate. For instance, one user pointed out that T-Bill yields were as low as 0.48% in January 2022 before rising with US Fed rate hikes. When applying, there are competitive and non-competitive bids.

Singapore Savings Bonds (SSBs): Flexibility and Long-Term Growth

SSBs offer a longer-term investment horizon (up to 10 years) with the flexibility to redeem early (monthly) without penalty. Projections for upcoming SSB issues (e.g., SBJUL25) show interest rates stepping up over the years, potentially averaging around 2.50% p.a. over 10 years, with initial years around 2.08%.

A key consideration is the falling interest rate environment. Some investors prefer SSBs over T-Bills, arguing that locking in current SSB rates might be beneficial if T-Bill rates decline further. As one contributor mentioned, “Between 6 mths tbill and SSB, go for SSB. Rates are falling. 6 mths later, you might not even get 2.2% for SSB.”

Fixed Deposits (FDs) and High Yield Savings Accounts (HYSAs)

Traditional banking products also remain relevant. For example:

- DBS has offered a CASA account with 2.3% for 6 months with no cap, accessible by visiting a branch between May 2 and May 31, 2025, with earmarking ending October 31.

- DBS Fixed Deposits were also mentioned as attractive, though potentially with caps (e.g., a $19,999 cap).

- For larger amounts (e.g., >$80K), options like OCBC’s 2.58% for 88 days or premier accounts with welcome gifts might be worth exploring. There are reportedly about 7 HYSAs available.

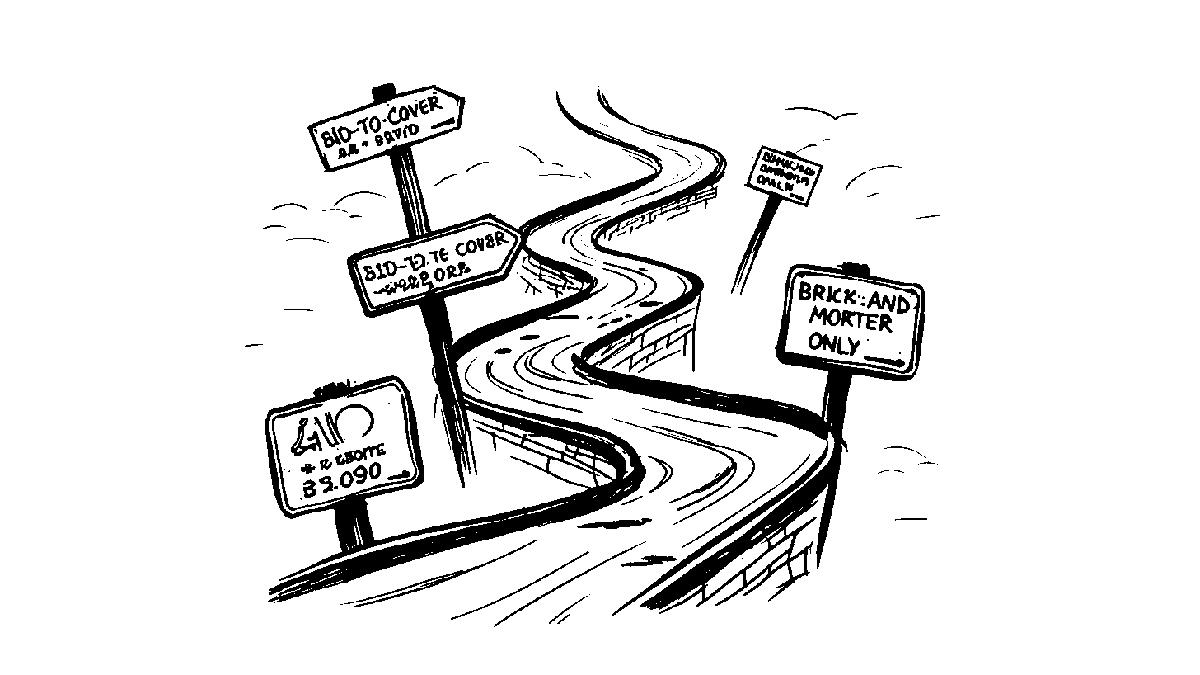

Access can be a factor, with some promotions requiring a visit to a “brick and mortar” branch, while others are available online.

Navigating Your Choices & Platform Considerations

When deciding, consider:

- Investment Amount: Different products may be more suitable for varying amounts.

- Liquidity Needs: SSBs offer more flexibility than T-Bills or fixed-term FDs if you need to access funds.

- Rate Outlook: Your view on future interest rate movements can influence whether to lock in longer-term rates (SSBs) or opt for shorter-term instruments (T-Bills).

- Application Process: Some prefer the ease of online applications, while others don’t mind branch visits for specific offers.

It’s also wise to be aware of potential complexities with other investment platforms. For instance, a user on Interactive Brokers reported an unexpected 24% US tax withholding on trade proceeds from US shares (e.g., selling USD$10k of NVDA), highlighting the need to understand tax implications for international investments.

Conclusion

Whether you opt for the relative safety of T-Bills and SSBs, or explore FDs and HYSAs, understanding the nuances of each product is key. Some investors might choose to be “slightly more aggressive” with T-Bill bids or “wholesale into SSB” if bids are unsuccessful. Ultimately, aligning your investment choices with your financial goals and risk tolerance will pave the way for a sound investment strategy.

Read the original discussions on HardwareZone: