Do you ever feel like your bank account has a slow leak? You check your statement, only to find a trail of small, confusing charges from subscriptions and hidden fees. You’re not just imagining it. Many of us are unknowingly paying for “legal scams” designed to drain our wallets, one small transaction at a time. It’s a frustrating cycle, but one you can break.

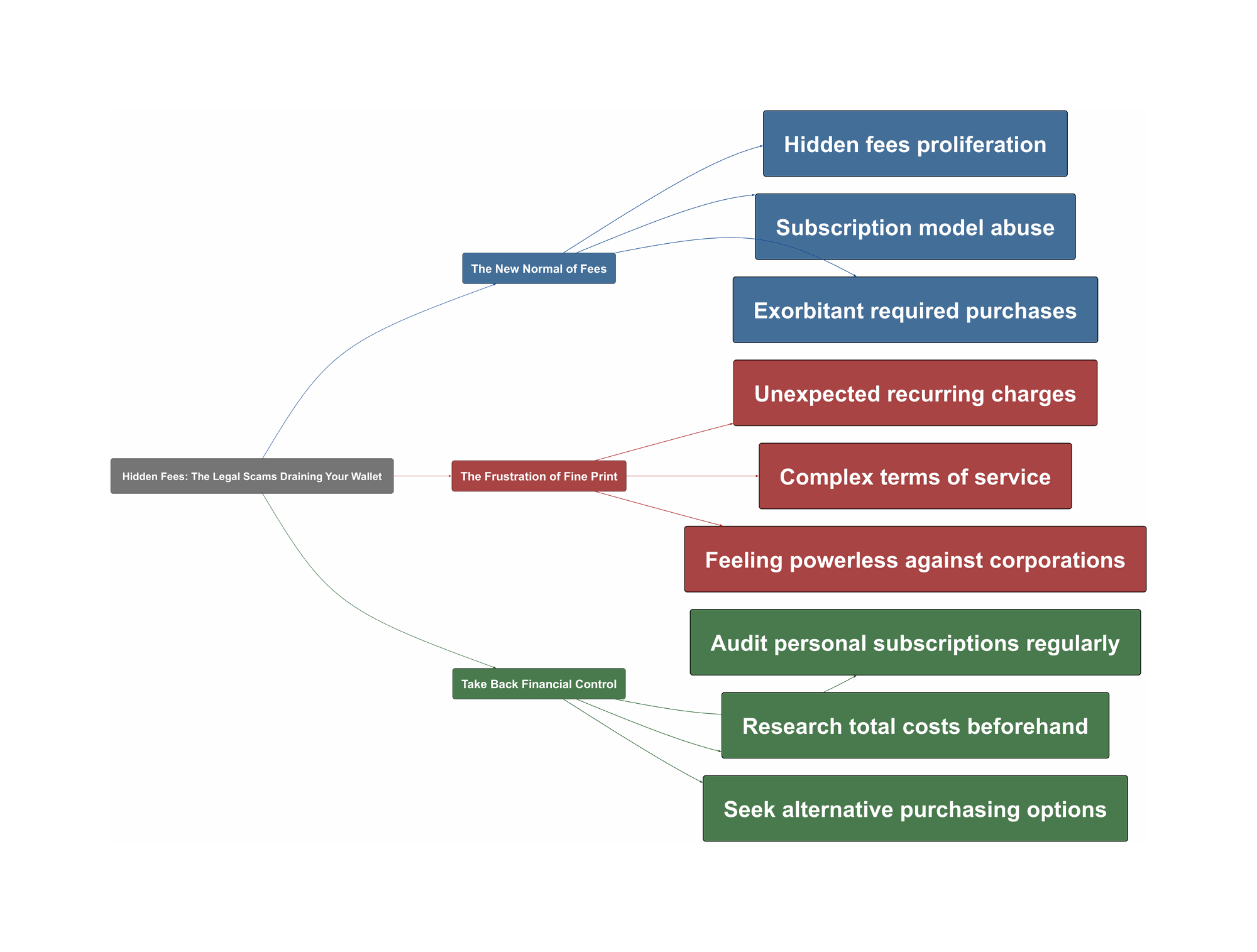

The New Normal of Fees

In recent years, a new business model has taken over. Companies now unbundle services that were once included in the price. Think about airlines charging for seats or hotels adding mandatory “resort fees.” This strategy makes the initial price look lower, luring customers in before revealing the true cost at the very end. This practice has become so common it now feels unavoidable.

Additionally, the subscription economy is booming. We no longer just buy software or products; we rent them. While convenient at first, this model ensures a constant flow of money from your pocket. Many consumers report having 5 or more monthly subscriptions they barely use, creating a significant financial drain over time.

Just went to Vegas, why is there a resort fee on top of booking a hotel room, why do we have to pay for parking also? Someone learned they could add hidden fees and were successful so now nearly all of Vegas does it also.

Subscriptions. To everything. Streaming kicked it off, then everyone figured out they could bleed us dry, one “feature” at a time.

The Frustration of Fine Print

One of the biggest challenges is that these costs are intentionally obscured. They are often buried deep within lengthy terms of service agreements. Or they appear suddenly on the final checkout page after you’ve already committed to the purchase. This leaves many people feeling deceived and powerless against large corporations.

Furthermore, some businesses change the rules after you’ve already paid. A product you bought with a one-time fee might suddenly require a new annual subscription to keep its features. This feels like a bait-and-switch, trapping customers who have already invested their money and time into a product. This tactic erodes trust between consumers and companies.

Companies who change their Terms of Service to force you to pay an annual subscription to continue using a product you have had for years that didn’t require a subscription to begin with.

Take Back Financial Control

Fortunately, you are not helpless against these creeping costs. You can fight back by becoming a more conscious consumer. Taking a few proactive steps can protect your money and restore your sense of control. The key is to build simple habits that make you aware of where every dollar is going.

As a result, you should start with a complete audit of your recurring payments. Many people are surprised to find what they’re still paying for. Here are a few community-tested strategies to get you started:

- Set a calendar reminder every three months to review all subscriptions.

- Use a budgeting app that automatically tracks and categorizes recurring charges.

- Before booking travel, search for the hotel or airline name plus “hidden fees” to see what others have experienced.

- For required purchases like textbooks, always check for used, rental, or free library options first.

College textbooks. New edition every year, barely any changes, and somehow still $300+ a pop

Ultimately, voting with your wallet sends the strongest message. By choosing businesses with clear and honest pricing, you help create a market that respects its customers.