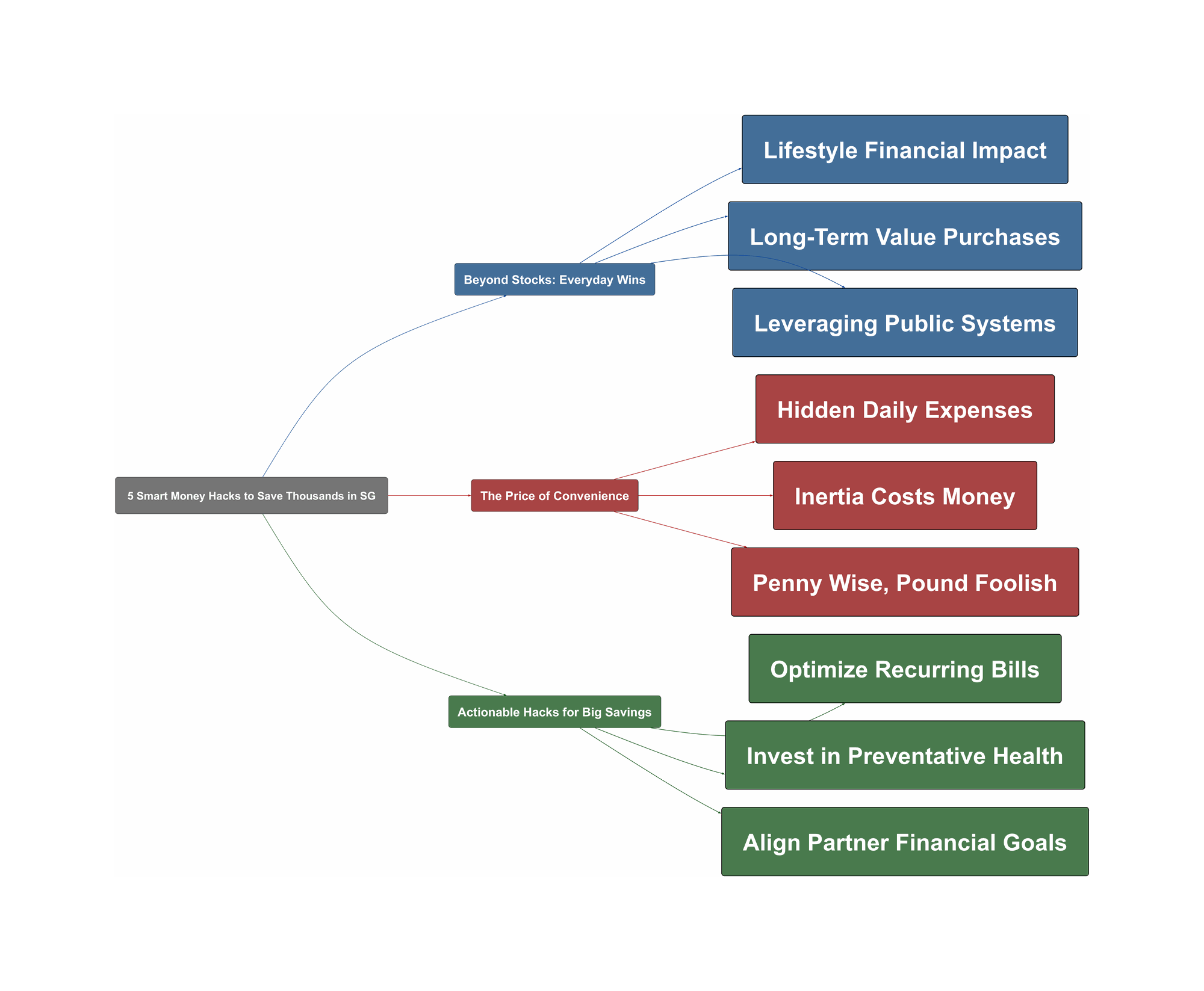

Are you focused on complex stock charts while your money quietly slips away elsewhere? Many Singaporeans chase investment returns. Yet, the biggest financial wins are often hiding in plain sight, far from the stock market. Let’s uncover the simple changes that can save you thousands.

Beyond Stocks: Everyday Wins

We often think financial success comes from big investment plays. However, the real impact comes from optimizing daily life. Small, consistent savings in areas like telecommunications, transport, and housing add up to significant amounts over time. Reddit users frequently share these practical wins.

For instance, many people overpay for phone data they never use. A simple switch to a budget-friendly plan can save hundreds annually. This is a clear trend away from legacy providers toward more competitive options. This shift shows people are getting smarter about their recurring bills.

“Switching from Singtel to SIMBA: $10/month, 100GB data. No issues.”

Furthermore, lifestyle choices like where you work and live have massive financial consequences. Reducing your commute not only saves money but also gives you back precious time. This time can be used to prepare meals at home, which further cuts down on expenses.

“Moved to an office closer to home… Able to arrive home earlier. More time to rest and can prep food for dinner, and breakfast+lunch the next day.”

The Price of Convenience

Despite knowing better, why do we stick with costly habits? The main obstacle is often inertia. It feels easier to stay with a familiar brand or routine. The perceived hassle of making a change prevents us from unlocking major savings.

Moreover, a common pitfall is the “penny wise, pound foolish” mindset. People buy cheap products to save money upfront. However, these items often break quickly, leading to repeat purchases and higher long-term costs. This creates a frustrating cycle of spending.

“For me I always think it’s expensive to be cheap; buy quality stuff so you don’t have to buy it again so often”

In contrast, brand loyalty can also be a financial trap. Many pay a premium for branded medicine when generic versions are identical and much cheaper. The reality is that you are often just paying for marketing, not better quality or effectiveness.

“Instead of buying expensive over the counter medications from retail pharmacies, you can get the generic version of the same drug at a fraction of the price at polyclinic/public hosp pharmacies.”

Actionable Hacks for Big Savings

Fortunately, you can reclaim your cash with a few strategic moves. These solutions, shared by the community, are simple yet powerful. They focus on long-term value and smart resource management rather than painful sacrifices.

First, make preventative care a priority. Regular exercise and dental checkups can prevent costly health issues down the road. Think of it as an investment in your future well-being and financial stability. This proactive approach saves you both money and stress.

“visit the dentist every 6 months to save on future dental expenses; save money on nutrition now, pay more on healthcare later on”

Additionally, leverage local resources wisely. Securing affordable public housing like a BTO before your income exceeds the ceiling is a game-changer. Finally, aligning with your partner on finances is perhaps the most powerful move of all. Shared goals make everything easier.

“Marrying the right partner with similar views on life including finance. We got our 4 room bto (right next to mrt) for less than 270k.”