Eh, Singaporeans, ever felt that sinking feeling when you see your savings dwindling after a big life event? Buying your HDB, that wedding, or even just a major renovation can really hit your wallet hard. It’s a common worry, especially with rising costs of everything from BTOs to hawker food. Let’s talk about how to handle this, yeah?

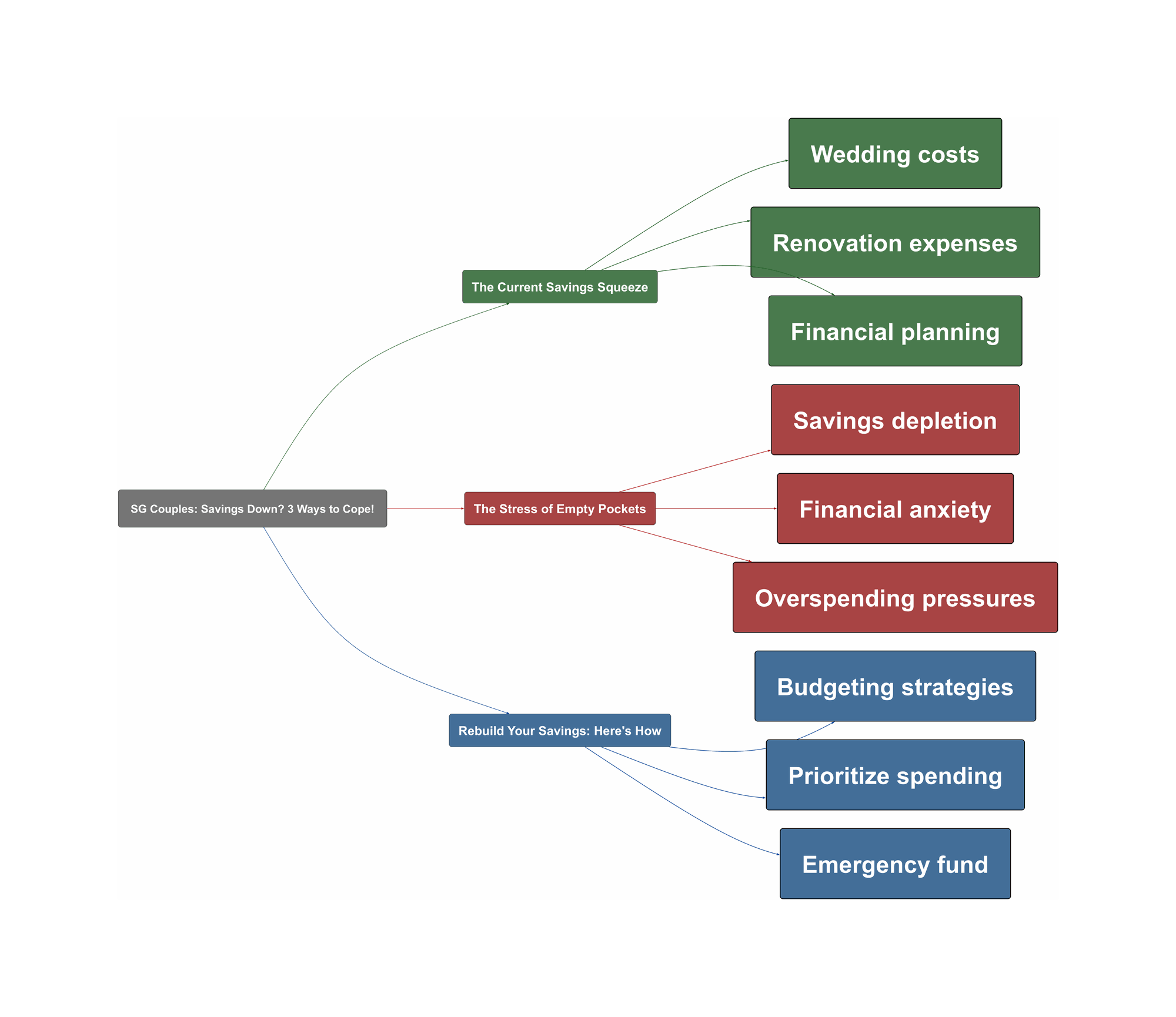

The Current Savings Squeeze

- Big life milestones can wipe out savings

“How do couples cope after using up most of their savings on big-ticket items (house, renovation, wedding etc)?”

- Couples face tough financial decisions

“Since the idea of savings going to 0 scares you, why not you plan your finances in a way that doesn’t zero out?”

- High costs of weddings and renovations in Singapore

- Financial planning is essential for couples

Recent trends show many Singaporean couples are indeed dipping deep into their savings for major life events. The cost of housing remains a significant concern, with BTO prices and resale flats eating into funds. Weddings, too, are a major expense. Many couples feel pressured to have a lavish wedding to meet societal expectations. The renovation costs are another big factor to consider.

The Stress of Empty Pockets

- Financial anxiety is a common problem

“I understand how you’re feeling, and it’s completely okay to feel a bit down after all the big expenses.”

- Pressure to keep up with societal norms

- Overspending can lead to regret

- Unexpected costs can arise

The biggest problem here? Stress! Many couples feel the pressure to spend big, often leading to financial anxiety and regret. The fear of not meeting societal expectations for weddings and renovations can be overwhelming. Furthermore, unexpected costs, like hidden renovation fees or unforeseen home repairs, can add to the burden. This leads to many couples feeling like they are living paycheck to paycheck after these major expenses.

Rebuild Your Savings: Here’s How

- Prioritize spending on essentials

“You can always cut your budget allocation for renovation and wedding expenses.”

- Plan for renovation and wedding spending

“Do simple reno using a contractor will be more cost effective. Again stick to both your budget +10% in case there are changes to your ideas during the Reno period.”

- Build an emergency fund and keep CPF

First off, take a deep breath. You’re not alone! Start by reviewing your spending. Can you cut back on non-essentials? Consider a simpler wedding or a phased renovation. Set a budget and stick to it. Build an emergency fund (even a small one) to cover any unexpected costs. Consider retaining some funds in your CPF OA for rainy days. Finally, don’t forget the joy of life. Remember that the memories you make with your partner are more important than the size of your bank account.