You see the latest condo launch price. It’s over $2,400 per square foot. Your heart sinks a little. Is the Singaporean dream of owning a private property slipping away? Many on HardwareZone feel the same pressure. The market is moving fast. But being smart can put you ahead. It’s not just about earning more. It’s about making the right moves at the right time. Let’s break down what’s happening and how you can navigate this complex market.

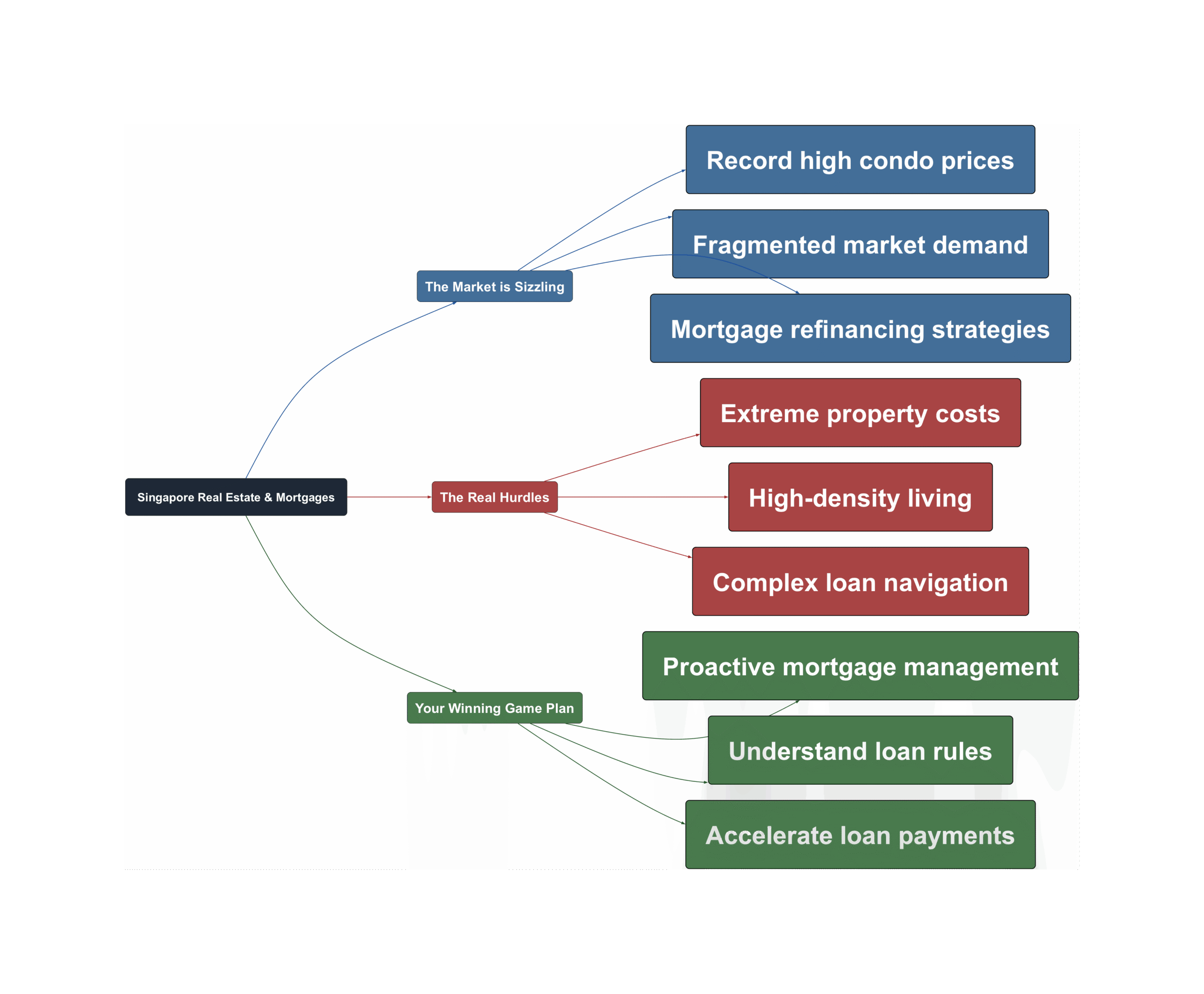

The Market is Sizzling

Property prices are making headlines again. New launches are setting records. The resale market is not far behind. But the demand isn’t the same everywhere. This creates a confusing but interesting picture for potential buyers and investors.

- New launches are hitting record highs.

Some new projects are selling extremely well despite high prices. This shows there is still strong demand in certain segments. Buyers are eager to secure units in popular developments.

Heard upper house selling like hotcakes.

- The resale market is also heating up.

It’s not just about new condos. Resale prices are climbing steadily. Some predict they will soon reach an average of $2,000 psf. This upward trend is pushing many to act fast.

Resale condo hitting the avg 2000psf mark soon. Better buy before the next wave up, esp with int rates coming down, more liquidity into the market soon

- But demand is surprisingly patchy.

Not every project is a success story. High-end condos in prime areas are facing challenges. One development in the Marina area saw very few units sold. This shows that buyers are becoming more selective.

only 2 units sold in marina area https://www.bloomberg.com/news/arti…ndo-s-early-flop-shows-property-boom-s-limits

The Real Hurdles

Chasing the property dream in Singapore comes with real challenges. It is more than just the price tag. Buyers are worried about affordability, living space, and confusing financial decisions. These are the pain points Singaporeans are discussing right now.

- Extreme prices create immense pressure.

With prices at $2,450 psf for new launches, affordability is a major concern. Many feel that property prices are rising much faster than their salaries. This makes the goal of ownership feel further away than ever.

- High-density living feels very cramped.

Newer condos are packing more people into smaller spaces. This lack of space and privacy is a growing issue. The dream of a luxurious lifestyle can feel lost in a crowded development.

Looks like Kowloon walled city. Density even higher than Treasure at Tampines, can’t even get any lux feel

- Navigating bank loans is a maze.

Understanding mortgage options is difficult. Terms like refinancing and repricing can be confusing. Homebuyers are trying to find ways to manage their loans better, sometimes looking for ‘cheat codes’ to save money.

I heard about this “Cheat” code. But one of my client set the amount much higher. He got a letter from DBS for it.

Your Winning Game Plan

Feeling overwhelmed is normal. But you can take control. Smart strategies can make a huge difference. Focus on what you can manage. Here are three actionable steps you can take to navigate the property market successfully and secure your future.

- Be a hawk with your mortgage.

Don’t just accept your bank’s first offer. Always be on the lookout for better deals. Proactively check for repricing or refinancing opportunities. A small change in interest rates can save you thousands.

If you do not want to refinance and prefer to stick with repricing. You might want to refresh the rate early August. You might be able to get a better deal.

- Master the rules of the loan game.

Understand how banks calculate your loan tenure. Key factors include your age and how long you’ve had the loan. Knowing these rules helps you plan your finances for the long term and avoid surprises.

When it is refinancing, it will be based on the following 1) Age up to 75 years old 2) 35 – years of usage of the loan – 1/2(Depending bank) Which ever it is higher.

- Pay down your loan faster.

Consider making small, extra payments on your mortgage. Even a little extra each month can shorten your loan term significantly. This saves you interest and helps you achieve financial freedom sooner.

Instead of finish paying by 75, I might be done by 74. Did it for convience rather than intentional. Bank don’t complain, I just let it be.

The Singapore property market is a tough challenge. Prices are high and the future is uncertain. But you are not powerless. By staying informed, managing your mortgage actively, and understanding the rules, you can make smart decisions. The path to your dream home is not closed. It just requires a better strategy.

Read the original discussions on HardwareZone: