Ever felt like your hard-earned cash isn’t working hard enough for you in Singapore? With rising costs and the constant hunt for better returns, many of us are trying to figure out the best way to grow our savings. From chasing the latest bank promotions to navigating tricky terms and conditions, it can feel like a maze. But don’t worry, you’re not alone! Our fellow Singaporeans on HardwareZone are sharing their tips and frustrations, and we’ve got the lowdown for you.

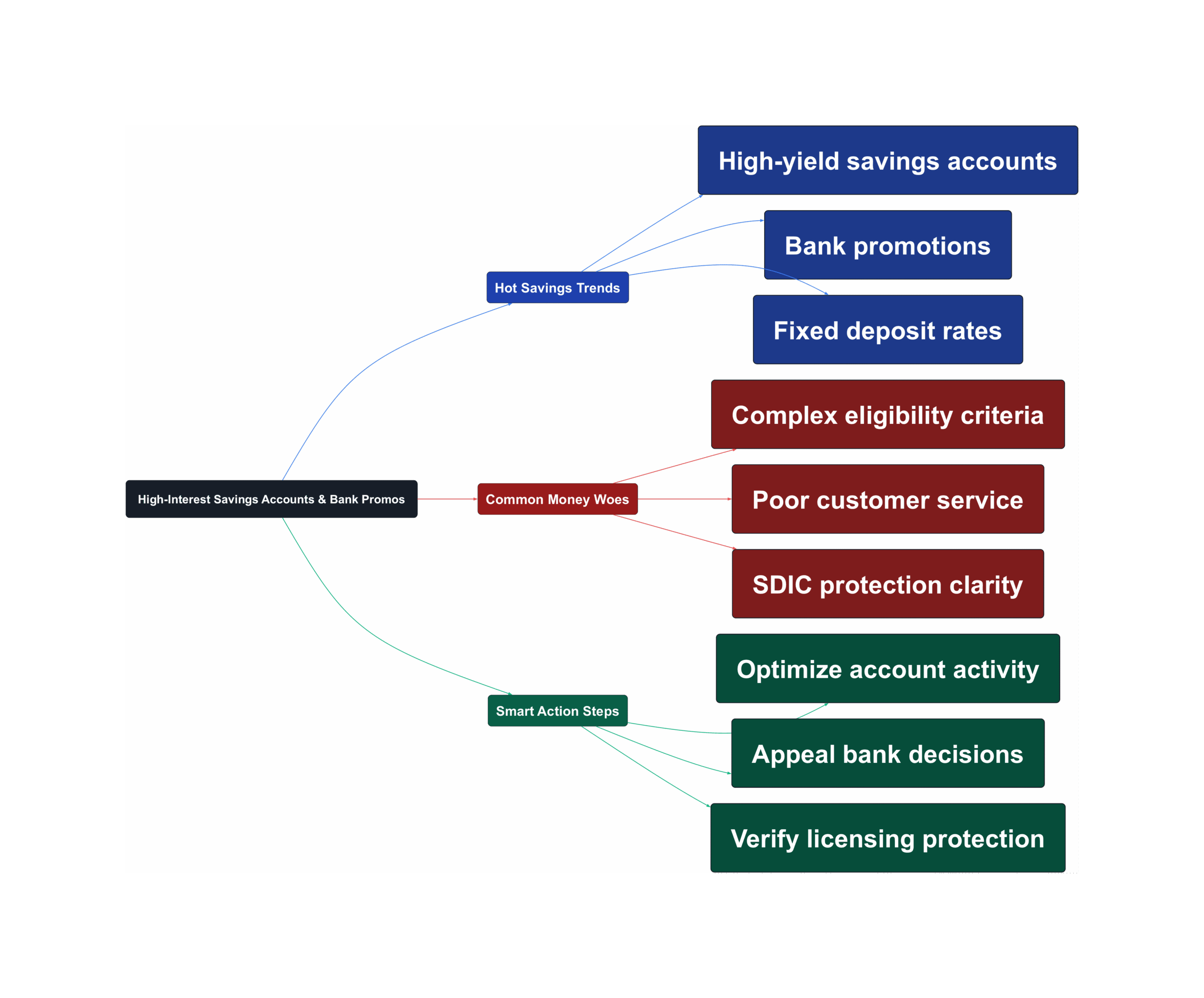

Hot Savings Trends

Singaporeans are always on the lookout for the best places to park their cash and earn more. The buzz on HardwareZone shows a clear trend towards high-interest savings accounts and attractive fixed deposit rates, but also a sharp eye on limited-time promotions.

- High-yield savings accounts are still king. Many forum users are actively discussing and optimizing their UOB One, OCBC 360, and Standard Chartered eSaver accounts to hit those bonus interest tiers. These accounts remain popular for daily banking needs while offering competitive rates.

“May bonus interest is in for normal/public esaver today”

- Bank promotions are a hot commodity. From cash incentives to boosted investment returns, Singaporeans are quick to jump on new offers. However, the fine print often requires careful reading, as seen with HSBC’s MMF promo and CIMB’s CNY bonus.

“Joined CNY promo on mid Feb, got the $688. Not popular bank i guess”

- Fixed Deposit (FD) rates are dynamic. While some banks like RHB are increasing their FD rates slightly, others like SBI have withdrawn their offers. This constant fluctuation means savers need to stay vigilant to lock in good rates, especially for larger sums like S$20,000 or S$50,000 minimum placements.

“Received news that RHB FD rates will be revised tomorrow. 3 and 6 mth will be slightly higher. Rate now is 2% for personal, 2.1% for premier for 3, 6, 12 mths.”

Common Money Woes

While the hunt for higher returns is exciting, it often comes with its own set of headaches. HardwareZone users frequently voice frustrations about navigating complex bank terms and dealing with inconsistent customer service, which can turn a promising offer into a real challenge.

- Complex criteria and hidden catches. Many high-interest accounts require specific actions like salary crediting, minimum spend, or wealth holdings. Figuring out what truly qualifies can be a nightmare, leading to missed bonus interests.

“i read until so shiok until they say qualifying spend are only transactions made in china… sian 7/8…”

- Frustrating customer service. Getting clear answers from bank customer service officers (CSOs) or relationship managers (RMs) can be a hit-or-miss affair. Users report being given conflicting information or simply being left in the dark about promotion eligibility or account specifics.

“I tried to check with the CSO who does not know and said will ask my RM to contact me. And as expected, no one call me for 2 days already…”

- Uncertainty over SDIC protection. For some, especially when considering lesser-known banks or investment products, the clarity and scope of Singapore Deposit Insurance Corporation (SDIC) protection is a major concern. This can deter them from exploring potentially higher-yielding options.

“If it’s a bank, i expect them to be licensed and in SDIC list, else they can fXXX off. If it’s a brokerage, i expect them to be registered with MAS and not be shamelessly operating here without license.”

Smart Action Steps

It’s not all doom and gloom! Our savvy Singaporean forum members are sharing practical strategies to overcome these challenges and make the most of their money. These actionable steps can help you navigate the banking landscape more effectively and secure those coveted bonus rates.

- Optimize account activity strategically. To meet salary crediting or transaction requirements, many users employ clever methods like using FAST transfers or GIRO to simulate salary credits, keeping their main salary account separate for convenience.

“Its an open secret. You can always FAST transfer 1600 into the account, don’t even need the actual salary. Likewise for BOC SS also.”

- Don’t shy away from appealing. If you miss a bonus interest tier due to a minor shortfall or technicality, it’s worth calling the bank to appeal. Many users have found success, especially if it’s a first-time appeal or due to circumstances beyond their control.

“No harm calling to appeal. Tell them don’t know why your company this month salary credited only on 2 Jun instead of the usual 28 – 30th. Not within your control.”

- Verify SDIC and MAS licensing. Before committing funds, especially to new or less familiar platforms, always check if the institution is licensed by the Monetary Authority of Singapore (MAS) and is part of the SDIC scheme. This ensures a level of protection for your deposits.

“I think the sdic existence serve its purpose, such as a bank run by (being around) to jus assure ur money is fine. Can’t guarantee a risk but merely a sign board existence.”

Navigating Singapore’s banking landscape can feel like a treasure hunt, but with the right strategies, you can definitely make your money work harder for you. By staying informed, understanding the fine print, and leveraging community insights, you can avoid common pitfalls and unlock better returns. Keep an eye on those forums, because the next best deal might just be a click away!

Read the original discussions on HardwareZone: