Eh, check your phone again? See the USDSGD rate? Wah, dipped below 1.29 already! Many Singaporeans holding US stocks are feeling the pinch. Your stocks might be going up, but the strong Singdollar is eating away at your gains when you convert back. So, what’s the game plan now?

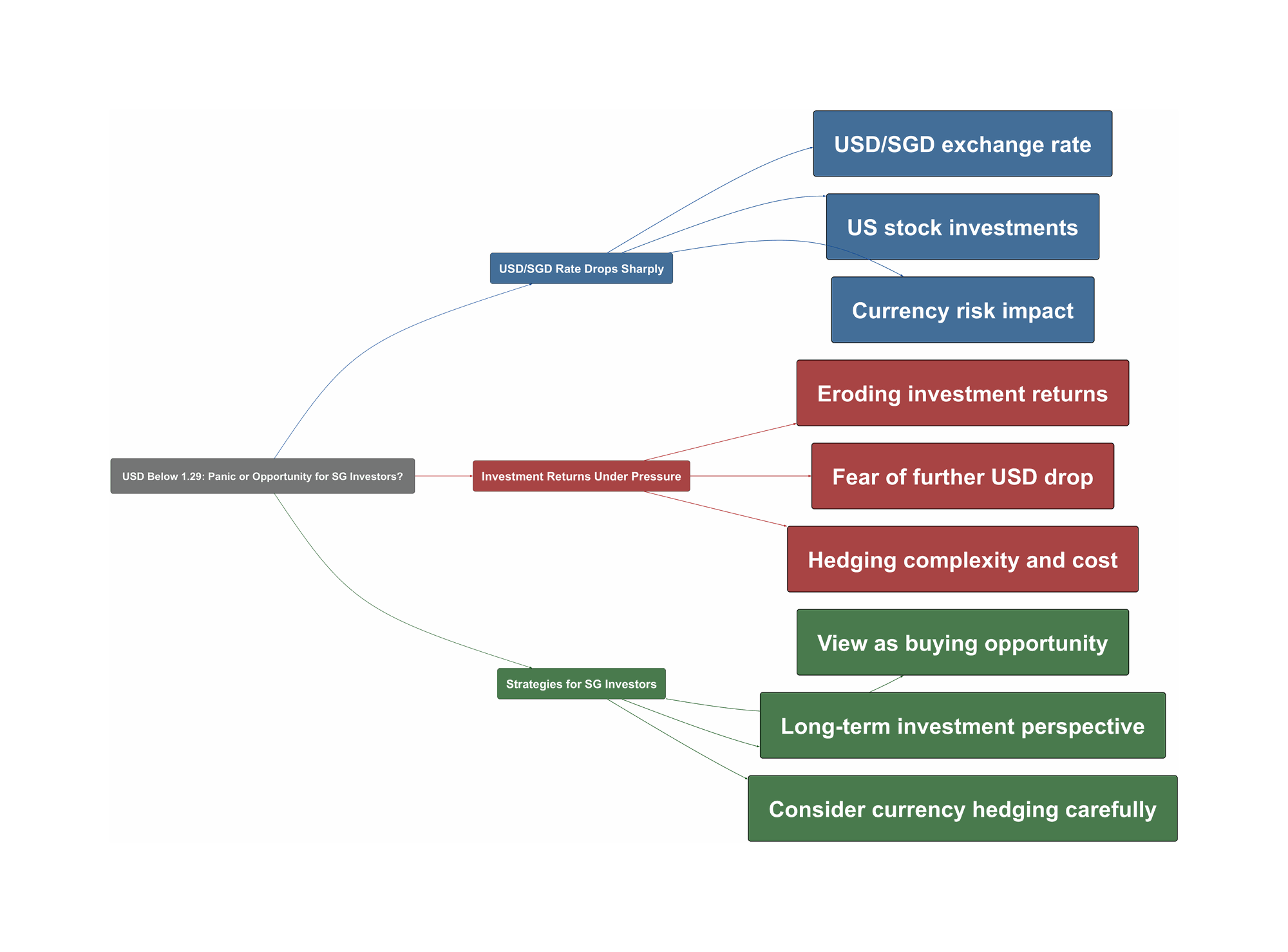

USD/SGD Rate Drops Sharply

Recently, the US dollar has weakened quite a bit against the Singapore dollar, falling below the 1.29 mark. This trend has sparked discussions online among local investors worried about their US-denominated assets, like stocks or ETFs. While a strong SGD sounds good, it means your overseas investments are worth less in Singdollar terms. Some folks remember similar dips before, suggesting it might bounce back, while others are watching the Monetary Authority of Singapore (MAS) closely for any hints about future policy shifts, especially with recession whispers.

- Recent dip below 1.29 USDSGD concerns investors.

“USDSGD dipped below 1.29 already. No matter your profits in US stocks, your returns are getting eroded.”

- Historical context shows previous dips, like hitting 1.28 last September.

“Last year Sept.the dollar hit 1.28 to the Sing dollar before bouncing back”

- Market watchers anticipate potential MAS policy pivots.

“Wait for MAS to pivot their monetary policy as they expect recession in the next few quarters.”

Investment Returns Under Pressure

The main headache? Seeing hard-earned investment gains shrink simply due to currency fluctuations. This leads to real anxiety, with some even wondering about worst-case scenarios, like a 1:1 exchange rate someday. Finding good alternatives isn’t easy either; where else can Singaporeans reliably invest with similar potential? There’s a frustrating disconnect when your US portfolio shows profit, but the actual SGD value decreases. While hedging exists, it’s complex and comes at a cost, especially since US interest rates are higher.

- Fear of further USD decline eroding returns significantly.

“What if 1 day USD/SGD 1:1 exchange rate? Does it mean that all my us stock loss about 30% in sgd value?”

- Difficulty finding alternative markets or currencies.

“Tell me a better place? move where ?”

- Complexity and cost associated with currency hedging.

“An alternative if you really believe USD will fall further is to hedge your currency exposure with fx swaps or futures (if you know what you are doing). You’ll pay a premium though since USD has higher interest rates.”

- Contradiction between asset performance and actual SGD returns.

Strategies for SG Investors

So, how to navigate this choppy currency situation? For long-term investors, some see this as a chance to buy US assets ‘on discount’ because the stronger SGD makes them cheaper. If market dips and currency swings make you lose sleep, perhaps it’s time to reassess your overall investment strategy and risk tolerance. For those more experienced, exploring currency hedging via FX swaps or futures could be an option, but proceed with caution and understand the costs involved. Staying informed about global economic trends and potential MAS responses remains crucial for everyone.

- View the dip as opportunity to buy cheaper US assets.

“Just means stocks are cheaper for you now. I don’t see a problem unless you are retiring or had an inheritance.”

- Re-evaluate risk tolerance if volatility causes significant stress.

“If retiring and balls shrink because of 5% change then you need to rethink your strategy”

- Consider hedging currency risk if knowledgeable (understand premiums).

- Adopt a long-term perspective, focusing on investment goals over short-term fluctuations.