Eh, you hear the news? Some experts say our Singapore Dollar might one day be 1-to-1 with the US Dollar! Good or not, ah? Sounds like a dream for our US online shopping sprees, but hold your horses, lah. It’s not as straightforward as it seems for our little red dot.

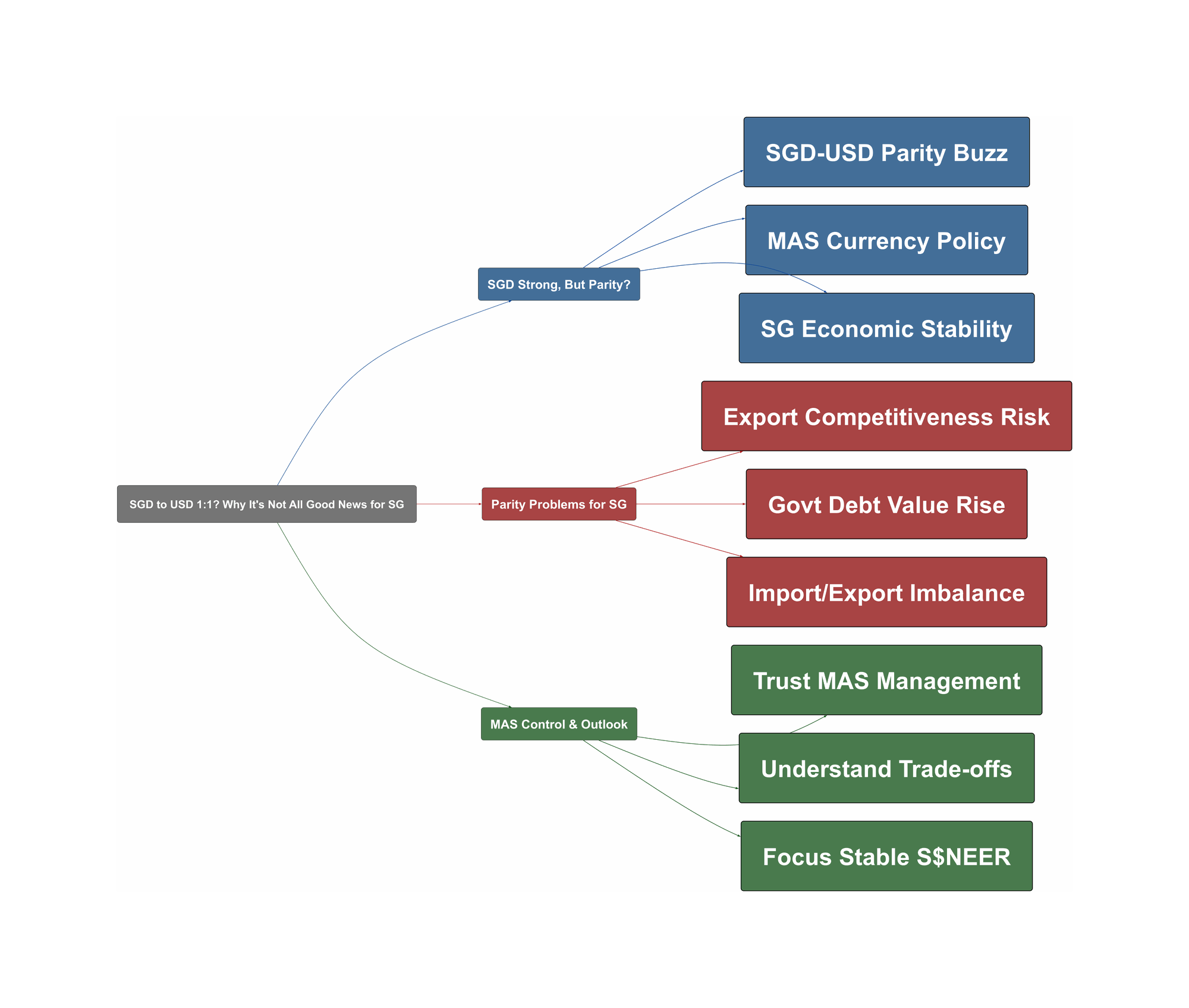

SGD Strong, But Parity?

-

Recently, some financial analysts have been buzzing about the incredible possibility of our Singapore Dollar (SGD) achieving parity – a 1:1 exchange rate – with the US Dollar (USD). One economist even suggested this could happen “in our lifetimes,” sparking quite a bit of chatter online. For many Singaporeans, a strong dollar often feels like a win, especially when planning that overseas holiday or snagging deals on US websites. It makes us feel a bit richer on the global stage, right?

“They also said that parity between the two currencies is possible in the future, with one economist saying it could happen “in our lifetimes”. The world would have to be in a very, very different state for such parity to happen and I’m not too sure if that is a good thing.”

-

However, such a dramatic shift would signal a massively different global economic landscape, and as the Redditor above notes, it’s not clear if that’s a good thing. The Monetary Authority of Singapore (MAS) currently manages the SGD’s value against a basket of currencies of our major trading partners. This is done through the Singapore Dollar Nominal Effective Exchange Rate (S$NEER) policy, allowing it to float within an undisclosed policy band. This approach aims for overall stability rather than targeting a specific bilateral exchange rate like SGD/USD.

Parity Problems for SG

-

So, why are many Redditors saying SGD-USD parity would be bad? One major concern is our export competitiveness. Singapore relies heavily on exports, like high-end semiconductors. A super-strong SGD makes our goods more expensive for overseas buyers, potentially hitting this crucial sector hard.

“RIP to our exports lol”

-

We also import almost everything, from our daily Kopi O to electronics – about 80-90% of items, according to one Redditor. While a strong SGD makes these imports cheaper (yay, cheaper Taobao!), the overall hit to our export-driven economy could outweigh this consumer benefit. It’s a delicate balancing act for a nation without its own natural resources, heavily dependent on trade.

“Would be bad for SG. SG have to manage export as well as import – aka different from other countries (we don’t have natural resources) depend on high end semi conductor for export and 80-90% item we depend on import.”

-

Another important point raised online is that government liabilities, such as our CPF savings and Singapore Savings Bonds (SSBs), are denominated in SGD. If the SGD becomes exceptionally strong, the real value of these government debts effectively increases. This isn’t generally seen as a positive development for national finances.

“Note that the Singapore government’s liabilities (e.g. CPF and Singa bonds) are mostly denominated in the SGD. Why would the Singapore government increase the value of its debts?”

MAS Control & Outlook

-

So, should we be worried or excited? The good news is that the Monetary Authority of Singapore (MAS) has a firm and steady hand on the SGD. They’ve openly stated their policy of managing our currency within a specific (though not publicly detailed) band against the currencies of our major trading partners, not just the USD. This isn’t a free-for-all float where anything can happen overnight.

“MAS controls the SGD against the USD within a bracket. This is not a secret, they even said so themselves. For this to ever happen, it means that that either the MAS changed it’s policy or the forces so strong that MAS can’t even control it. Either way, I think unlikely.”

-

For the SGD to actually reach parity with the USD, it would likely require a fundamental change in MAS’s long-standing monetary policy or truly extreme global economic forces that could overwhelm even MAS’s significant reserves and influence. Most local analysts and Redditors familiar with MAS policy consider this scenario highly unlikely under current conditions.

-

Ultimately, MAS’s primary goal is to maintain price stability to support sustainable economic growth for Singapore. This means carefully balancing the cost of our essential imports with the competitiveness of our vital exports. So, while dreaming of a 1:1 exchange rate for your next US Amazon order is understandable, the reality is our nation’s economic health depends on a more nuanced and carefully managed S$NEER policy. Steady lah!