Eh, Singaporeans, ever feel like your CPF money is just sitting there, doing…nothing? We all want to make our money work harder, right? Especially with retirement just around the corner (or maybe you’re just starting out!). Let’s talk about how to make your CPF and other investments work smarter, not harder, to achieve your financial goals.

Current Market Pulse

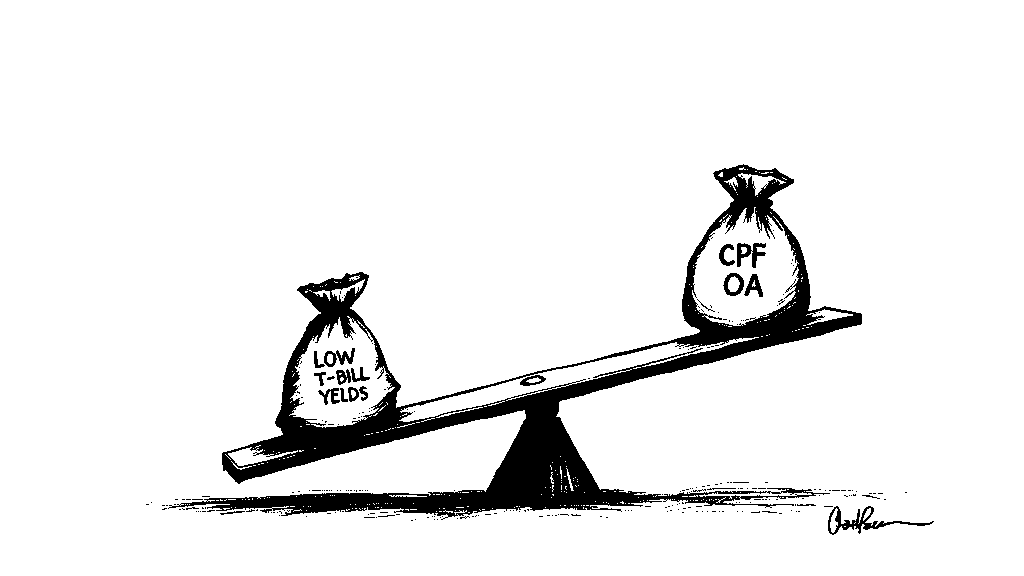

- CPF Interest Rates Still Attractive: Many are weighing their options with CPF, especially as interest rates on T-bills fluctuate. The CPF Ordinary Account (OA) offers a guaranteed 2.5% interest rate, a solid foundation. Some are considering options like SGS bonds for CPF OA.

“Dun take out of cpf unless u have real need for it. t-bills is not going to earn such high interest forever, whereas cpf will always pay 2.5% for the near future.”

- T-Bills and Bond Yields: Recent T-bill yields have been a bit underwhelming, hovering below 3%, leading some to reconsider their strategies. SGS bonds are also being considered as alternatives.

“a bit disappointed with < 3% yield, but maybe it’s expected given the current environment.”

- Investment Options: HardwareZone users are exploring various investment avenues, including SRS accounts, and US-based funds. Many are seeking advice on how to optimize their portfolios for retirement and long-term growth.

“Anyone investing in Nikko AM Short Term fund using OA?”

The Real Struggles

- Low T-Bill Yields: The current returns on T-bills may not be as attractive as expected, potentially leading to a loss of interest when compared to the CPF OA.

“Need 2.92% to breakeven leh… 2.9% is lose interest one.. and withdrawing the OA to play tbill is the most stupid move ever. Tbill interest will drop below 2.5% while OA will still be at 2.5% for the near future. Can u put the money back into cpf when Tbill drops below 2.5%?”

- Investment Complexity: Choosing the right investment mix, especially when nearing retirement, can be overwhelming. Balancing risk and return, while considering CPF rules and regulations, is a challenge for many.

“Im 58. Im alread into full ERS. From 65 I would like to get steady stream of cash and don’t want to bother about financial markets going up and down as I plan on going slow travel around Asia as long as I could.”

- Confusing Options: The variety of investment options, from CPFIS to SRS, can be confusing. Many struggle to navigate the best choices for their specific financial situation and risk tolerance.

Smart Action Steps

- Prioritize CPF OA: Unless you have immediate needs, consider keeping your funds in your CPF OA. The 2.5% interest rate is a safe and reliable option, especially compared to potentially lower yields from T-bills.

“If you’re looking for a higher yield than 2.5% then fundamentally you have to look at longer term bets. CPF itself offers SA and RA, subject to limits.”

- Diversify with SRS and Other Investments: Explore your SRS account for investment options like global stock index funds or corporate bonds to diversify your portfolio. Consider your risk tolerance and time horizon. This might take a few weeks to research.

- Seek Professional Advice: If you’re unsure, consult a financial advisor who can help you create a personalized investment plan tailored to your goals and risk profile. It might take a few consultations to get a clear plan.

Read the original discussions on HardwareZone: