See another property headline screaming ‘$3k psf’? Does your heart sink a little? You are not alone. Many Singaporeans are asking the same thing. Is the dream of owning a home slipping away? The market feels hotter than a crowded MRT in the afternoon. It is a confusing time for home buyers and investors. Let’s break down what is really happening on the ground. We will look at what fellow Singaporeans on HardwareZone are saying.

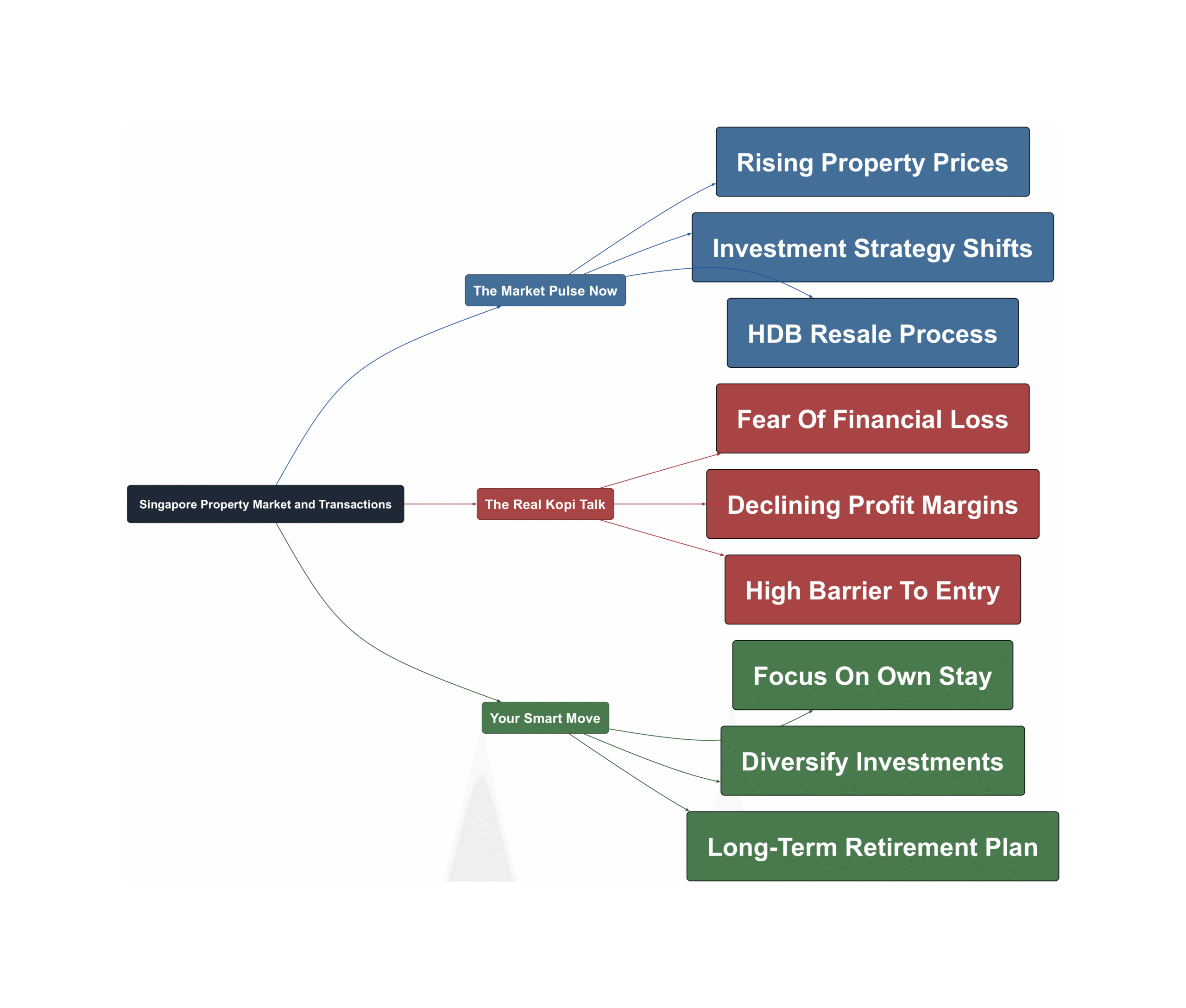

The Market Pulse Now

The property market is moving at a dizzying pace. Prices continue to climb, especially for well-located units. Understanding the current trends is the first step. Here is what people are seeing right now.

- Prices are hitting new highs, especially near transport hubs

The talk of $3,000 per square foot is no longer just chatter. It is becoming a reality for new launches. Properties near an MRT station or with integrated facilities command premium prices. This trend makes it harder for many to enter the market.

Property prices to the moon? No 3kpsf no talk now.

- Strong belief that prices will keep increasing

Despite the high prices, some believe this is the new normal. The logic is simple. Singapore’s land is scarce. Wealthy foreigners continue to move here. This demand keeps pushing prices up. What seems expensive today might look cheap tomorrow.

today expensive is tomorrow cheap. Macro speak for itself, more rich coming in , land still same, no brainer

- The HDB resale process is long and complex

Buying a resale flat involves many steps. The entire timeline can take months. From the Offer to Purchase (OTP) to the final HDB completion, it is a marathon. The process involves valuation requests, bank loans, and multiple submissions. One buyer shared their journey took about 4 months from viewing to completion.

The Real Kopi Talk

Behind the impressive numbers are real worries. Singaporeans are weighing the risks more carefully than ever. The high stakes are leading to tough conversations. Here are the main struggles people face.

- Growing fear of losing hard-earned savings

Many older Singaporeans are becoming more risk-averse. They prefer safer investments like T-bills and blue-chip stocks. The thought of losing their retirement nest egg on a risky property is a major concern. They want to protect what they have built over the years.

I am not prepared to take alot of risk and lose all I have worked hard to garner all these years.

- Future profits from property look uncertain

The days of easy money from property may be ending. Forum members predict that profits will get smaller after 2030. Government policies like the Prime Location Housing (PLH) model also cap potential gains. The risk-to-reward ratio is not as attractive as it once was.

The profits are gradually thinning, you pay half of your profits out while you take all the risk.

- The high barrier to entry divides generations

The current market creates a generational gap. Young buyers might need to take on huge loans to afford a home. They can leverage their longer earning runway. However, older buyers who cannot leverage as much find the risk too high. It is a game that favors those with a long time horizon.

Young people who can leverage max and still can lose can still try. For older people who can’t leverage as much the property game is not worth it.

Your Smart Move

Feeling overwhelmed is normal. But you can still make smart choices. It is about shifting your strategy to fit today’s reality. Here are some actionable steps discussed on the forums.

- Focus on buying for your own stay, not just for profit

Change your mindset. Instead of chasing huge capital gains, find a home you can afford and enjoy. A good home for your family is a worthy goal. Once you buy a suitable place, you can let it be and not worry too much about market fluctuations.

buy one nice one for own stay enough liao… buy liao is to let it run, don’t need to fuss over it too much is the best case scenario.

- Diversify your investments beyond property

Property is not the only way to grow your wealth. Many are turning to more stable options. Consider building a portfolio with high-yield savings accounts, Singapore Savings Bonds (SSBs), and reliable stocks. This approach helps manage risk effectively.

High yield savings account, T-bills, SSB are my preferred investment of choice.

- Create a solid long-term retirement plan

Think about your future needs. A fully paid-off property can be a great asset in retirement. You could rent out a room or the whole unit for passive income. This strategy can help you achieve financial freedom and enjoy your golden years.

Planning to rent out one of the 4-bedroom places to cover monthly costs… 55 will be the sweet spot to lim kopi jiak loti everyday here and there.

Navigating Singapore’s property market is tough. There is no one-size-fits-all answer. Some see prices going ‘to the moon’. Others are becoming more careful with their money. The best path depends on you. Think about your life goals and what you can afford. Whether you buy, wait, or invest elsewhere, make a choice that lets you sleep soundly at night. Your future self will thank you for it.

Read the original discussions on HardwareZone: