Is finding your dream home in Singapore feeling like a squeeze? Property prices keep hitting new highs. Yet, new condo launches sometimes feel more cramped than spacious. Many Singaporeans are feeling this push and pull. It is a common topic in kopitiams and online forums. Let’s dive into what the buzz is on HardwareZone. Understanding these trends helps you navigate the market. Make informed decisions for your future home.

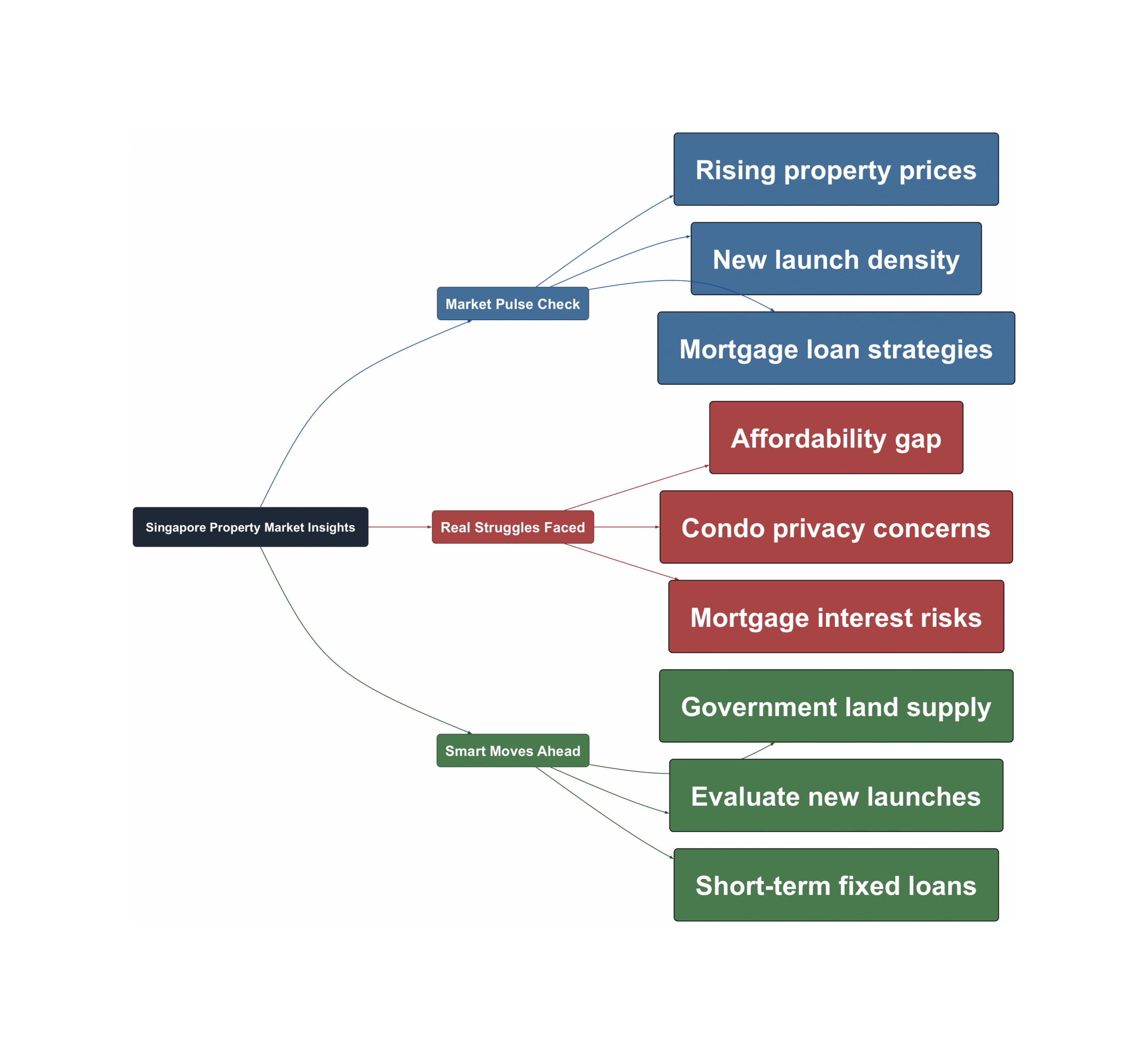

Market Pulse Check

- Property prices have surged dramatically. Resale HDBs and private condos see significant gains. Some reports show over 50% increase in four years. This rapid growth excites many property owners. It also creates a sense of urgency for potential buyers. Many Singaporeans are keen to ride this wave.

“You huat kueh blood sucker. 4 years increase more than 50%. Lol! Well done. If every 2 years increase 50%, I think the bears and property haters all shitting in their pyjamas at night.”

- The government is releasing more land for development. This includes numerous Government Land Sales (GLS) plots. A significant portion are near MRT stations. This strategy aims to increase housing supply. It could help cool down the heated market. This move is a strategic planning effort.

“I am just surprised the G is throwing out quite alot of good land plots for GLS. I watched EC’s 2H2025 GLS video, seems like almost 80% is less than 500m to MRT?”

- New condo launches are facing density concerns. Many large projects feature over 1000 units. This leads to a crowded feel. Some compare it to an HDB cluster. Block-to-block distances vary greatly. This affects views and natural light.

“Wow this place really machiam like HDB cluster.. Can practically see into each other living rooms / bedrooms.”

“From the outside looks cramp, 1000+ units afterall. But GD block to block distance is around 60m. TC is also around 60m with the road in between. TG / EOK by comparison is only around 40m.”

Real Struggles Faced

- Many Singaporeans feel left behind by rising prices. Those who delayed buying now face higher entry costs. This creates frustration among potential homeowners. They feel the market is unfair. Some lament missing out on prime opportunities. The “fear of missing out” is real.

“Aiya, it’s pointless to kpkb about the G la, it’s always those who missed the boats that are making alot of noise; everything is always unfair to them.”

- New developments often lack sufficient privacy. High-density projects mean units are close together. Residents worry about overlooking neighbours. This impacts daily living comfort. It is a key consideration for buyers. Some even joke about walking around in shorts.

“Wow this place really machiam like HDB cluster.. Can practically see into each other living rooms / bedrooms. Even golden block also not spared.”

“And I’m going to be walking around in shorts instead of in undies”

- Navigating mortgage loans can be risky for homeowners. Interest rates are a major concern. Choosing the wrong package can lead to financial strain. Long-term fixed rates are seen as potential traps. Buyers need to be careful. Always seek expert advice.

“One thing for sure. DONT GO 3 or 5 years fixed rate. Most likely fall in the bank trap.”

Smart Moves Ahead

- Monitor new Government Land Sales (GLS) plots closely. Increased supply could stabilize prices. Look for plots near MRT stations. These locations offer good connectivity. They present strong long-term value. This shows the government’s strategic planning.

“Government strategic planning one mah. They cannot be wrong. Probably throwing more land to cool the market.”

- Carefully evaluate new launch projects for privacy and space. Do not just look at floor plans. Consider the block-to-block distances. Check the overall density of the development. Visit the showflat to get a real feel. Ask about unit orientation.

“The project stand-alone status does make it looks somewhat “tight” from a far.”

- Opt for shorter-term fixed mortgage rates. Many prefer 1 or 2-year fixed rates. This helps hedge against rising interest rates. It offers flexibility for future refinancing. Avoid committing to long-term fixed packages. Seek advice from property brokers.

“Most of my clients still prefer to hedge against interest rate going upward hence they go with 2 years fixed with FC12 or 1 years fixed FC12(2 years lock in).”

Singapore’s property journey is always evolving. Staying informed helps you make better decisions. Evaluate your options carefully. Your ideal home might be just around the corner. Keep an eye on market trends and expert advice. Plan your next steps wisely for a smoother ride.

Read the original discussions on HardwareZone: