Feeling the pinch as fixed deposit and SSB rates start to dip? You’re not alone. Many Singaporeans planning for retirement or aiming for Financial Independence, Retire Early (FIRE) are wondering how these lower returns will impact their carefully laid plans. Is the dream of living off passive income getting harder? Let’s dive into what’s happening, the challenges we face, and how we can adapt our strategies to keep our financial goals on track, drawing insights from fellow Singaporeans on HardwareZone.

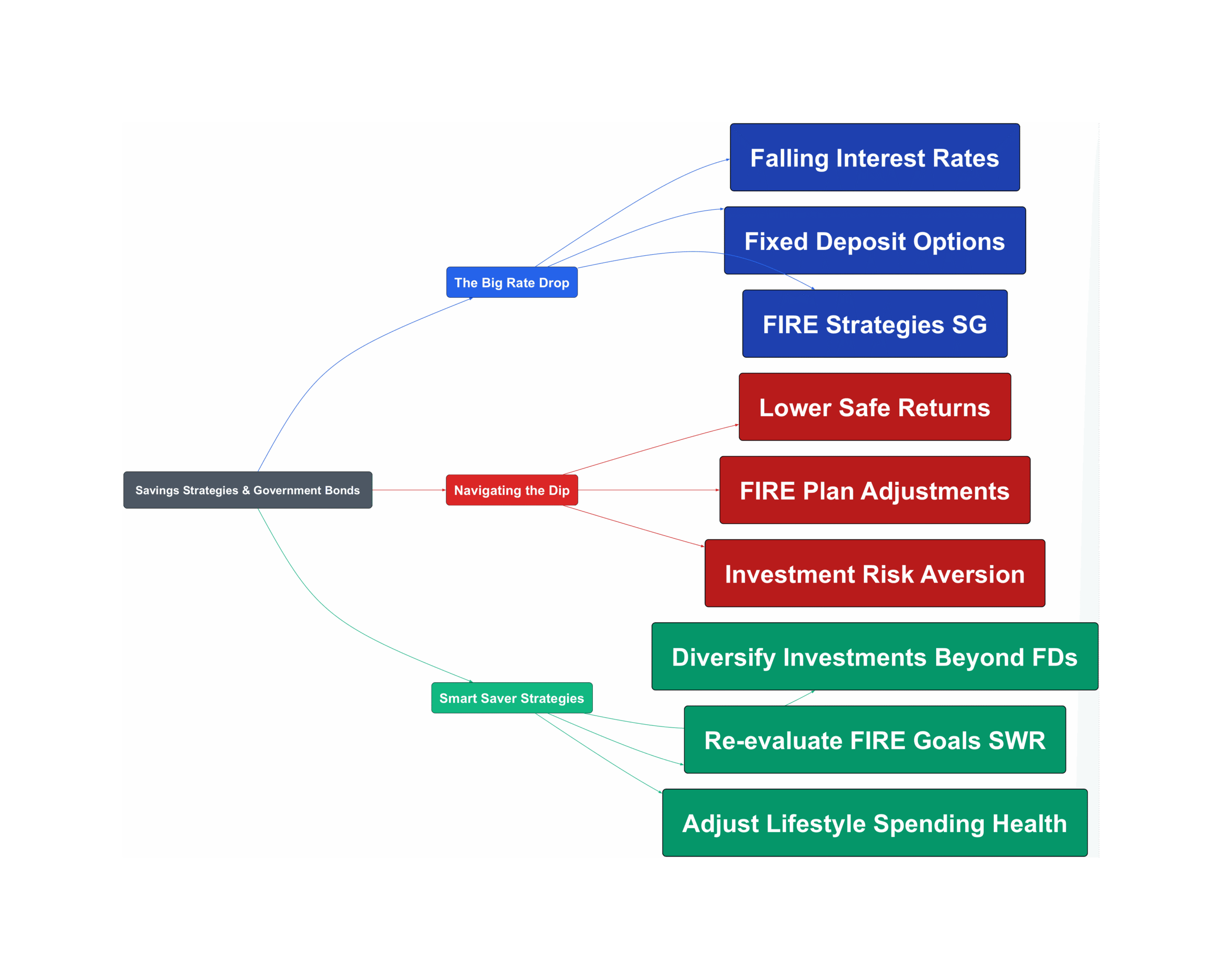

The Big Rate Drop

The era of easily grabbing high interest on safe havens seems to be cooling off. Major banks are adjusting their fixed deposit (FD) rates downwards, making it tougher to lock in those attractive returns we saw previously. Singapore Savings Bonds (SSBs) and Treasury Bills (T-Bills) are also reflecting this trend.

- Major Banks Cutting FD Rates

Banks like Maybank, OCBC, and UOB have recently revised their promotional FD rates. For example, Maybank cut its 6-month Deposit Bundle rate from 2.90% to 2.45% and its 12-month rate from 2.70% to 2.25% effective late April 2025. Similarly, OCBC and UOB have also trimmed their offers.

“Maybank promo rates will be cut with effect from 28 April… OCBC cut its offer rates again… UOB cut its 10 months offer from 23 Apr.”

- SSB Returns Trending Lower

Projections for upcoming SSB issues show a decrease in average returns. The SBJUN25 issue, for instance, projects an average return of around 2.56% p.a. over 10 years, slightly lower than previous projections, though still offering stability.

“Final projection by https://www.ilovessb.com/projection/SBJUN25, as of 30/4/2025: … Average return per year % … 2.56”

- T-Bill Yields Also Dipping

Recent T-Bill auctions have seen lower cut-off yields. The 6-month T-Bill auction on April 24th, 2025, closed with a cut-off yield of 2.38% p.a., down from previous highs. While still beating standard savings accounts, the trend is clear.

“Interest and interest getting lower.”

Navigating the Dip

Lower interest rates present real challenges for Singaporean savers and FIRE aspirants. It forces a rethink on how we grow our nest egg and plan for the future. The path to financial security requires navigating these new realities.

- Harder to Find Safe High Yields

With FD, SSB, and T-Bill rates softening, finding low-risk options that significantly beat inflation becomes more challenging. The days of easily securing over 3-4% on these instruments seem numbered for now, making some question the effort involved.

“kinda troublesome just for this. the returns aren’t exactly that fantastic. in the end just bought today’s 6-mth t-bills…”

- Rethinking FIRE Strategies & SWR

Those pursuing FIRE rely heavily on investment returns. Lower yields mean needing a larger capital base or adjusting the Safe Withdrawal Rate (SWR). The debate between focusing on dividends versus total returns becomes more pertinent as generating sufficient passive income gets tougher.

“A portfolio that generates 6% in dividends/interest… is the same thing as another portfolio that generates… 6% in capital gains… net return is the only thing that matter… In general a lower SWR has a higher chance of success… its just math.”

- Balancing Risk Aversion and Growth Needs

Many Singaporeans prefer the safety of CPF Ordinary Account (OA) rates (currently 2.5%) or FDs over potentially volatile investments. However, sticking only to the safest options might not be enough to reach long-term goals, especially with rising costs. Some feel parking cash in OA is better than chasing slightly higher, but taxable and less liquid, T-Bill rates.

“No. I rather leave in OA if cannot get better rates outside… Money that you need but cannot touch earn 4% also no use.”

Smart Saver Strategies

Don’t despair! Lower rates just mean we need to be smarter and more adaptable with our money. There are still ways to work towards financial independence and a comfortable retirement. Here are some strategies discussed by the HardwareZone community:

- Diversify Your Investments

Don’t put all your eggs in one basket. While FDs and SSBs provide stability, consider diversifying into other assets like stocks, ETFs, or REITs for potentially higher returns and passive income streams, accepting the associated risks.

“I have achieved FI thanks to passive income from stocks and ETF… As long as I am able to generate positive returns on my investment, it doesn’t bother me that much that others are generating higher returns.”

- Explore Different FIRE Paths

Recognise that there isn’t just one ‘right’ way to achieve FIRE. Some focus on dividends, others on capital growth, property, or even side hustles. Find the approach that aligns with your risk tolerance and goals.

“100% agree there are many ways to invest and many ways to FIRE. I never understand those who think there is only one way and if you don’t follow their method you are wrong.”

- Optimise Lifestyle & Spending

Financial independence isn’t just about earning more; it’s also about managing expenses. Simple changes, like mindful eating or health adjustments, can reduce long-term costs (like healthcare) and lessen the pressure on your investments to perform.

“By simply going vegetarian 2 days a week… plus exercise, I am able to keep my weight, cholesterol, triglycerides, APO levels within desirable ranges.”

Falling interest rates might feel like a setback, especially if you rely on fixed deposits, SSBs, or T-Bills. However, it’s also an opportunity to reassess your financial strategy. By staying informed, diversifying wisely, and perhaps adjusting lifestyle expectations, Singaporeans can continue to navigate the path towards financial security and even early retirement. The key is flexibility and proactive planning. Don’t let the dip derail your dreams – adapt and keep moving forward!

Read the original discussions on HardwareZone: