Eh, check your bank app again ah? Feels like every other week got news about savings account interest rates dropping, right? One moment you think you found the best deal for your hard-earned cash, next moment kena cut. It’s like trying to catch the MRT during peak hour – blink and you miss the good spot! Keeping up with which Singapore bank offers the best savings account interest rate feels like a full-time job sometimes. You’re not alone in feeling this way; many Singaporeans on forums like HardwareZone (HWZ) are actively discussing these changes, sharing tips, and figuring out how to still make their money work harder. Let’s dive into what the HWZ community is saying and what you can actually do about it.

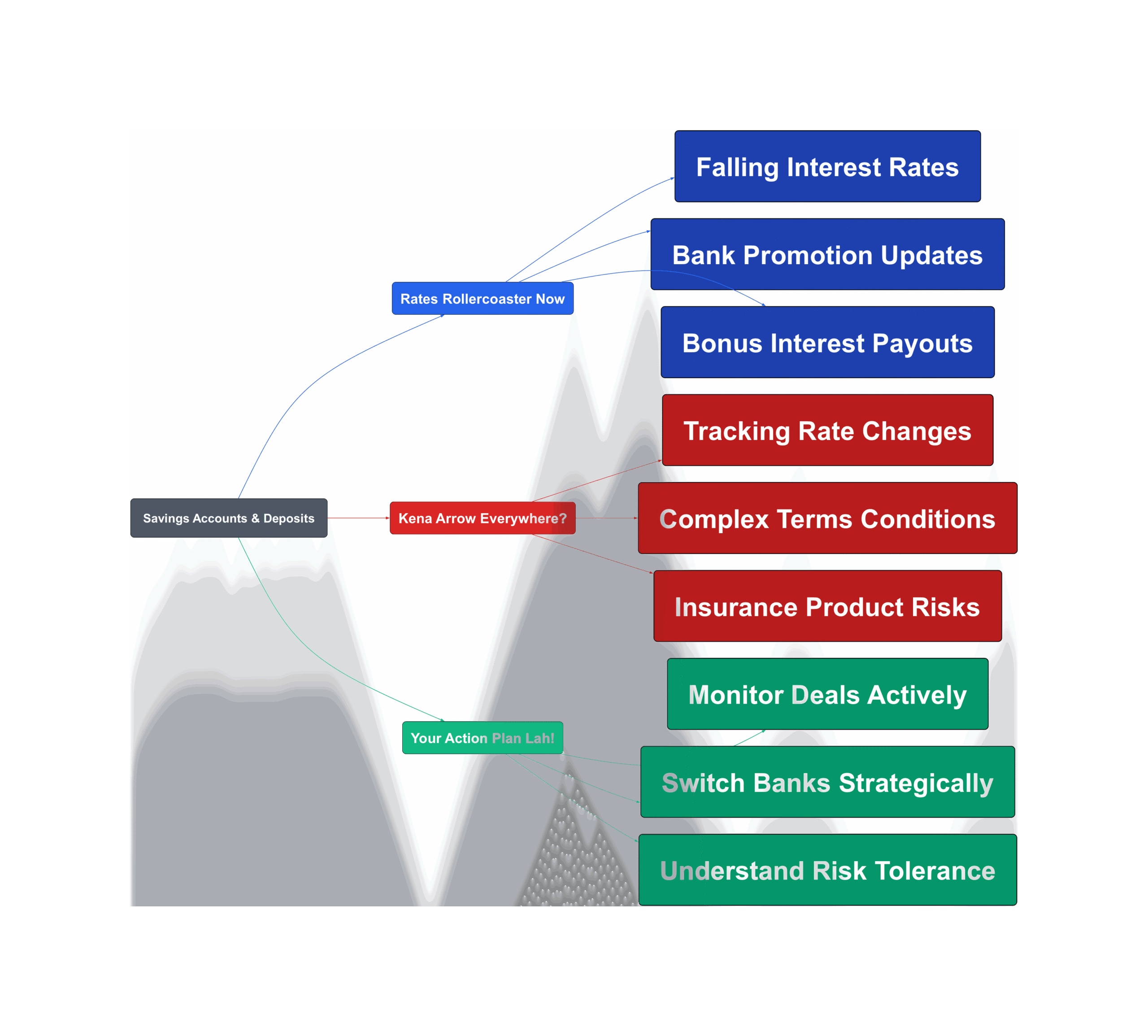

Rates Rollercoaster Now

So, what’s the latestlobang on the savings scene according to HWZ users? It’s a mixed bag, lah. While some banks are trimming their offers, others are dangling targeted promos or paying out those bonus interests we all wait for.

- Overall Interest Rates Trending Down

Several major banks have recently adjusted their promotional and fixed deposit rates downwards. It seems the era of super high promotional rates might be cooling off slightly, making it crucial to check the latest figures before committing your funds.

“Maybank promo rates will be cut with effect from 28 April.”

“Not sure when but OCBC cut its offer rates again… UOB cut its 10 months offer from 23 Apr.”

- Targeted Promotions and Invitations Still Exist

Banks like StanChart are sending out specific invitations for promotional rates on accounts like the eSaver. However, these offers aren’t uniform – different customers might receive slightly different rates, adding another layer of complexity.

“Received invitation today…2.85 + 0.05, 2.9% for 3 months. Will transfer all from ocbc premier dividend plus to esaver tomorrow”

“My colleague received a slightly different invite – 3 months 0.05% + 2.75%”

- Bonus Interest Payouts Bring Cheer

Many users are happy to receive their bonus interest payouts from accounts like CIMB FastSaver or UOB Stash. These payouts provide a welcome boost, even if the base rates are less exciting. Some users even strategise how to manage these payouts for future interest calculations.

“Just checked. Bonus interest is in. Tonite can order kfc liao.”

“Yes- stash always first to give interest (of local big banks) . $242.87, and I transfer this amount out on same day (a simple way to allow next month interest crediting to remain intact…)”

Kena Arrow Everywhere?

While chasing the best rates can feel rewarding, the HWZ discussions also highlight some common frustrations and challenges Singaporeans face when managing their savings accounts.

- Keeping Up with Constant Changes & Fine Print

Banks change their rates and T&Cs frequently. Promotions have specific start and end dates, eligibility criteria (like fresh funds, salary crediting, card spend), and calculation methods that can be confusing. You really need to read the details carefully.

“You can refer to the TnC https://www.cimb.com.sg/content/dam/cimbsg/personal/document/tnc/accounts/2025/casa-tnc-jan2025.pdf”

- Declining Base Rates and Tiered Interest

Even if you qualify for bonus tiers, the underlying base interest rates offered by many accounts are often very low (e.g., 0.05% p.a.). Furthermore, higher interest rates might only apply up to a certain amount, with subsequent balances earning minimal interest, making optimisation tricky.

“Some people commented that it is not worth for the Grow criteria because the next S$100,000 will only earn a base interest of 0.05% p.a.”

“RHB. IIRC, it was 4.18% about 2 years back. Now 1.20%.”

- Risks and Lock-ins with Alternatives

Some users explore insurance savings plans or other products offering seemingly higher yields (like Dash Pet 2 or Singlife). However, these often come with lock-in periods and potentially high surrender fees or penalties if you need to withdraw funds early, which might not suit everyone’s liquidity needs.

“im pretty sure that the premature cancel / policy surrender cost is ‘high’ as this is insurance savings product”

“catch is probably high surrender fees singlife also have a 3% policy, with no fixed terms can withdraw anytime. but cap at only 10k”

Your Action Plan Lah!

Okay, so the situation is dynamic. But don’t just sigh and leave your money sitting there! Based on the collective wisdom (and struggles) shared on HWZ, here are some practical steps you can take.

- Stay Kaypoh: Monitor Actively

Make it a habit to check bank websites, financial comparison sites, and yes, forums like HWZ for the latest updates on interest rates and promotions. Knowledge is power in this game. Some users meticulously calculate potential returns based on T&Cs.

“New to citibank? Then from [link] … above should work out to be 3.17% (without AI) or 3.57% (with AI), without any investment needed.”

- Be Nimble: Switch Strategically

Don’t be afraid to move your funds to take advantage of better offers, especially short-term promotions for fresh funds. Many HWZ users explicitly state their intention to transfer money between banks to maximise returns based on current deals.

“Will transfer all from ocbc premier dividend plus to esaver tomorrow”

- Know Yourself: Assess Risk vs. Reward

Before jumping into a high-yield product, understand the terms fully. Consider if you need the liquidity, the risks involved (e.g., insurance products are not SDIC insured like bank deposits), and whether the extra interest is worth the lock-in or complexity. Sometimes, a slightly lower but simpler rate is better for peace of mind.

“i’ll just use it for doing options. selling puts. generate higher percentage of returns.”

This user has a specific, higher-risk strategy, highlighting that different approaches suit different people.

So yes, the savings game in Singapore is more challenging now, maybe like trying to chope a good seat at Lau Pa Sat during the lunch hour rush. But don’t give up lah! By staying alert (‘kaypoh’), understanding the deals inside out, and being willing to make a move when needed, you can still navigate the changing landscape and make your savings work harder for you. Keep sharing info and good luck hunting for the best rates!

Read the original discussions on HardwareZone: